Traders remain calm despite three straight draws

The Oct. 26 release of the U.S. Energy Information Administration’s (EIA) Weekly Petroleum Status Report for the week ending Oct. 21 surprised retailers and traders by reporting a 2.115-million-barrel draw on U.S. propane inventory.

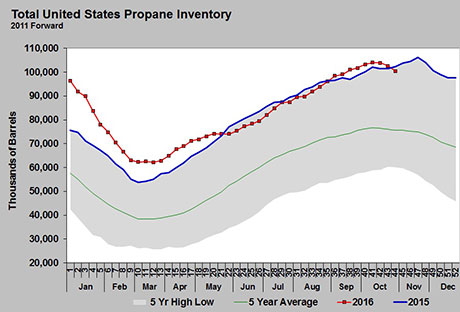

It was the third week in a row that inventory fell. For the week ending Oct. 7, there was a modest 72,000-barrel draw. For the week ending Oct. 14, there was a 1.246-million-barrel draw.

It certainly appears inventory has reached its peak for the year. If it has, that peak came six weeks earlier than it did last year. It also peaked 2.202 million barrels less than last year. If inventory has peaked, it is possible we are in for a long drawdown period, with many of the weather forecasts predicting a longer winter this year.

At 100.567 million barrels, current inventory is comparable to where it was during the first week of December last year. What makes this drawdown interesting is it came before cold weather has kicked in for most of the country.

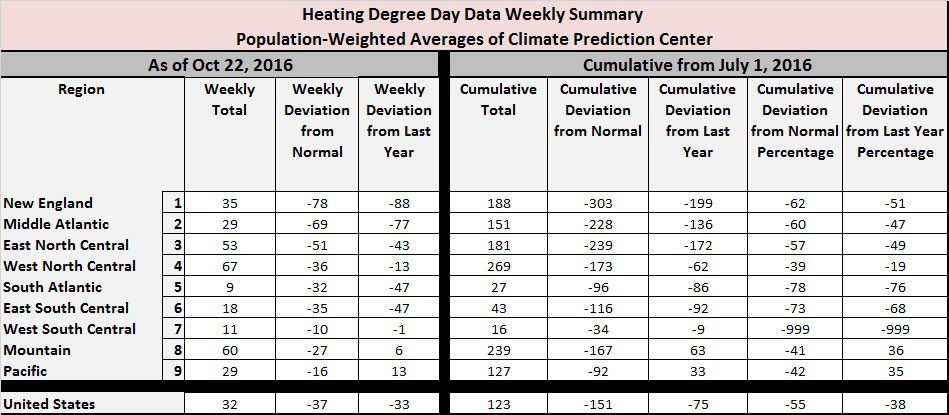

The heating degree-day data we use is population weighted from the National Oceanic and Atmospheric Administration. It may not line up with the heating degree-day tool you use. For that reason, it is probably best to concentrate on the last two columns, which are the percentage deviations for normal and from last year.

Regardless of which heating degree-day tool you use, you should see similar percentage changes. This source shows cumulative heating degree-days since July 1 at 55 percent below normal and 38 percent below last year. It also shows heating demand conditions have been weaker than they were last year.

That knowledge, combined with the inventory data, presents a rather bullish picture. However, propane markets have been anything but bullish during this three-week period of inventory drawdown. Traders seem skeptical about the data EIA is putting out.

For the most part, traders appear to believe EIA is still adjusting to its new methodology for collecting data. They are calm despite what might otherwise be considered more supportive fundamental conditions. There remains a lot of inventory and the weather outlook for next month is looking mild. We have seen natural gas prices falling rapidly over the last week on those mild weather outlooks.

EIA reported U.S. propane exports at 981,000 barrels per day (bpd) for the week ending Oct. 21. That was up 296,000 bpd from the previous week. Propane traders believe this is an adjustment number by EIA and not the actual rate of exports, which is why the market is calm. However, if exports happen to settle in anywhere close to that mark, markets will not remain calm for long.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.