|

Click here for a free, 10-day trial of The Propane Price Insider!

Call Cost Management Solutions today at 888-441-3338 for more information about how Client Services can enhance your business or drop us an email at info@propanecost.com.

Trader's Corner

This week’s Trader’s Corner looks at how to use options to manage all of the volatility we are seeing in propane prices.

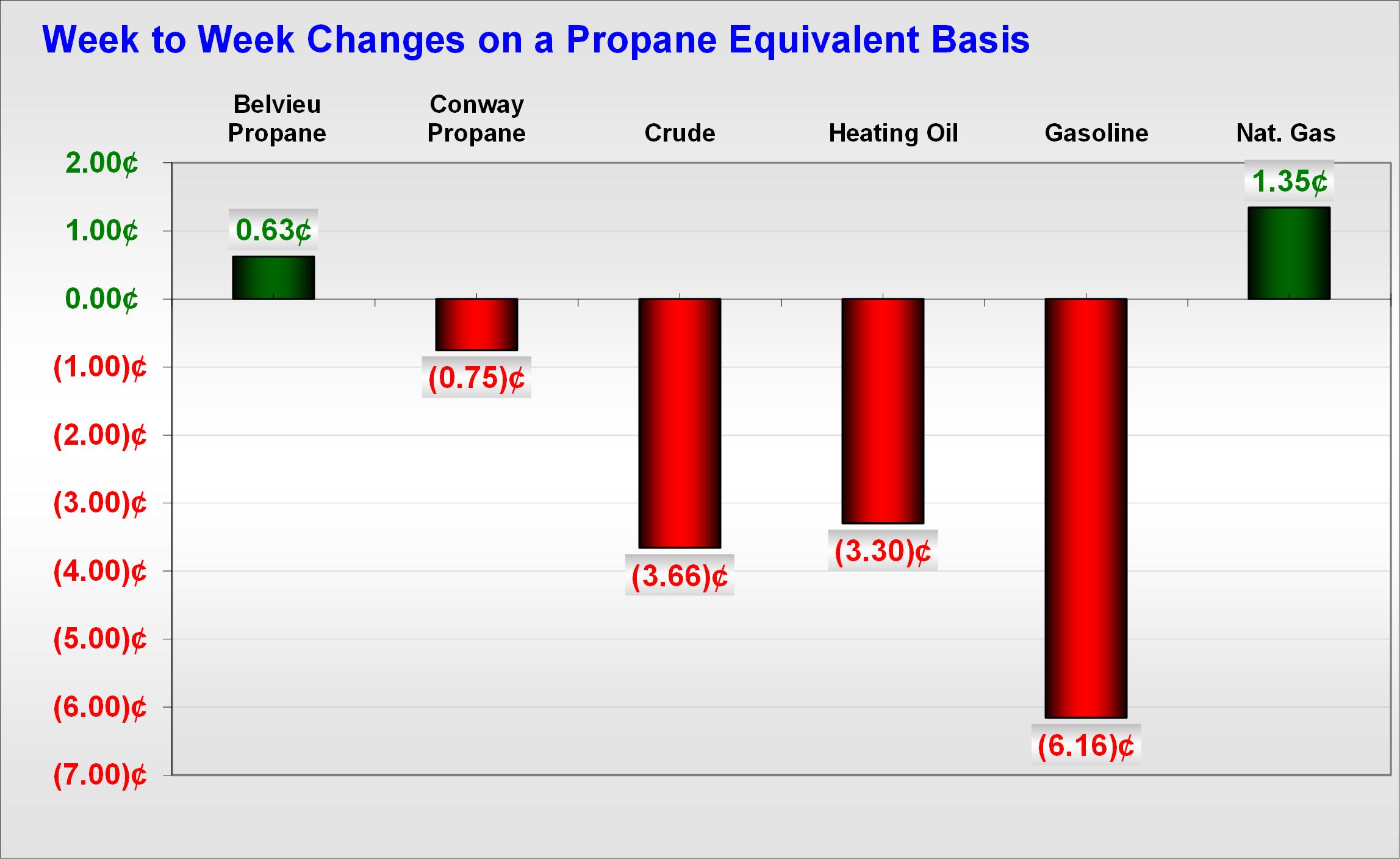

Last week we looked at the sharp drop in propane demand that caused a 2.5-million-barrel build in propane inventory. That build caused a sharp reversal in propane prices. But propane was rebounding following the latest inventory report. Demand rebounded and propane inventories actually declined. The price chart below shows the quick change in propane prices. Click to enlarge.

The U.S. Energy Information Administration (EIA) report that showed the 2.5-million-barrel build and the sharp drop in propane demand was released on Sept. 5. We see the dramatic reaction with prices falling sharply until Wednesday, Sept. 10, when the EIA reported that demand had recovered and propane inventory had actually declined. We left crude on the chart to show that the fall in propane was totally based on the inventory data since crude was in the midst of a rally as propane fell.

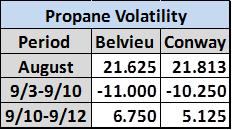

The table captures the volatility in propane prices. Prices were up more than 21 cents in August, down in the 10- to 11-cent range in six days and up in a 5- to 7-cent range in just two days.

This kind of volatility can be difficult on propane retailers. The pressure to buy in August with prices on such a strong run was palatable. But if you did, you faced agony for a few days in September. With the degree of price movement we see these days, it is easy to find ourselves in a supply position that puts us at a competitive disadvantage.

When markets become this volatile and we still fear upside price risk, we think of call options. This kind of agony does not make us want to take on supply side risk. We want to transfer it to someone else. That is what we do when we buy a call option.

We did a quick check just before writing this piece and found we could own a series of Belvieu or Conway call options that would cover the months of October, November and December for just less than 7 cents per gallon. Seven cents is the premium we would pay for someone else to assume all of this price volatility for us during the front half of winter. That may seem like a lot of money, but is it really when we can see that much movement in prices in a day or two?

You may have read the above and easily come to the conclusion that paying 7 cents to transfer all of this uncertainty is a no-brainer. However, you don’t do anything because you don’t quite understand how options work. For those of you who have not used options, it is much easier than you think.

There are two things you must understand to become comfortable enough to use options – the mechanics of the option and how you use it once you own it.

Mechanics

Options are month and volume specific. To cover the period from October through December, we must buy three options. For the quote we got, we averaged the two primary components of the option together for all three months to make it simple. These two components are the strike price and the premium. This is actually a common way to price the options, though you can get separate strikes and premiums for each month if that works better for you.

Step one: Determine volume. We must decide how much volume we want to protect each month. Let’s use 50,000 gallons per month.

Step two: Write a check. The premium for transferring the risk is 7 cents per gallon. We are buying 50,000 gallons on three separate call options, totaling 150,000 gallons. Therefore, we write a check for $10,500.

In exchange for the check, the option writer gives us a strike and a promise. The strike is where the market valued propane over the October-to-December time frame at the moment we bought the option. When we got our quote, the strike for Belvieu was 114 cents and Conway 113.25 cents. Let’s use Belvieu at 114 cents for the rest of our discussion.

The option writer promises that if the monthly average for propane exceeds 114 cents in any or all of the three monthly call options we own that he will reimburse us the difference.

It is September, and we now own three call options with a strike of 114 cents. From a mechanics standpoint, there is nothing else to do until the end of October.

Step three: Compare the strike to the monthly average. When October is complete, we compare the strike of 114 cents to the monthly average for Belvieu for October.

Step four: Invoice (or not). If the monthly average for October is greater than 114 cents, we will send an invoice to the option provider for the difference. If the October monthly average is 124 cents, we send an invoice for 10 cents times 50,000 gallons or $5,000.

If the monthly average is 114 cents or lower, we do nothing. This process will be repeated again at the end of November and December. If your option paid, you will receive a check from the option provider within a few days of invoicing.

Using the option

Owning the option replaces unknowns with knowns. We still don’t know what the price of propane will be in our local market during October, November or December. We have no idea what invoices from our physical supplier might look like as we receive them during the winter.

However, we should know about what our market prices above Belvieu or Conway. Hopefully we even have a contract with our physical supplier that allows us to buy from them at a price indexed to the hub. For example, we buy at Belvieu plus 10 cents.

We do know that our option will reimburse us for any amount the monthly average is above our strike. If prices have risen, we can expect to pay more to our physical supplier, but we also know we will get a check from the option writer. That means we can use 114 cents as our base cost of supply free on board at Belvieu.

To that number, we need to add the cost of the option (7 cents), the differential between Belvieu and our market, and our margin to set a sales price. Our sales price calculation would look something like this:

By going through the process above, we can establish a known sales price through December for our customers and know we should make 75 cents per gallon for our troubles.

In this case, $2.06 becomes the highest price we will bill our customers. However, the beauty of an option is that we can also lower our price, which is what makes options superior to swaps and pre-buys in falling markets.

If the monthly average is below 114 cents, we know we will pay less to our physical supplier for the gallons he is putting in our tank. If we keep our price at $2.06, we make more margin. But, if our competitors are lowering their street price, we can come down with them to remain competitive and never make less than 75 cents margin.

If your competitor does not do options, you will probably initially be pricing the cost of the option higher than him – 7 cents in this case. That is the basic question to ask when considering options: Can I initially price the premium cost above my competitors’ cost without running off my customers? If you can, then you are absolutely in the driver’s seat from that point forward.

Perhaps the last question you have is how to buy an option. That is the easiest part of all. Pick up the phone and give us a call. We will find the option providers for you and walk you through the entire process. We even let you know how much to invoice when the option settles.

Experienced clients that know what they want can call us and have an option in place in less than five minutes. But you may still have questions that need to be answered – that’s okay because we are here to answer them no matter how long it takes.

You can’t know what propane prices will do this winter. However, you can know the highest price your customer will pay and the margin you will make. You can know the types of tools available to lower prices so you will remain competitive without hurting margin, should prices fall. Right now about 7 cents buys that kind of certainty.

Call Cost Management Solutions today at 888-441-3338 for more information about how Client Services can enhance your business, or drop us an email at info@propanecost.com.

WEEK IN REVIEW

The EIA reported a draw on propane inventory, which turned prices higher again. Crude moved lower as the probability of the United States making a military strike against Syria was greatly diminished. Despite a rather soft day for propane and crude on Friday, we will remain bullish to start this week.

LAST WEEK'S DAILY HIGHLIGHTS

Monday: Propane opened the week lower as traders continued to react to the 2.5-million-barrel propane inventory build reported by the EIA on Thursday. Crude fell on lowered expectations the United States would make a military strike on Syria.

Tuesday: Major fall in propane as the inventory build undermined prices. A proposal by Russia to get Syria to turn over its stockpile of chemical weapons in exchange for the United States not making a military strike had crude lower.

Wednesday: The EIA reported a draw on propane inventory, causing propane prices to rise sharply. Crude was essentially flat, with less worries about Syria taking away some of the geopolitical support for prices.

Thursday: Propane continued to recover recent losses as the draw on inventory reported by the EIA on Wednesday motivated buyers. Crude moved higher on word that two missiles fired from Syria had hit in southern Golan.

Friday: The upward momentum in propane slowed as crude slipped. Investment dollars seemed to favor equities on increasing expectations the Federal Reserve, at its meeting next week, will not reduce its bond-buying program aimed at stimulating economic growth. |