EIA adds accuracy to key driver of propane price direction

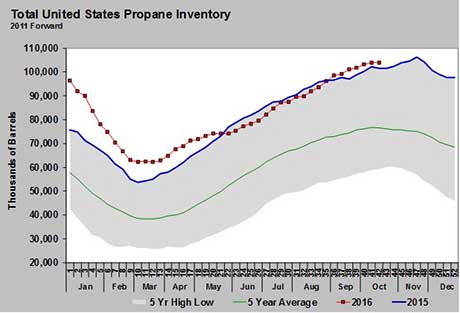

The latest data from the U.S. Energy Information Administration (EIA) for the week ending Oct. 7 showed U.S. propane inventory declined 72,000 barrels. That decline went against industry expectations for a 600,000-barrel increase. It also went against the five-year average for week 40 of the year, which had been a 739,000-barrel build.

Despite the draw, U.S. propane inventory still set an all-time high for this time of the year at 103.928 million barrels.

Most in the industry would assume the surprise decrease happened because crop drying demand is higher than expected. That may actually be the case, but it was not what EIA data supports. In fact, EIA reported U.S. domestic demand decreased 74,000 barrels per day (bpd) to 931,000 bpd.

That is certainly good domestic demand, but the draw would not have occurred without a 61,000-bpd increase in propane exports, as well as drops in imports (down 79,000 bpd) and propane production (down 49,000 bpd).

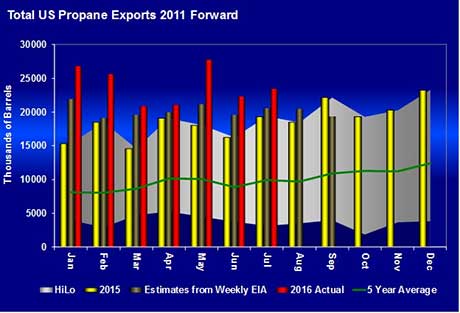

But our focus needs to be on the exports. EIA changed its methodology for collecting data on exports, including propane, in an effort to try and make its weekly estimates more accurate. It is now using data from U.S. Customs and Border Protection in its weekly export estimates.

The bar chart above shows why EIA made the change. The brown bar shows the exports for each month based on weekly estimates. Three months after the weekly estimates are in, the official data is released. The pattern shows more exports for official data than weekly data.

What is important to know is that the change in methodology for collecting export data also affects domestic demand. Domestic demand is a calculated number. EIA does not collect weekly data from retailers or consumers of propane to determine demand. It collects data on imports, exports, production and inventory changes. It uses those numbers to provide an implied domestic demand number.

Of course, that means if EIA has been underestimating exports in its weekly data, it has been overestimating domestic demand. Last week’s data showed a 61,000-barrel increase in exports and a 74,000-barrel decrease in demand. Unfortunately, all of us who monitor the data to try and determine how different facets of our industry are going will have to establish the new norms after the methodology change.

Hopefully EIA’s changes will cause weekly propane export estimates and official monthly data to more closely align. That would be great, given how long of a lag exists between the two. Exports, not domestic demand, have now become the most critical factor in determining propane price direction. Having timely information that is more accurate is a major step in the right direction if the new methodology for export data collection does turn out to be better.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.