Selling swaps provides protection against falling prices

As propane retailers, we consider our hard-won customers the only ones interested in buying our propane. We believe we must wait until our customers need the propane or are willing to sign on the dotted line for a fixed price, cap or budget program before we realize the price we’ll get for the supply purchased. However, there are times when waiting on our retail customers to purchase our supply is not in our best interest.

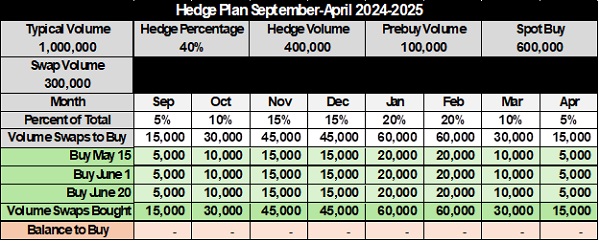

Selling a swap against existing supply has become very common among propane retailers wanting to avoid downside price risk. For example, when retailers put propane in storage or commit to a pre-buy, they assume the risk of falling propane prices.

Many times retailers put propane in storage for supply-security issues. They really don’t want to speculate on whether prices will go up or down. By selling swaps to cover the time the product is in storage, the retailer can avoid losing money if prices fall.

If retailers purchase pre-buys and later become concerned that propane prices are going to drop – potentially putting them at a supply-cost disadvantage – they can sell a swap to mitigate the risk.

Many retailers now use the buying and selling of swaps to take advantage of market trends and new information concerning propane supply. As long as supply conditions look tight, with the greatest risk being that prices will rise, retailers will buy swaps. However, if conditions change and the risk shifts more to falling prices, they will sell swaps for equal volumes and months to take the profit on a swap bought or to minimize losses.

The ability to sell swaps gives retailers a lot of confidence in taking supply positions such as storage, pre-buy or swap buys. They know if conditions change from bullish to bearish that selling swaps can mitigate the new downside price risk that can develop.

Swap sell

Sell when you:

- Desire protection from lower prices

- Have little or no concern for rising prices

- Prefer to avoid option premiums

Swaps are best used to:

- Protect stored gas from falling prices

- Protect pre-buys from falling prices

- Close swap buys to take profits or minimize losses

Financial hedging tools such as swaps and options are all about managing supply risk and turning unknowns about price into knowns. They offset what is going on in the physical propane market to minimize price volatility and provide stability and security for propane retailers and their customers.

Cost Management Solutions’ (CMS) Financial Hedging Services provides:

- Price transparency so retailers know they are getting the best price for swaps and options

- Deal confirmations at the time of deal execution

- Market reports at the end of each month so the retailer knows the status of the position

- Advice on what hedging tools and supply risk management strategies will best meet the retailer’s needs

- Assistance in setting up with counterparties and obtaining the necessary approval from the government to trade financials

If a retailer has never used financial hedging tools, it may seem as if they are mysterious and difficult to utilize. However, nothing could be further from the truth. They are actually quite basic and easily mastered – certainly much easier than the daunting list of regulations a retailer must understand and implement.

Financial hedging tools have become an essential component of any successful retail propane business, and CMS can help you every step of the way in becoming a master of them.

For more Cost Management Solutions analysis of the energy market that helps propane retailers manage their supply sources and make informed purchasing decisions, visit www.lpgasmagazine.com/propane-price-insider/archives/.

very insightful info