Underestimating January propane exports

Last week in Trader’s Corner, we discussed the perplexingly high amount of propane demand being reported. This week, the Energy Information Administration (EIA) released information that supported the point made last week. After comparing heating degree-days and demand for March 2015 and 2016, we made the following statement:

“In our calculations, we deduced that retail demand could be overestimated by as much as 214,000 barrels per day (bpd) based on the light number of heating degree-days. It is possible those barrels should be showing up in exports rather than domestic demand.”

The problem is that EIA implies domestic propane demand using inventory changes, production and exports. If EIA is off in any of those calculations, domestic demand can be overstated. Our discussion last week was based on March numbers. This week, EIA released official export data for January. What occurred in January supports our concern that domestic demand was being overstated, while exports were being underestimated.

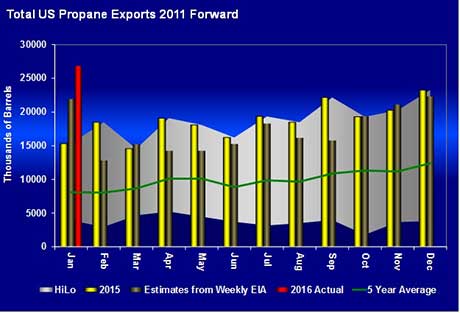

In its official report on January exports, which lags by about two months, EIA reported the United States exported 26.8 million barrels of propane. That export rate is nearly 866,000 bpd. During January, EIA pegged exports at 707,000 bpd, or just below 22 million barrels, in its weekly estimates.

By underestimating exports by 161,000 bpd, EIA likely overestimated domestic demand by that amount. Based on industry data, it is likely EIA underestimated exports again in February, and it is possible it continued to do so during March. For February, industry data shows exports at a higher rate than January. Meanwhile, EIA estimated a drop in exports to just over 19 million barrels.

Certainly, the industry would look at the overstated domestic demand and assume demand will fall considerably during the summer as winter heating falls out of the equation. But if exports were responsible for the exceptionally high drawdown in U.S. inventory this year, demand may not decrease this summer, which could possibly lead to a slower rate of inventory growth leading into next winter.

If that turns out to be the case, it could lead to more propane price appreciation than current propane inventory levels might suggest between now and winter. Yes, inventory levels are high and recent inventory builds have been above average and, thus, bearish for propane prices.

But at this point, it would be wise for propane retailers not to assume inventory builds will remain robust and above average all summer. Monitoring builds in inventory this summer to see if they start falling below normal should be high on most retailers’ watch lists.

For more Cost Management Solutions analysis of the energy market that helps propane retailers manage their supply sources and make informed purchasing decisions, visit www.lpgasmagazine.com/propane-price-insider/archives/.

Chart: Cost Management Solutions