Defining and analyzing speculative propane positions

A majority of traders are in the propane business in some way, shape or form. These individuals are called commercial traders or players. Commercial traders can be propane producers, transporters and retailers, among others. Primarily, a commercial trader is one who touches a wet barrel of propane somewhere along its path from wellhead to burner tip.

Commercial players have reasons to hold propane futures or hedges. A producer may hedge by selling future production to lock in the revenue that will be generated from sales. A retailer generally buys propane futures to lock in a known cost of supply. One way or the other, hedging helps them manage a business where physical propane is being moved along a supply chain.

However, not all propane is traded by commercial players. There are also non-commercial, or speculative, players. A speculative player can be a bank or some other financial institution that is not in the physical propane business. Though these players only represent 10 percent of the propane futures market for Mont Belvieu, they are worth monitoring to see how they are positioning for propane.

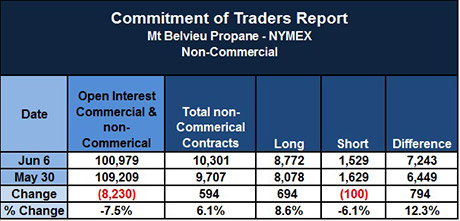

The table shows propane futures activity as reported by the Commodities Futures Trading Commission (CFTC) for the weeks ending May 30 and June 6. For the week ending June 6, there were 100,979 total positions held for Mont Belvieu propane. Almost exactly 90 percent were held by commercial traders, and the remaining 10 percent – 10,301 contracts – was held by speculative traders. A contract is 1,000 barrels of propane.

What makes speculative players unique is that they can only make money if they call the market correctly, which is unlike a commercial player, who may or may not care if prices are going up, down or sideways once their position is hedged. The commercial player has a physical position that will offset the financial or futures activity. In fact, that is the whole point of using futures for the commercial player: to remove the unknowns from their physical business to turn a future unknown price outcome into a known.

Since speculative players do not have physical barrels that can offset their financial positions, they must be correct on the financial position to make money. That is why monitoring their activity is beneficial. When we focus on where they are positioning themselves in the propane market, we have an idea on whether the majority is expecting prices to go up or down.

In the table above for the week ending June 6, speculators held 8,772 long positions. A long position requires prices to rise for its holder to make money on the position. There were 1,529 speculators holding propane short positions, which require prices to lower for the position to be profitable for the holder. That means the market was net long by 7,243 contracts. This shows a strong bias that prices will rise.

Note that from the week ending May 30 to the week ending June 6, long positions increased by 694, while short positions decreased by 100. Not only is the overall position net long, but the most recent activity showed a bullish bias for the future of Mont Belvieu propane prices.

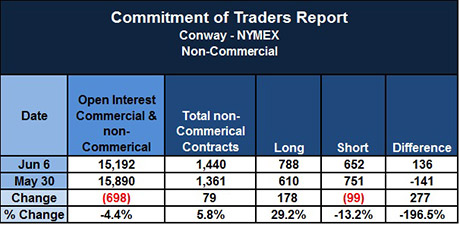

The above table shows the same data for Conway. Speculation on Conway propane is much closer to neutral than in Mont Belvieu. What is significant in the weekly change is that for the week ending May 30, speculators were net short. They held 610 long to 751 short positions. For the week ending in June 6, the net position had flipped, with long positions outnumbering short positions by 136.

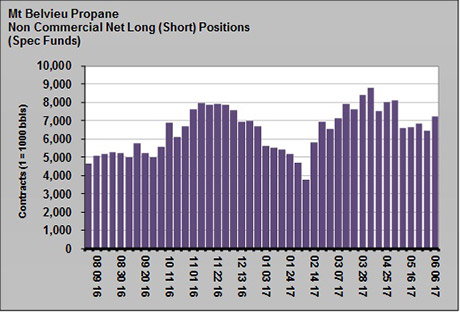

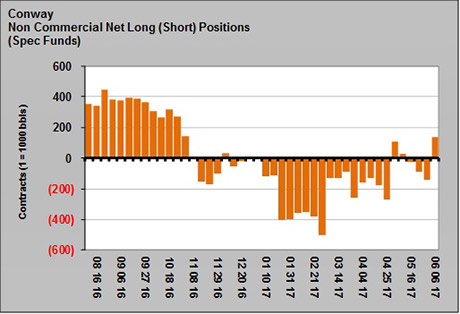

The charts below show the net long (positive) or net short (negative) position of speculative players over a 10-month period.

As of last week, speculative traders were net long for both Mont Belvieu and Conway propane. That means a majority of bets are for propane prices to rise by those that must be right to make money.

Even though a propane retailer is considered a commercial player, their activity can still be speculative in nature. If a propane retailer takes a futures position by either committing to pre-buys at a certain price or buying financial swaps without a corresponding sale, they are speculating until the physical propane is delivered and the sale price is known.

When a propane retailer takes a supply position at a fixed number and then makes sales against that position at a fixed number to customers, they have created a hedge and are not speculating. But when they have committed to the supply at a fixed price and not made the sale at a known price, they are speculating. If retailers are considering speculating, which almost all do, monitoring how professional traders are positioning themselves on a speculative basis is a good idea.

There is a lot of information in the marketplace and no one has all of it. However, if you look at overall positions like those provided by the CFTC reports, they reflect the combined knowledge of the marketplace. These reports are a way to determine if our thinking about the future price of propane is in line with a majority of those that need to be right on the call to make money.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.