Traditional or new markets – which is the best route for your business?

Threats and opportunities – they are the pathways to progress, determining the speed at which we reach our potential.

To gauge where we stand as an industry, we must identify these threats in order to overcome them. We must learn about these opportunities in order to capitalize on them.

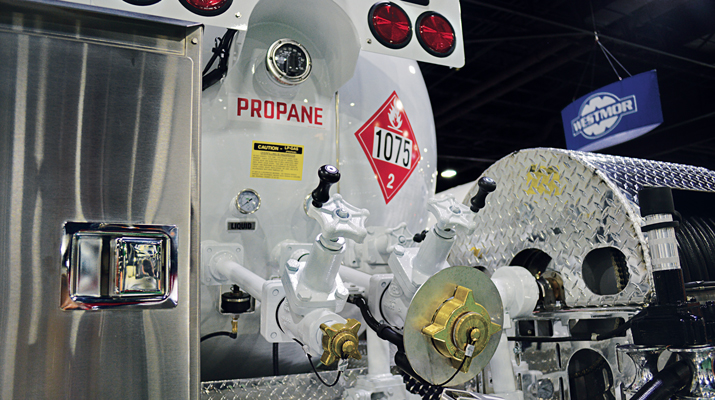

The propane industry has been in a state of change. We have lost traction in traditional markets, but we have built momentum in new markets. And our supply picture has become drastically different, greatly influencing the movement of propane at our borders.

It’s important to understand what’s happening in the market. Having an awareness of these factors and trends will help you make better business decisions. The research done in the 2013 Propane Market Outlook by ICF International for the Propane Education & Research Council (PERC) provides that valuable insight for the industry.

Vast improvement

The industry is in much better shape today than it was a year ago, as we were coming out of a record-warm winter.

Propane prices are down substantially, and new opportunities are becoming more apparent. These new opportunities, particularly in the engine fuel markets, are helping to offset declines in traditional markets and will pave the way for slow growth in total consumption through 2020, ICF research shows.

Warm winters, customer conservation, efficiency improvements, energy competition and a slow-to-recover housing market have led to declines in the residential market, which represents about 60 percent of total consumer propane sales. Consumption had declined for the last four years, and while sales appeared to have recovered this year ICF expects residential demand to fall slowly through 2020.

Inroads are expected to come in engine fuel markets, as ICF projects propane sales in internal combustion engine applications to double from about 600 million gallons in 2011 to about 1.2 billion gallons in 2020. The price disparity between propane and counterparts gasoline and diesel is too large to ignore, especially with the available tax incentives. On-road vehicles, especially the school bus market, and mowers offer the greatest potential.

However, hurdles remain for the industry to maximize its potential in these markets.

The industry must continue to increase the number of propane-fueled vehicles, as propane autogas vies with natural gas and electric vehicles, and push for a long-term extension of alternative fuel tax credits. Current credits expire at the end of this year.

In addition, not all mower OEMs are aggressively promoting their propane models, and the distribution and servicing structure has developed more slowly than the technologies, ICF reports.

A new consumer education campaign would help potential customers understand the benefits of adopting propane while filling an industry void that has existed since 2009.

About four years ago, the federal government limited the industry’s consumer education campaign, with a rise in propane prices relative to other heating fuels triggering a consumer-protection clause in the legislation that created PERC. But PERC is considering a new campaign for 2014.

Shale-based supply sources

Propane’s reputation as a domestic fuel continues to strengthen with the growth in natural gas liquids production from shale plays.

Much of that growth is emanating from the Marcellus (in the Northeast) and Bakken (in North Dakota) shale plays, where propane production per year could total about 4 billion gallons by 2020, according to ICF. This new domestic fuel source has made the United States a net exporter of propane and dramatically boosted propane’s use as a petrochemical feedstock.

So how should propane marketers use all of this information? ICF says staying in traditional markets or branching into new markets is an individual choice, as long as marketers know what’s ahead before making the decision on where to focus their energy.

You can read more about these trends by obtaining a copy of the outlook at www.propanemarc.com.