What happens when petchems shy away from propane?

With winter approaching, the most recent data shows petrochemical companies shying away from propane as a feedstock. This is good news for propane retailers, as petrochemical companies are the biggest competition for domestic propane supply.

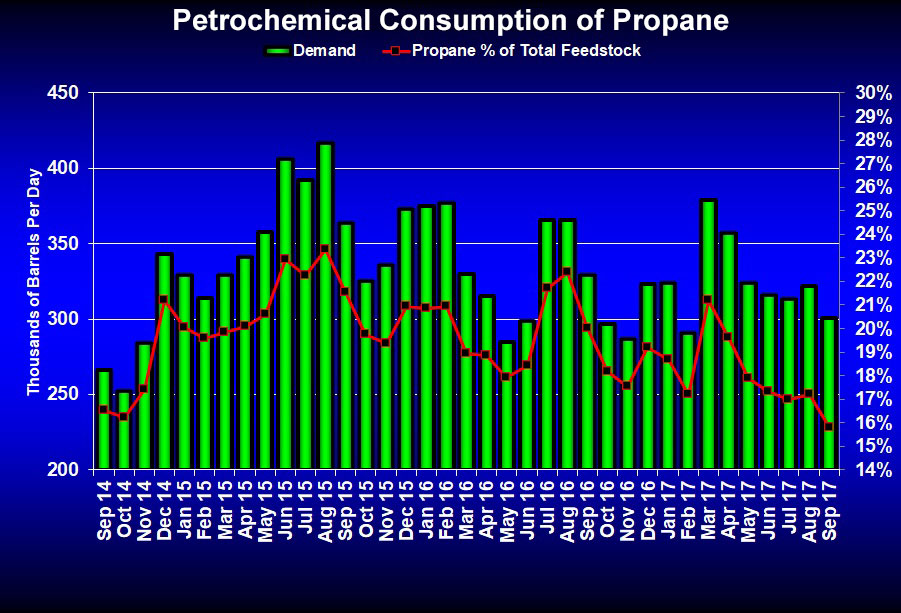

Petrochemical companies processed more feedstock in September than in August, but less of it was propane, which accounted for just 15.81 percent of the total feedstock stream, or 301,000 barrels per day (bpd). Propane was 17.2 percent of the stream in August, at 322,000 bpd. As recently as March, propane was 21.21 percent of the feedstock stream and in September 2016, petrochemicals consumed 329,000 bpd of propane, or 20 percent of the feedstock stream.

Obviously, propane is becoming less preferred by petrochemical companies, as ethane and butane are making up for the drop in propane consumption. This month, ethane was 70.6 percent of the feedstock stream, up 2 percentage points from September. Butanes were 6.9 percent, up 1.2 percentage points.

U.S. propane inventory is now at 78.837 million barrels. Inventory has declined in four of the last five weeks. It is nearly 24 million barrels below where it was at this time last year and nearly 7 million barrels below the five-year average for this point in the year.

With inventory light and export levels relatively strong, the lowered competition for domestic supply by petrochemicals is needed. With propane prices relatively high compared with other feedstock, we expect petrochemical consumption will likely stay on the lower side of normal, despite capacity expansion in the petrochemical industry. Consumption in September 2017 was below where it was in September 2015 and 2016.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.