Exports harness propane inventory builds, prices

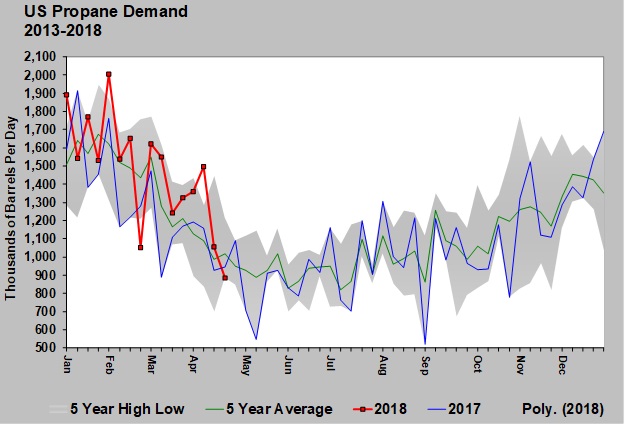

In recent weeks, several “Trader’s Corner” columns have centered around domestic propane demand and exports. This year, domestic demand has remained high due to a long winter heating season, when compared to recent winters.

The higher domestic demand had gone a long way to limit propane inventory builds (see last week’s “Trader’s Corner”) even as export volumes remained well below last year’s rates.

The last couple of weeks, however, have seen a significant drop in domestic demand.

After setting a new five-year high three weeks ago, domestic propane demand dropped sharply over the last two weeks. In fact, demand set a five-year low for the week ending April 20. Domestic demand dropped a massive 612,000 barrels per day (bpd) from the five-year high to this week’s five-year low.

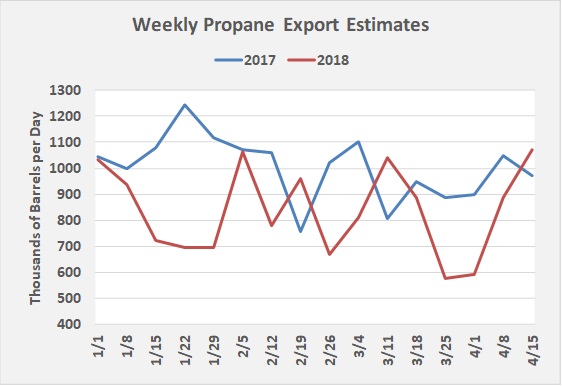

Since propane exports were extremely weak at the beginning of April, this dramatic drop seemed to be setting up a major build in U.S. propane inventory. Instead, the U.S. Energy Information Administration (EIA) reported U.S. inventory declined 162,000 barrels. This occurred in a week that averaged an 876,000-barrel build over the last five years.

The inventory build was missed because of a resurgence in export volumes during the last two weeks. The chart above shows how exports were well behind last year’s export rate, and rose above that rate for the week ending April 20.

Exports hit a rate of 1.071 million bpd that week. That rate of exports would certainly limit inventory builds if it were maintained. But, it may be a bit early to make that assumption. So far this year, exports have averaged 165,000 bpd below where they were during the same period last year. According to weekly estimates from the EIA, exports have averaged just 839,000 bpd this year compared to weekly estimates of 1.003 million bpd during the same period last year.

U.S. propane prices have surged this past week, which could quickly slow down export activity. But, if exports stay near that 1-million-bpd rate for a while, they could keep limiting inventory build and maintain upward pressure on prices.

For the most part, exports are now in control of propane inventory builds and prices. Propane’s relative value to crude significantly increased this past week, but that could quickly reverse if exports slow down following the surge of the last couple of weeks.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.