|

|

|

|

|

|

THIS WEEK'S TOPIC:

PROPANE PRICING AND INVENTORY

|

|

Big drop in demand undermines propane prices

|

There was a little less wringing of hands and pacing around trading desks last week after the U.S. Energy Information Administration’s (EIA) weekly inventory data finally showed a significant build in U.S. propane inventory.

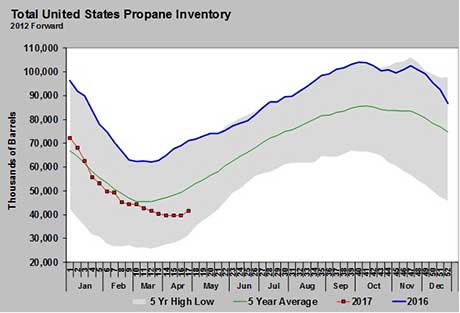

For the week ending May 5, EIA reported a 1.966-million-barrel build in inventory. That greatly exceeded industry expectations for a 375,000-barrel build. It was also higher than the five-year average build for week 18 of the year of 1.851 million barrels.

Most importantly, it seemed to confirm that exports need to remain at high levels to keep an excess of inventory from building this summer. The talk all week was of the poor export economics that need to improve to end the rash of export cargo cancellations.

The combination of an inventory build and worries about dropping exports caused propane to lag a major runup in crude prices on Wednesday and separate from rising crude on Thursday with a pullback. Propane remained weak on Friday, proving a bearish bias remains in the market.

However, it was not a drop in export activity, but rather a major drop in domestic propane demand, that led to the increase in propane inventory. In fact, propane exports increased, according to the weekly EIA estimate. Exports had dropped to 764,000 barrels per day (bpd) for the week ending April 28, but improved to 830,000 bpd for the week ending May 5. In our estimation, an export rate of around 775,000 bpd this summer will have inventory at around 80 million barrels by the start of winter.

The build in propane inventory didn’t get any help from the supply side either. U.S. propane production dropped 41,000 bpd week to week. At 1.729 million bpd, U.S. production was exactly where it stood during the same week last year.

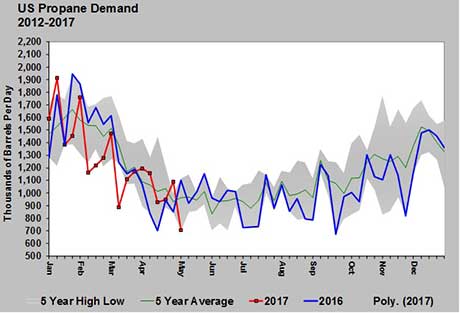

The inventory increase was almost exclusively linked to a drop in U.S. domestic demand. Week-to-week demand fell 383,000 bpd from 1.090 million bpd to 707,000 bpd. As a comparison, demand was at 918,000 bpd during the same week last year. The domestic demand rate was near a five-year low.

(continued below)

To see a drop in domestic demand would not seem abnormal at this time of year. The drop was mostly significant due to its magnitude. What makes the demand drop even more interesting is that some industry watchers had noted that EIA’s weekly estimates were showing a lower inventory level than its official monthly data. The difference was around 5 million barrels. Since propane demand is an implied number in the weekly figures, that is where any adjustment elsewhere in the data that EIA might make would show up. If EIA plugged a higher number in inventory to make an adjustment, it could be reflected in an unusually large drop in domestic demand.

We are not suggesting that is the case, but we also don’t rule out the possibility. It can’t be ignored that this past week’s numbers showed an increase in exports and a decrease in domestic supply. Those two numbers, over the course of the summer, are the ones to watch. All the rest will be a reflection of how those two numbers trend.

|

|

|

|

|

|

|

|

|

WHAT IS COST MANAGEMENT SOLUTIONS?

|

|

|

|

|

The Propane Price Insider is an email service that provides:

- Three daily price Flash Wires

- Periodic option quotes

- Wednesday inventory data updates around 11 a.m. ET

-

Evening report with executive summary, weather maps and complete review of energy prices that are based on propane's Btu equivalent

For a free 10-day trial subscription by email, sign up online here or call 888-441-3338.

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the analysis of the energy markets for the propane marketplace. Since we are not a supplier of propane, you can be assured our focus is to provide an unbiased analysis.

Contact us today to see if you can benefit from having the Energy Price Watchdog working for you.

|

Many retailers simply don't have time to analyze the large amounts of data to make an informed purchasing decision.

We offer:

-

Detailed market recommendations on hedge and pre-buy entry points

-

Prompt market execution of hedging strategies

-

Supply cost analysis and recommendation as to effective hedging strategies

-

Large volume consideration when we place your hedges

|

|

|

GOT STORY IDEAS? Email Brian Richesson, Editor in Chief

LOOKING FOR ADVERTISING OPPORTUNITIES? Email Brian Kanaba, Publisher

|

|

|

|