Petrochemical companies boost propane usage

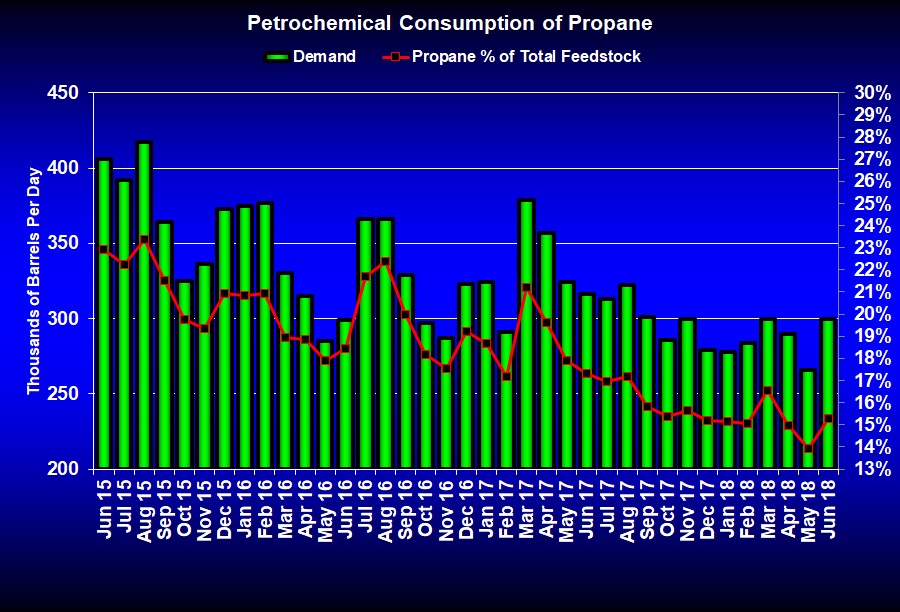

Recent data shows petrochemical companies are increasing propane as a feedstock this month after a sharp falloff in May.

Estimates show petrochemical companies are using propane at a rate of 300,000 barrels per day (bpd) in June compared to 266,000 bpd in May. Propane moved from 13.95 percent of the total petrochemical feedstock stream in May to 15.27 percent in June.

Petrochemical companies have been favoring vastly cheaper ethane as their primary feedstock. Ethane remains the primary feedstock, but dropped from 73.7 percent of the feedstock stream in May to 72.5 percent this month. Ethane consumption is at 1.424 million bpd.

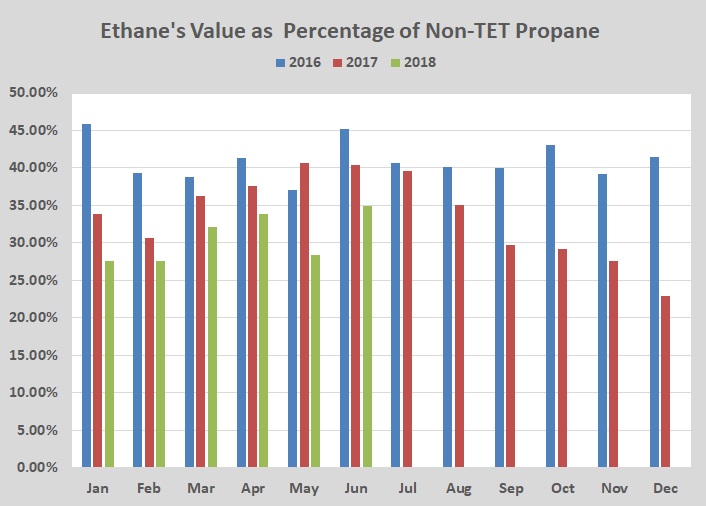

The reason for the change in the feedstock stream mix could be an improvement in the relative value of ethane to propane. Petrochemical companies are extremely sensitive to price, causing them to use cheaper feedstocks where they can. Petrochemical companies’ feedstock mix also can be impacted by what products are needed to supply customers, so the price of the feedstock is not the only consideration.

In 2016, ethane averaged 41.01 percent of propane. As propane inventory fell with more propane export capacity, prices improved, leaving more constricted ethane behind. That resulted in a sharp decline in ethane’s relative value during the second half of last year. For all of 2017, ethane priced at just 33.63 percent of propane. In the second half of the year, the average was just 30.68 percent. Due to the relative low value, petrochemical companies were using as much ethane as possible.

Recently, ethane values have been improving against propane. The average this year has been 30.73 percent, which is just slightly better than the last six months of 2017, but ethane’s value is trending upward. In January, ethane averaged just 27.58 percent of propane’s value, although it is 34.99 percent this month. It is our understanding that pipeline projects that could relieve the bottleneck from that production area will not be complete until sometime next year.

Ethane export capacity is improving, and more units that turn ethane into ethylene are being completed. That seems to be increasing ethane values, which is causing petrochemical companies to respond.

The implication for propane retailers is that petrochemical companies could demand more propane moving forward if the trend in ethane’s relative value to propane continues on its current path. If that slows down the build in propane inventories, it could result in price support for propane.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.