|

|

|

DIGITAL EDITION

|

|

|

|

THIS WEEK'S TOPIC:

PROPANE PRICES

|

|

Propane prices on uptrend

with improved fundamentals

|

Propane prices have been on a strong uptrend over the past year as fundamental conditions improve.

Click to enlarge.

Click to enlarge.

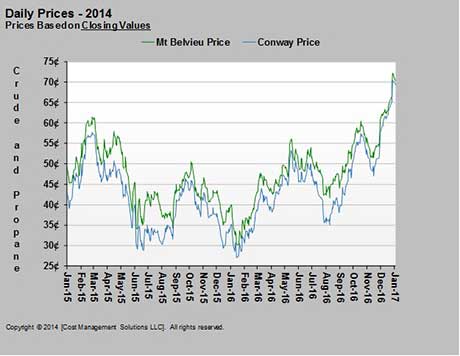

Mont Belvieu propane is currently trading at around 71 cents. At this point last year, Mont Belvieu was trading at 39 cents and trending lower. In fact, the year-low close came on Jan. 19 at 30.125 cents. Prices are 181 percent of last year’s price and 234 percent of last year’s low. Meanwhile, West Texas Intermediate crude is 149 percent of its January 2016 price and 205 percent of its $26.21 low set in February 2016.

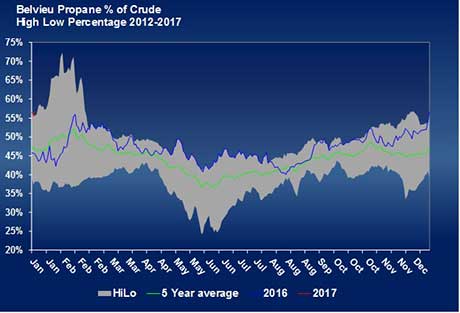

The pricing data shows that propane prices have outgained crude over the past year. Last January, Mont Belvieu propane was trading at about 44 percent of West Texas Intermediate. Currently, Mont Belvieu is trading at around 55 percent.

Propane is now valued right at its five-year high relative to crude set in 2012. Propane was valued above its five-year average relative to crude for most of 2016 and even set some new five-year highs last year.

The higher gains in propane and resulting improvement in relative value to crude suggest changes in propane fundamentals are at play. Until recently, winter weather hasn’t been that much more supportive this year compared to last year. The key reason for the improvement in propane’s relative value is an increase in the ability to move propane production to markets.

New export facilities have eliminated the bottleneck that had suppressed propane values relative to crude in the past. Reports show a current export capacity of around 1.7 million barrels per day (bpd).

(continued below)

In December 2015, the U.S. Energy Information Administration (EIA) provided weekly estimates on propane exports of 720,000 bpd. In December 2016, the estimate was 944,000 bpd. For the week ending Dec. 23, EIA estimated 1.313 million bpd of exports – the highest weekly estimate ever. Even that rate is only 77 percent of the estimated export capacity.

Propane production continues to grow, but at a much slower pace than in previous years. At some point, increases in production will catch up to the new capacity, which could suppress prices again if additions in export capacity are not made.

But for now, the bottleneck is eliminated, allowing U.S. propane prices to fully reflect global demand. As long as spare export capacity exists, there will be increased risk to upside pricing pressure. There will also likely be less downward pressure on prices over the summer, which would mean the opportunity to buy supply in 2017 for as low as it was in 2016 is also at risk.

|

|

|

|

|

|

|

|

|

WHAT IS COST MANAGEMENT SOLUTIONS?

|

|

|

|

|

The Propane Price Insider is an email service that provides:

- Three daily price Flash Wires

- Periodic option quotes

- Wednesday inventory data updates around 11 a.m. ET

-

Evening report with executive summary, weather maps and complete review of energy prices that are based on propane's Btu equivalent

For a free 10-day trial subscription by email, sign up online here or call 888-441-3338.

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the analysis of the energy markets for the propane marketplace. Since we are not a supplier of propane, you can be assured our focus is to provide an unbiased analysis.

Contact us today to see if you can benefit from having the Energy Price Watchdog working for you.

|

Many retailers simply don't have time to analyze the large amounts of data to make an informed purchasing decision.

We offer:

-

Detailed market recommendations on hedge and pre-buy entry points

-

Prompt market execution of hedging strategies

-

Supply cost analysis and recommendation as to effective hedging strategies

-

Large volume consideration when we place your hedges

|

|

|

GOT STORY IDEAS? Email Brian Richesson, Editor in Chief

LOOKING FOR ADVERTISING OPPORTUNITIES? Email Brian Kanaba, Publisher

|

|

|

|