Why US propane exports are under pressure

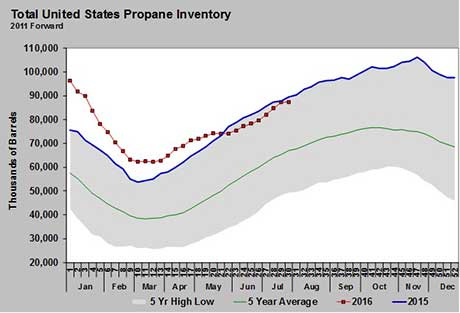

The U.S. Energy Information Administration reported U.S. propane inventory increased 2.038 million barrels for the week ending Aug. 5. Inventory at 91.903 million barrels is just 889,000 barrels below last year’s record level for this time of year.

Current inventory stands in stark contrast to the way it was trending at the beginning of the year. During the first week of January, U.S. propane inventory stood at 96.341 million barrels. That was 20.691 million barrels higher than where it stood at the beginning of 2015 and 38.643 million barrels higher than the five-year-average start-of-the-year inventory position.

By June 1, inventory had dropped 20.960 million barrels and stood 3.414 million barrels below the June 2015 inventory of 78.795 million barrels. That huge draw in inventory occurred during very mild winter conditions.

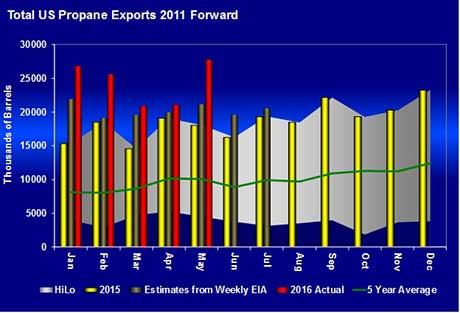

Over the same time period in 2015, U.S. inventory increased 3.942 million barrels. The key difference this year was a dramatic increase in U.S. propane exports.

Exports increased about 7.3 million barrels per month, or about 36 million barrels, from January through May 2015 to January through May 2016. Obviously, the increase in exports was responsible for drawing down the high surplus in propane inventories that were present at the beginning of the year.

With the drawdown in inventory came an increase in U.S. propane values relative to crude values. As prices increased, export margins that were sometimes more than 40 cents above the U.S. domestic market began to decrease. Buyers, once eager to obtain all of the U.S. propane they could get, began to back off during midsummer.

As exports decreased, propane inventories began to build on a more typical trend, which, along with a drop in crude prices, caused propane prices to decline. The weakness in propane exports experienced in June and July of this year has carried into August.

A recent report says up to 12 propane export cargoes for August have been canceled. According to the report, the canceled cargoes could keep close to 200,000 barrels per day of propane in Mont Belvieu this month. That is somewhere around 6 million more barrels that will be looking for a home in the domestic market.

At this point, we do not have high expectations for propane demand for crop drying this year. The corn crop is going to be huge, but reports suggest field drying conditions are excellent. The need for propane to dry the corn will decrease as a result of the excellent natural drying conditions.

With potentially little demand help from crop drying and struggling exports, it is highly probable that propane pricing conditions will be on the bearish side leading into the fall. U.S. propane exporters need to see Brent crude prices improve relative to West Texas Intermediate crude to help improve U.S. export margins.

Until exports improve, even strong domestic demand this winter is unlikely to stress inventories that are at near record-high levels. However, as the first five months of the year show, if exports pick up – even with average winter demand – inventory could be pulled down another step rather quickly.

Right now it looks like export activity is fairly price elastic. That means an increase in price will cause a rather quick decline in exports. Current conditions suggest the upside pressure on propane prices should remain contained. That should only change if foreign demand for U.S. propane picks up considerably during the winter months.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.