|

|

|

DIGITAL EDITION

|

|

|

|

THIS WEEK'S TOPIC:

PROPANE'S VALUE TO CRUDE

|

|

What propane’s value history tells us about the market today

|

Propane’s relative value to West Texas Intermediate (WTI) crude, the U.S. benchmark crude, continues to rise. The chart below shows Mont Belvieu’s value relative to WTI crude expressed in a simple percentage.

Propane is currently valued at around 70 percent of WTI crude. Propane has been setting new five-year high marks in relative valuation most of this year.

The chart above, which focuses on the valuation over the past five years, makes it appear as though the rise in relative valuation is an anomaly. That conclusion would be wrong.

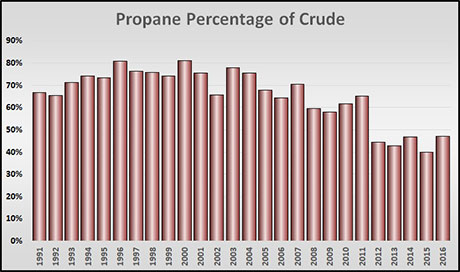

The chart above shows the average yearly value of Mont Belvieu propane relative to WTI from 1991 through 2016.

From 1991 through 2011, before the height of the shale gas revolution, propane’s average value was 70.51 percent of WTI crude. From 2012 through 2016, Mont Belvieu propane had an average value of just 44.23 percent of WTI crude.

Propane's relative value from 2012-16 was driven down because propane production overwhelmed domestic demand. There was not enough export capacity to deal with all of the excess in the early part of that period, causing a major build in inventory that did not start falling until 2016.

There is now enough export capacity to deal with the excess supply, and propane’s relative value is climbing back to more “normal” rates. The current climb in propane’s relative value to crude is not the anomaly. It was the exceptionally low propane-to-crude valuations over the last five years that were the anomaly.

(continued below)

Through July 2017, Mont Belvieu propane has averaged 56.62 percent of WTI crude. Currently, it is running around 72 percent. Current propane inventory would suggest values closer to the current relative valuation going forward.

Propane valued at 25 percent of WTI crude just a few years ago is still fresh in the minds of market participants. Some may be expecting to see propane’s relative value move down to those levels again, which is highly unlikely.

The far more likely scenario will be for the propane-to-crude relative valuation to remain around the levels established between 1991 and 2011 – before the shale gas revolution undermined propane valuations.

The anomaly of the past five years could cause propane retailers to set unrealistic expectations about the downside risk to propane prices. Hopefully, seeing the longer history of propane’s relative value to crude will help alleviate some of those worries and make propane buys at current valuation a little less worrisome.

|

|

|

|

|

|

|

|

|

WHAT IS COST MANAGEMENT SOLUTIONS?

|

|

|

|

|

The Propane Price Insider is an email service that provides:

- Three daily price Flash Wires

- Periodic option quotes

- Wednesday inventory data updates around 11 a.m. ET

-

Evening report with executive summary, weather maps and complete review of energy prices that are based on propane's Btu equivalent

For a free 10-day trial subscription by email, sign up online here or call 888-441-3338.

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the analysis of the energy markets for the propane marketplace. Since we are not a supplier of propane, you can be assured our focus is to provide an unbiased analysis.

Contact us today to see if you can benefit from having the Energy Price Watchdog working for you.

|

Many retailers simply don't have time to analyze the large amounts of data to make an informed purchasing decision.

We offer:

-

Detailed market recommendations on hedge and pre-buy entry points

-

Prompt market execution of hedging strategies

-

Supply cost analysis and recommendation as to effective hedging strategies

-

Large volume consideration when we place your hedges

|

|

|

GOT STORY IDEAS? Email Brian Richesson, Editor in Chief

LOOKING FOR ADVERTISING OPPORTUNITIES? Email Brian Kanaba, Publisher

|

|

|

|