Crude inventory drawdown’s relation to crude production

Crude prices have been volatile throughout the August downtrend. They moved higher from mid-June through July, but dropped from $50.17 to below $47 in August.

The volatility comes as crude traders try to balance the pricing impacts of a drawdown in U.S. crude inventory against rising U.S. crude production.

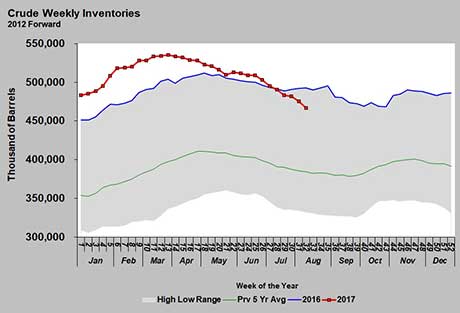

U.S. crude inventory dropped 8.945 million barrels for the week ending Aug. 11 (see the table above). Crude inventory at 466,492,000 barrels is 23,969,000 barrels below last year, but still 23.7 percent above the five-year average.

U.S. crude inventory was setting five-year highs through June but has dropped below last year’s levels over the last five weeks. The falling inventory has been a support for crude prices.

The drawdown in inventory has been due to a combination of factors:

- U.S. refinery throughput is up 454,000 barrels per day (bpd) year to date over the same time period in 2016.

- U.S. crude exports are up 299,000 bpd year to date over the same time period in 2016.

Those increases have only been partially offset by imports and increased production:

- U.S. imports are up 200,000 bpd year to date over the same time period in 2016.

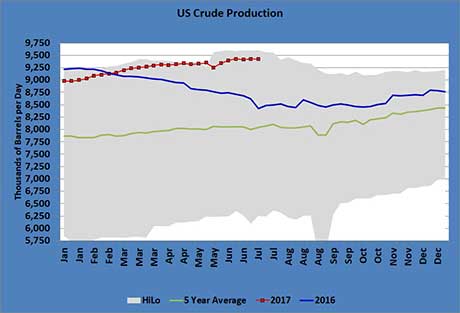

- U.S. crude production is up 344,000 bpd year to date over the same time period in 2016.

The difference yields a 209,000 bpd drawdown on U.S. crude inventory.

With U.S. crude production running 905,000 bpd higher than it was at this point last year (see the table above), we thought the year-to-date increase would have averaged more than 344,000 bpd.

We were surprised by several of these data points when we did this analysis. The increase in refinery throughput was far more than we expected.

We were also a little surprised to see imports running 200,000 bpd higher year to date, given Saudi Arabia’s cuts in exports to the United States. Those cuts have become more significant in the last couple of months.

Propane markets have benefited greatly from crude prices being capped by a surplus of crude inventory in industrialized nations around the world. Those inventories have remained above the five-year average despite efforts by producers to eliminate the surplus.

The drawdowns in crude inventory since March are typical as refiners ramp up throughput to meet summer gasoline demand during peak driving season. That season is coming to an end. Typically, that means less refinery throughput.

If production continues to grow as refinery throughput slows, U.S. inventory is likely to remain above the five-year average. That likelihood is exactly why West Texas Intermediate (WTI) crude prices have been under pressure this month and why they have been slipping in value relative to Brent crude, which is considered a more global benchmark.

However, changing dynamics in U.S. crude imports and exports are likely to have more say this year. In any case, a propane retailer is pulling for refinery throughput to slow and the sharp drawdown in crude inventory to end as fall approaches.

That would likely keep a cap on WTI crude at between $50 and $52.50 per barrel. If crude production continues to increase into the fall, WTI crude would more likely stay in the mid-$40s. With the potential for propane fundamentals to be tighter this winter, a cap on crude at $52.50 would be helpful in keeping propane prices out of a “shock” range that could be damaging to the retail propane industry.

Retailers need to keep a close eye on the crude data points (productions, imports, exports, refinery throughput) going into the fall. Will net import/export activity offset rising production? The degree at which crude exports could affect this fall’s crude inventory changes is a new phenomenon. Until the last couple of years, a U.S. crude export market was insignificant, but it is becoming a bigger part of the equation with each passing week.

Already, propane retailers are concerned that potential propane fundamentals will put upward pressure on propane prices this winter. However, the degree of that pressure is almost certain to be influenced by crude. If crude fundamentals become more price supportive, it will be even more imperative that propane retailers take actions that will limit the potential for price shocks to their customers.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.