Propane fundamentals at play in absence of strong crude rebound

Crude prices in the United States and around the world are in a sharp decline. A glut of crude and refined fuels has reversed a rally in crude prices. West Texas Intermediate (WTI) crude prices had rallied from a low of $26.40 per barrel on Feb. 11 to a high of $51.23 on June 8. WTI is now trading more than $10 below that high.

The near doubling of crude’s price had a strong speculative component to it. Traders were betting that reduced crude production and increased demand due to low prices and improved global economic conditions would rebalance crude supply and demand, bringing down a glut of crude and refined fuels inventories.

As the Organization of the Petroleum Exporting Countries continues to add to its production, U.S. crude production has been more resilient than expected and the global economy has been struggling to meet growth expectations. Thus, the tightening of supplies has not occurred, forcing crude, refined fuels and propane prices to adjust to the fundamental reality. At some point, prices elevated by speculation must have fundamental conditions support them. At this point, that support simply has not come.

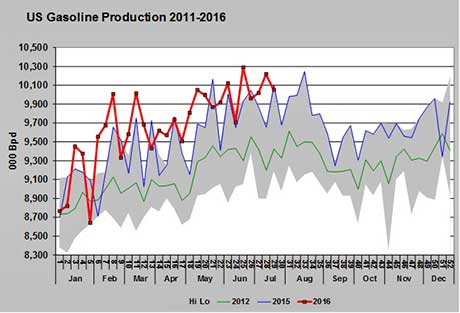

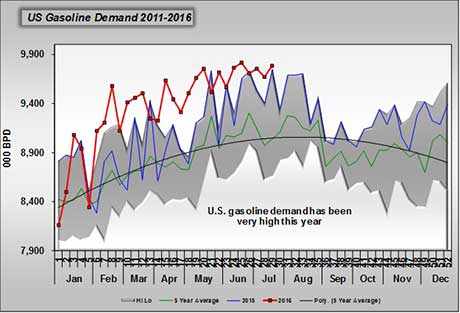

U.S. gasoline supply and demand is a key example of the fundamental reality that is causing a reset on energy prices. During this past winter, U.S. refiners did not do the normal maintenance work that is common during the fourth and first quarters. High profit potential for gasoline caused them to keep running the refineries near full capacity, resulting in high gasoline output.

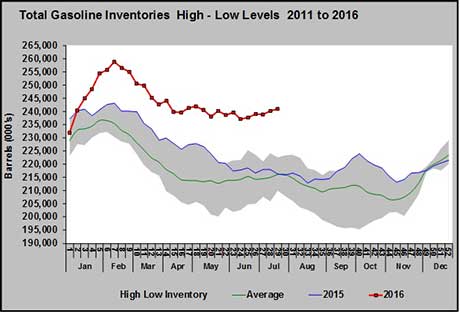

They switched to making summer-blend gasoline early this year to take advantage of a steeply contangoed (price in a month is higher than the price in the month that precedes it) pricing environment. The result was extremely high gasoline inventory coming out of winter.

Refiners were not necessarily wrong to increase their summer-blend inventory in anticipation of strong demand during the summer. The strong demand did occur.

Despite the high rate of gasoline consumption, it has not been enough to bring down the surplus inventory that refiners accumulated through the winter by not performing their normal maintenance work. In addition, gasoline inventory has been climbing at a time it normally is on the decline. This has caused refiners to stop making summer-blend gasoline and to begin making less-expensive winter-blend gasoline much earlier than normal.

This winter, we expect that refiners will engage in a more typical maintenance schedule. The result will be lower refinery throughput and lower crude demand. While this may support higher gasoline and distillate (diesel, heating oil) prices, it should have the effect of putting downward pressure on crude prices. The lower refinery throughput would have some support for propane prices as well, since propane supply would decrease slightly.

While crude analysts believe crude prices will rebound in the second half of the year, fundamentals do not support a strong rebound at this time. That means a rally in propane prices will not likely be based purely on a rebound in crude prices. For propane prices to strengthen, propane fundamentals are going to have to become more supportive. In other words, someone betting on higher propane prices can’t count on just a rally in crude to meet his or her expectation. Instead, winter demand needs to be more normal than the light demand experienced last winter, and propane exports need to pick back up closer to where they were at the beginning of the year. Exports have fallen off over the last couple of months, causing a sharp decrease in propane prices.

A decreased chance of a blowup in crude prices helps propane retailers simplify the propane-buying process this year. The focus can be primarily on propane fundamentals and less on crude. Propane fundamentals are going to go in the same direction as propane exports. With inventory so high, winter demand alone is unlikely to stress supplies significantly. But we saw at the beginning of this year that – even in a mild winter – if propane exports are robust, propane inventory will come down at a much higher-than-average pace.

Graph: Cost Management Solutions

For more Cost Management Solutions analysis of the energy market that helps propane retailers manage their supply sources and make informed purchasing decisions, visit www.lpgasmagazine.com/propane-price-insider/archives/.