|

|

|

|

|

|

THIS WEEK'S TOPIC:

CRUDE SUPPLY AND PRICING

|

|

US refinery utilization, throughput kick into high gear

|

Last year, only slightly more than 20 percent of U.S. propane came from the refining of crude oil. In a recent presentation, we projected a 5,000-barrel-per-day-(bpd) increase in fuel-use propane from refineries this year, as we expected higher capacity utilization as the economy improved.

At this point, refinery throughput and utilization are cooperating with that forecast.

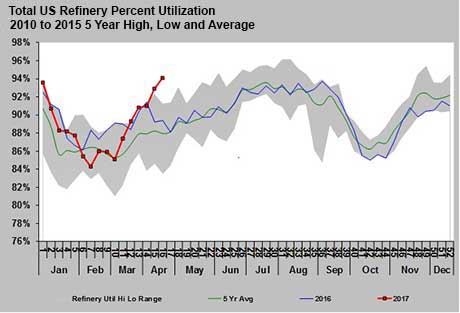

U.S. refining capacity is at 18.618 million bpd. That is up from 18.315 million bpd at the end of April 2016. Last week, refiners were operating at 94.1 percent capacity, a five-year high for this time of year. Refineries cranked up early this year, and they are already near the highest utilization rates we have seen historically.

With utilization rates up, refinery throughput is going to be on the rise, as well.

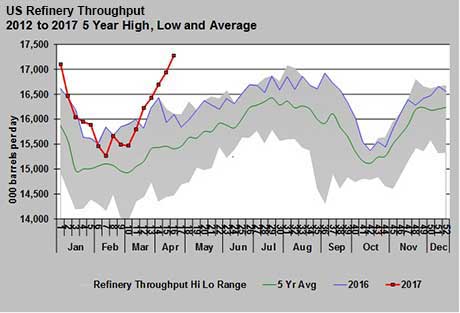

Refinery throughput has been surging over the past six weeks. For five weeks, new five-year highs on throughput for the respective weeks have been established.

West Texas Intermediate (WTI) crude prices are having a hard time finding a price floor given the weak macro picture for crude fundamentals. Crude supplies in industrialized nations are about 10 percent above their five-year averages. The Organization of the Petroleum Exporting Countries and other producers have been trying to get those inventories down, but so far their efforts have come up short. In fact, inventory in the industrialized countries is now higher than it was when producers began their production cuts four months ago.

(continued below)

In other bearish news for global crude supplies, there were reports last week that more than 50 million bpd of crude was shipped during April. That easily broke the old record of just over 46 million bpd. With that much crude moving between sellers and buyers, it is hard to see where a shortage is developing that would support prices.

However, early-season indications show U.S. refiners are going to be doing their part to consume a lot of crude. That could certainly help bring down excess crude supplies in the U.S. and support WTI crude prices. WTI crude is struggling to stay above its 200-day moving price average, a key technical point that can often define whether crude is in shorter-term correction or a longer-term downtrend.

Last week, analysts were expecting a 1.7-million-barrel draw in U.S. crude inventory, but it declined 3.6 million barrels instead. More importantly, Cushing, Oklahoma, crude inventory declined 1.2 million barrels. Cushing is important because it is the settlement location for crude's futures contracts. Changes in inventory levels there tend to have a disproportionate impact on prices.

If the increased utilization and throughput at U.S. refiners continue to take down U.S. crude inventory at an above-average pace, it could lead to a rebound in crude prices. That rebound would very likely be a catalyst for changing the direction of propane prices. Propane prices have been moving with crude in its recent downtrend. If anything, propane prices should have lagged the recent fall in crude prices because of tighter propane fundamentals, but they outpaced instead. Therefore, we see no reason that propane prices would be quick to recover with crude prices.

|

|

|

|

|

|

|

|

|

WHAT IS COST MANAGEMENT SOLUTIONS?

|

|

|

|

|

The Propane Price Insider is an email service that provides:

- Three daily price Flash Wires

- Periodic option quotes

- Wednesday inventory data updates around 11 a.m. ET

-

Evening report with executive summary, weather maps and complete review of energy prices that are based on propane's Btu equivalent

For a free 10-day trial subscription by email, sign up online here or call 888-441-3338.

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the analysis of the energy markets for the propane marketplace. Since we are not a supplier of propane, you can be assured our focus is to provide an unbiased analysis.

Contact us today to see if you can benefit from having the Energy Price Watchdog working for you.

|

Many retailers simply don't have time to analyze the large amounts of data to make an informed purchasing decision.

We offer:

-

Detailed market recommendations on hedge and pre-buy entry points

-

Prompt market execution of hedging strategies

-

Supply cost analysis and recommendation as to effective hedging strategies

-

Large volume consideration when we place your hedges

|

|

|

GOT STORY IDEAS? Email Brian Richesson, Editor in Chief

LOOKING FOR ADVERTISING OPPORTUNITIES? Email Brian Kanaba, Publisher

|

|

|

|