Analyzing demand data to clarify propane supply picture

For the week ending July 7, the U.S. Energy Information Administration (EIA) reported a significant recovery in U.S. export activity.

While we do believe that exports recovered, we question if they were as high as the EIA reported. We think the big bounce had its foundation in overreported domestic demand one week earlier. We believe the EIA may have made an adjustment in these numbers this week.

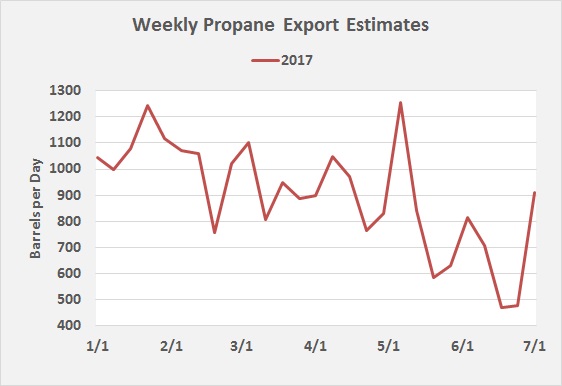

For the week ending June 23, U.S. propane exports dropped from 707,000 barrels per day (bpd) to 471,000 bpd — the week of the big 3.9-million-barrel inventory build. Exports presumably dropped due to tropical storm activity.

We were expecting exports to move back up the week ending June 30, but instead they essentially remained unchanged at 476,000 bpd. What made that data interesting is that for the same week, the EIA reported a major build in U.S. domestic demand. Domestic demand that week jumped from 916,000 bpd to 1.161 million bpd, an unusual jump for this time of year.

Then, according to the report for the week ending July 7, domestic demand decreased by 397,000 bpd to 764,000 bpd. Meanwhile, propane exports jumped 434,000 bpd. Our guess is domestic demand did not pick up in the week ending June 30, and exports did not gain as much for the week ending July 7.

Since demand is an implied number, we think exports were understated resulting in the high domestic demand number two weeks ago. We think an adjustment was made this week to correct it. Therefore, we would assume exports this week were closer to 700,000 bpd and domestic demand was around 960,000 bpd or less.

Whether the demand was from exports or domestic doesn’t really impact primary inventory changes, but it could have an impact on how the market is perceiving the health of second- and third-level storage. Such a strong surge in domestic demand, which is calculated relative to the primary storage level, would likely indicate movement of product into second- and third-level storage this time of year. This could provide more stability to U.S. markets down the road. It would give us an indication that retailers and wholesalers were seeing the potential for higher prices and making defensive moves to improve their local inventory positions.

However, if the barrels are exported, they don’t come back. If we are seeing light inventory builds in primary storage, we would like to see domestic demand high as it might indicate improvements in inventory levels downstream and aid in preventing a price spike later this year.

If primary storage is seeing light builds due to high rates of exports, we are only increasing the potential for domestic supply tightness this fall and winter. When we are seeing exports at 910,000 bpd, as reported by the EIA last week, we have a greater fear of domestic tightness developing that could result in a much higher price environment down the road.

With U.S. propane inventory well below last year’s levels and the calendar moving ever closer to the fall, we would like to see exports no higher than 800,000 bpd and much less would be preferred at this point. Exports reported at 910,000 bpd make us feel much less secure about domestic supply. This explains why we hope our feeling that exports were closer to the 700,000-bpd rate last week is correct.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.