Determining OPEC, crude’s impact on propane values

Any forecast on propane prices begins with trying to determine where crude will be priced. Propane fundamentals may push prices around in the current month and maybe a few months into the future. However, the further from the front month, the greater the impact of crude on setting propane values.

Evaluating crude can be difficult because of artificial market manipulation by the Organization of the Petroleum Exporting Countries (OPEC) and its allies – 24 producer nations in all. For example, they are limiting their production through the end of 2018, in an attempt to support prices.

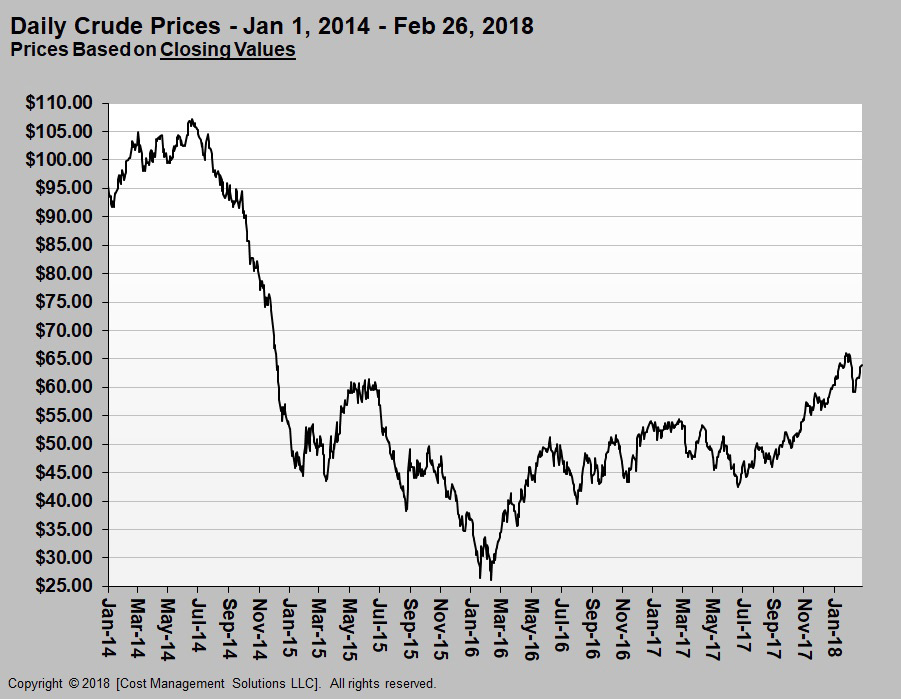

The chart above shows crude pricing history from January 2014 to February 2018. Crude prices reached $107.26 per barrel in mid-2014, but began collapsing as non-OPEC production surged, primarily in the United States. In November 2014, OPEC decided that with new shale production, it could no longer control prices and would let market forces determine them. OPEC members increased production, expecting their low-production cost advantage would crush higher-cost U.S. producers.

As a result, from November 2014 through February 2016, the world was oversupplied with crude, causing the price to drop to $26.21 per barrel. U.S. producers were hurt and their production declined. Crude-revenue-dependent OPEC nations, though, were crushed by the price collapse.

Because of this, in 2016, OPEC began talking about implementing production controls, but pledged it would not do it alone. The talk of production controls alone sent crude prices up in 2016. In January 2017, OPEC and a group of non-OPEC producers, led by Russia, implemented a quota system that reduced their combined production by 1.8 million barrels from their October production levels.

Predictably, U.S. production began to increase, limiting price gains. Eventually, prices fell in mid-2017, causing U.S. producers to cut back on drilling activity. That caused crude prices to recover with West Texas Intermediate reaching $66.14 in January 2018. U.S. producers have been slow to increase drilling, but production has continued to rise, reaching a record 10.27 million barrels per day (bpd). U.S. crude exports have been rising, reaching more than 2 million bpd at times. The U.S. is now producing more crude than Saudi Arabia and could overtake Russia to become the world’s top producer sometime this year.

As long as crude prices stay at current levels, U.S. production will continue to increase, resulting in a loss of market share for OPEC. So far, this hasn’t been a major issue since a drop in production from OPEC member Venezuela caused it to go well below its quota. This helped to offset the U.S. increases. Venezuela’s production is running 477,000 bpd below its October 2016 production rate due to geopolitical and economic issues. The country was only required to cut 95,000 bpd from its October 2016 production rate to be in compliance with the producer’s production control agreement that was implemented in January 2017. Most other OPEC nations have also voluntarily cut more than required. In February, the 12 OPEC nations under the production controls agreement had cut 1.748 million bpd against a target cut of 1.176 million bpd.

The conundrum for OPEC is that, to keep prices at current levels, it must keep reducing production to make way for non-OPEC suppliers or run the risk of unwinding all of the gains it has made in improving crude’s price. Right now, the price gains have more than offset the losses in market share. However, we wonder just how long these producers will be willing to watch U.S. producers thrive at their expense.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.