Subjects of circumstances: Tackling outside variables

U.S. propane inventory builds to an all-time high, but retailer success is still highly dependent on outside variables.

Propane is flowing like milk and honey from natural gas processing plants and crude oil refineries these days – to the tune of more than 90 million barrels – and every additional inventory build reported by the U.S. Energy Information Administration (EIA) sets a propane stockpiles record.

The high inventory level is one source of comfort for retailers as they prepare for the 2015-16 winter heating season. Low wholesale prices that have accompanied the soaring inventory are also putting some minds at ease as winter approaches.

The propane industry hasn’t experienced supply dynamics quite like these. Yet, many of the same winter heating-related questions remain.

For example, what kind of weather will U.S. regions experience? Can rail and other infrastructure withstand major weather events? And will retailers face stiff competition for available barrels in the coming months?

These questions and others related to the heating season will be answered in time. For now, wholesalers are scurrying to move as much propane as they can in advance of winter.

“[Wholesalers] would be happy if it started snowing in September,” says Jim Renaldo, director of sales and marketing at Norco Propane Energy Services in North Collins, N.Y. “Wholesalers are pushing on one end, and the retailers are pushing back on another end. These 90 million [barrels] are all and good, but if you’re a wholesaler you’re sitting on a powder keg.”

Retailers only have so much storage to accommodate the current production rate, which has steadily hovered around the 1.6-million-barrels-per-day mark since last year’s fourth quarter. The industry’s current circumstance begs a simple question about propane supply and demand, though.

“Just because we have this capacity, does it really mean we’ll have the demand to meet that capacity?” says Allison Tinn, NGL Americas reporter at Argus Media.

Weather

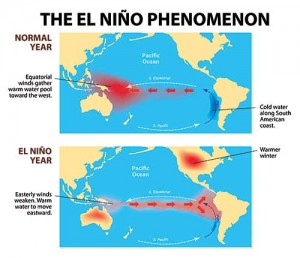

Weather, as always, will be a leading factor in determining propane demand this winter, but there is a unique influence to consider: El Niño, which National Oceanic Atmospheric Administration (NOAA) forecasters declared in March.

El Niño, a Pacific Ocean warming that occurs every two to seven years in equatorial waters, could be one of the strongest on record, according to NOAA forecasters. It has an 85 percent chance to last through the winter and into spring, based on an El Niño update NOAA provided in mid-August.

So, what does a strong El Niño mean for winter weather across the U.S.? The typical El Niño results vary, NOAA reports, but those situated in states along the northern tier – from the Northwest to the Northeast – may experience warmer-than-average winter temperatures. The Southwest and parts of the Gulf Coast and Rocky Mountains, meanwhile, may experience cooler-than-average temperatures.

Of course, NOAA cautions that El Niño is just one atmospheric influence that will affect this winter’s temperatures.

“It’s critical to realize that although we [understand] the typical relationships between El Niño and global climate patterns, none of the typical impacts are ever guaranteed,” says Mike Halpert, deputy director of NOAA’s Climate Prediction Center.

Still, El Niño will likely be a top driver of weather into next spring, according to Joshua Senechal, a meteorologist at Genscape.

“The average December, January and February looks pretty warm, especially for the northern half of the U.S.,” says Senechal, whose firm produces data and intelligence on the energy market. “Our top analog years are 1957-58, 1987-88 and 1997-98. These are all moderate-to-strong El Niño years. Overall, it looks like a pretty bearish winter for propane demand.”

Moderate-to-strong El Niños don’t always deliver the winter temperatures meteorologists forecast, though.

“It’s worth pointing out that 1957-58, even though it was an El Niño winter, it did have considerably cooler-than-normal conditions in the month of February,” Senechal says. “So while the winter as a whole looks warm, I think there is a risk later in the winter that we could see some pretty cold temperatures [and] perhaps a few cold snaps focused on the eastern half of the United States.”

In the Northeast, Renaldo expects a cold winter based on projections he’s read. He adds that the Midwest could use the weather this winter that the Northeast got last winter.

“The only profitable area of the country is the Northeast these days,” Renaldo says. “They’re taking hits in the Midwest. They’re experiencing milder winters than we are.”

Sharp Energy’s Matthew J. Perry is hoping for a cold, sustained winter.

“As long as the weather stays consistent, you would think the price would stay fairly consistent,” says Perry, manager of propane supply for the Mid-Atlantic wholesaler that serves about a dozen retailers. “The problem in my neck of the woods is you just need one hiccup and you get spot prices that are out of whack.

“But I personally think there’s going to be supply on the retail side this winter,” he adds.

Infrastructure

Even if supply is abundant, moving propane to demand areas remains a challenge. Rail terminal investments have been made to offset pipeline losses since the 2013-14 shortage, but retailers may face some of the same slowdowns should a severe winter storm or two surface.

“You don’t know how rail’s going to do,” Perry says. “You might have propane in railcars, but if that’s not moving then that’s a problem.”

Drew Combs, vice president of propane at CHS Inc., agrees.

“Even though there appears to be a surplus of propane out there, those gallons are still not at the right locations,” he says. “Mont Belvieu is at an all-time high inventory, but a lot of that is headed toward exports and is not positioned to feed into most demand markets. Retailers and end users need to make sure they are managing their supply logistics and not get lulled into a false sense of supply security.”

Rail infrastructure is at least on the rise.

“LPG rail has been on the rise substantially since 2009,” Tinn says. “From the third quarter of 2009 to the fourth quarter of 2014, rail traffic has been soaring.”

Conway pricing is one reason for the increase in rail use.

“The north and south arbitrage widening helps make it more profitable for traders to send barrels south to Mont Belvieu,” she says. “The more it widened, the more the arbitrage [is] profitable. That spread play seems to be more attractive.”

According to Anne Keller, manager of NGL research at energy consulting firm Wood Mackenzie, some rail terminals have added storage to avoid potential runouts. Those additions could offset slowdowns.

“I think you’ll see more investment to maintain flow assurance,” she says. “With PERC (the Propane Education & Research Council) now able to do market development, you don’t need to be a concerned supplier.

“This is a great year for everybody to see that the bottlenecks have been removed,” Keller adds.

Renaldo says more storage is preferable, though.

“Wholesalers are trying for more storage, but communities are pushing back,” he says. “Ten years ago, all these short [rail] lines were running and you could put storage facilities out in the middle of nowhere. We missed an opportunity to put these railroads back to work.”

In the meantime, wholesalers are storing propane anywhere they can.

“There are a lot of pipelines going up in Canada right now to move gas around,” Renaldo says. “You put a lot of gas in those pipes and that’s storage. [Wholesalers] are putting this stuff anywhere they can. They’re running around with teacups. If it’ll hold gas, let’s put it in there.”

Exports

If propane isn’t staying on the mainland, it’s shipped overseas in many cases.

Competition from international buyers has increased significantly in recent years. A number of retailers have expressed concerns that propane should be prioritized for the domestic market during winter months.

Propane/propylene exports have been up exponentially during winter months in the last decade, peaking at 661,000 barrels per day in February of this year. That EIA figure is nearly double the number of barrels shipped the previous February and more than three times the number shipped in February 2013. Exports of propane/propylene remained high as this past summer approached.

“Exports are the 800-pound gorilla when it comes to LPG balances these days,” says Amanda Townsley, senior adviser of NGLs at Genscape. “U.S. exports peaked earlier this year, and they peaked at about the same time as the (Sunoco Logistics) Nederland, (Texas), terminal startup. Since that happened, we’ve seen utilization of the export facilities fall.”

Export facilities were running close to 100 percent capacity over the last couple of years, Townsley says, but those facilities are now at about 80 percent capacity.

“That’s primarily due to economics as well as scarce freight, which, of course, go hand in hand,” she says. “We just haven’t had the incentive to use all that capacity.”

But those facilities should soon have incentives. Genscape expects an additional 35 to 40 very large gas carriers (VLGCs) and large gas carriers (LGCs) to be available by year’s end.

“There are some new ones hitting the market right now, but the ramp-up is mostly [expected] in the fourth quarter,” Townsley says. “Even later than this year, there’s another 40 or 50 or so expected to come online in 2016.”

The ramp-up should take propane exports to new heights.

“Year-on-year, we’re expecting propane exports to average about 700,000 barrels per day of waterborne [product] during demand season,” Townsley says.

Petrochemicals

Petrochemical plant demand for propane is another area worth exploring in relation to winter heating demand.

“We have very strong demand for LPG for petrochemical use due to favorable economics,” Townsley says. “At the lower crude price, propane and butane are a lot more competitive to go into the cracker than ethane.”

Indeed, the low price of crude oil has been instrumental in this year’s low propane prices. As of press time, crude oil plummeted to a six-year low of $43.20 per barrel.

The spot price of Mont Belvieu propane is also as cheap as it’s been in years. According to EIA, Mont Belvieu propane bottomed out earlier this summer at 31 cents per gallon. The price has since increased to the high-30s, but it’s still remarkably low in a historical sense.

According to Townsley, propane currently has the advantage in the U.S. petrochemicals sector because butane is close to saturating its petrochemical demand here.

Tinn agrees propane currently has an advantage in the petrochemicals market.

“Now, we’re hearing that propane is the feedstock of choice,” she says. “We’re hearing more people are cracking propane.”

Some companies are hesitant to make propane their feedstock of choice, though. An oversupply of propylene, which is yielded as a byproduct of propane cracking at a higher rate than ethane cracking, is a source of uncertainty.

“When you go from cracking propane instead of ethane, you get a 17 percent propylene yield instead of a yield of under 3 percent,” Townsley says. “So [companies] have a lot more propylene to find a home for.”

One source of comfort for propane retailers is that petrochemical companies typically shy away from propane during winter months because of price spikes. Petrochemical companies have been burned in the past, Townsley says, so they tend to buy other feedstocks.

Crop drying

Fall crop drying, like petrochemicals, has a potential impact on the propane supply available for winter heating. And summer weather, of course, is a key driver of crop drying.

The Midwest experienced two to four times the average amount of June rainfall, Senechal reports. Illinois, Indiana and Ohio have at least 50 percent additional soil moisture, he adds.

September could be a wet month as well, he says, creating conditions that require more crop drying than usual.

“I do think excess rain moisture is going to be a bit of an issue,” Senechal says. “If you have six to 12 inches of rainfall in one month like we saw in Illinois, Indiana and Ohio, we’re going to have a lot of excessive grain moisture.”

Another large crop is expected this year, including a near-record harvest for corn. The U.S. Department of Agriculture forecasts the harvest to yield about 13.7 billion bushels of corn. That’s about a half-billion bushels less than last year’s estimated record 14.2 billion bushels.

The crop yield is just one factor that influences crop drying. Based on the crop yield and weather conditions, Genscape forecasts 2 million barrels of propane use related to crop drying this fall.

Two million barrels is low compared to past crop drying years. According to Genscape, farmers demanded about 9 million barrels of propane for crop drying in 2009. That year, the crop was both planted and maturing late.

In the fall of 2013, about 7 million barrels were consumed for crop drying. About 3 million barrels were consumed for crop drying last year.

As always, weather will dictate how much propane is consumed for both crop drying and winter heating, as well as how much remains come spring.

“For context, the difference between a warm winter versus a cold winter is about 40 million barrels of propane demand, or 20 million on either side of average,” Townsley says. “Last winter was only slightly colder than normal, [resulting in] about 5 million barrels of extra demand than the average winter would have.”

Assuming average winters emerge across the U.S., Townsley expects consumers to draw about 20 million barrels more propane than they did last year.

“That’s a very material chunk of the overhang we have in inventory,” she says. “This could bring us back to about 33 million barrels by the end of March, which is a normal range versus history.”