|

|

|

DIGITAL EDITION

|

|

|

|

THIS WEEK'S TOPIC:

PROPANE INVENTORY

|

|

What's causing a big jump

in propane inventory?

|

For the week ending Sept. 1, the U.S. Energy Information Administration (EIA) reported a 6.346-million-barrel build in U.S. propane inventory.

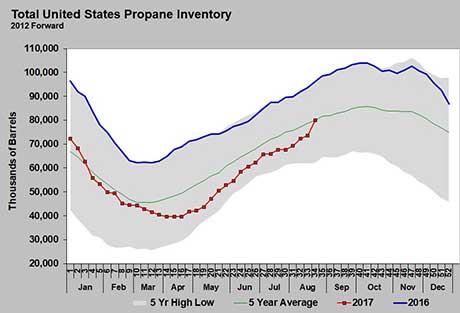

The build took inventory to 79.899 million barrels, near its five-year average (see the chart above).

It was certainly a welcome development with inventory running about 24 million barrels below last year’s inventory level prior to the build. The build reduced the deficit to around 19 million barrels.

Most industry members realize the build was due to the impact of Hurricane Harvey. For that reason, propane traders have largely shrugged off the build and propane prices have remained on an upward trajectory even after the build was reported.

Leading up to the report, propane traders knew that propane export volumes were going to be very low, thus increasing the likelihood of a big inventory build. The data backed those expectations as propane exports dropped 416,000 barrels per day (bpd) to a meager 191,000 bpd.

Perhaps the bigger surprise was how much impact Harvey had on domestic demand. Again, there were expectations of a decline with many chemical operations down. EIA reported domestic demand was down 694,000 bpd. Petrochemicals used only 305,000 bpd nationwide during the month of July, making the falloff in demand an eye-opener. The demand drop was likely largely due to a lack of pipeline movements out of Mont Belvieu to delivery points east due to infrastructure issues. That caused the build in inventory, which, in turn, caused the implied domestic demand number to be so low.

(continued below)

However, with Mont Belvieu operations affected to that degree, we were a little surprised to see propane production only drop 382,000 bpd to 1.497 million bpd.

The simple fact is that it is going to take several EIA reports before we know the true impact of Harvey. We would expect at least one more week with a hefty inventory build reported. After that, it will depend on how robust exports become. We expect that most of the ships that were delayed from Harvey will still pick up their loads, resulting in very heavy export volumes for a couple of weeks. We expect most of that activity to show up in data collected on Sept. 15.

We think the propane market’s muted response to this massive inventory build was the correct response. We would guard against knee-jerk reactions to data reported over the next two to three weeks at a minimum.

Overreaction to big inventory builds over the next two weeks could result in unloading supply positions that retailers wished they had back later. At this point, we suggest delaying decisions on unloading supply positions until closer to the end of the month, when the full impact of Harvey should be more clear. The controlled response to last week's inventory report makes that recommendation much easier to make.

|

|

|

|

|

|

|

|

|

|

WHAT IS COST MANAGEMENT SOLUTIONS?

|

|

|

|

|

The Propane Price Insider is an email service that provides:

- Three daily price Flash Wires

- Periodic option quotes

- Wednesday inventory data updates around 11 a.m. ET

-

Evening report with executive summary, weather maps and complete review of energy prices that are based on propane's Btu equivalent

For a free 10-day trial subscription by email, sign up online here or call 888-441-3338.

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the analysis of the energy markets for the propane marketplace. Since we are not a supplier of propane, you can be assured our focus is to provide an unbiased analysis.

Contact us today to see if you can benefit from having the Energy Price Watchdog working for you.

|

Many retailers simply don't have time to analyze the large amounts of data to make an informed purchasing decision.

We offer:

-

Detailed market recommendations on hedge and pre-buy entry points

-

Prompt market execution of hedging strategies

-

Supply cost analysis and recommendation as to effective hedging strategies

-

Large volume consideration when we place your hedges

|

|

|

GOT STORY IDEAS? Email Brian Richesson, Editor in Chief

LOOKING FOR ADVERTISING OPPORTUNITIES? Email Brian Kanaba, Publisher

|

|

|

|