|

|

|

DIGITAL EDITION

|

|

|

|

THIS WEEK'S TOPIC:

PROPANE DEMAND

|

|

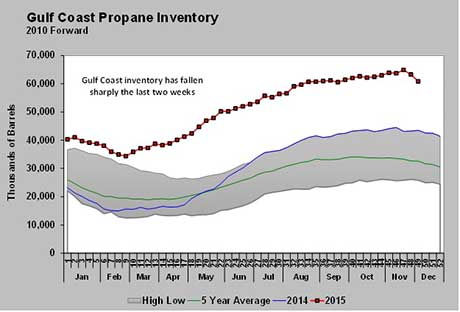

Big draws on Gulf Coast propane inventory

|

In last week’s Trader’s Corner, we looked at the propane inventory information released in the Energy Information Administration’s (EIA) Weekly Petroleum Status Report.

As we pointed out, domestic demand for propane is an implied number derived after EIA receives reports on propane imports, production and inventory changes and estimates exports.

Over the last two weeks, U.S. propane inventories have fallen dramatically, from 106.202 million barrels to 100.658 million barrels. For the week ending Nov. 27, inventory fell 2.099 million barrels, which was followed by a draw of 3.445 million barrels for the week ending Dec. 4.

Of the 5.544-million-barrel decline in U.S. inventory over that two-week span, 4.032 million barrels declined in Gulf Coast inventory (PADD 3).

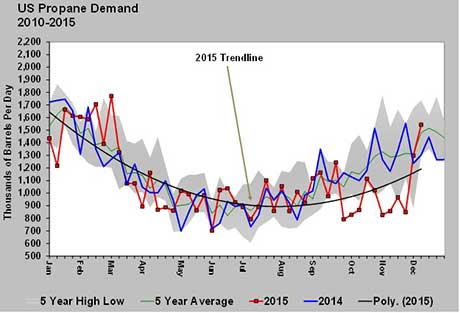

The Gulf Coast inventory draws were a bit surprising, with sharp increases in domestic demand causing the draws. U.S. propane demand went from 849,000 barrels per day (bpd) for the week ending Nov. 20 to 1.543 million bpd for the week ending Dec. 4. What’s difficult to identify is the source of the increased domestic demand.

Temperature maps, heating degree-day data and reports from the field certainly do not suggest that the areas of the country Mont Belvieu supplies have had a big increase in demand. In fact, reports of logistical issues on pipelines with not enough product are being drawn off the systems. One would not suspect a huge increase in domestic retail demand.

Also contributing to demand is petrochemical consumption. Again, the data does not support a sudden jump in demand. Through November, petrochemicals were consuming 319,000 bpd of propane, which is down from 321,000 bpd in October and 417,000 bpd as recently as August.

The implied demand calculated by EIA may be right on the mark. However, the conditions and the data make one wonder. We have to remember that propane exports are an estimated number by EIA. Over the couple of weeks that domestic demand has risen so dramatically, propane exports have stayed steady at 729,000 bpd. Is it possible propane exports are being underestimated?

Knowing the answer to that question is fairly important. If the draws on inventory are totally due to increases in domestic demand, given the current weather conditions, then that demand could lower rather quickly.

As the chart above shows, U.S. domestic demand is now running above the five-year average. Neither weather conditions nor petrochemical consumption suggest it should be. Perhaps there was a lot of pent-up demand that needed to be dealt with due to the exceptionally low demand during the previous seven weeks. For now, that is what we must assume. If that is the case, the continued lack of supportive winter weather should see demand fall back below normal soon.

(continued below)

On the other hand, if EIA has underestimated exports, causing implied domestic demand numbers to be inflated, then the recent high draws in inventory could be more sustainable. We believe increases in exports would be more sustainable than the recently reported dramatic domestic demand increases.

If increased export activity is pulling inventory down, then we might expect a trend of above-average draws on inventory to develop that would begin to support prices and perhaps cause propane prices to improve in relative value to West Texas Intermediate crude. But, if the draws are the result of increased domestic demand, as EIA is reporting, it is more likely that we will see a slowdown in domestic demand and a return to more normal inventory draws that would be less price supportive.

EIA is due to revise its weekly estimate on propane exports, perhaps as soon as this week. It will be most interesting to see the change in that estimate.

|

|

|

|

CONNECT

|

|

|

|

|

|

|

WHAT IS COST MANAGEMENT SOLUTIONS?

|

|

|

|

|

The Propane Price Insider is an email service that provides:

- Three daily price Flash Wires

- Periodic option quotes

- Wednesday inventory data updates around 11 a.m. ET

-

Evening report with executive summary, weather maps and complete review of energy prices that are based on propane's Btu equivalent

For a free 10-day trial subscription by email, sign up online here or call 888-441-3338.

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the analysis of the energy markets for the propane marketplace. Since we are not a supplier of propane, you can be assured our focus is to provide an unbiased analysis.

Contact us today to see if you can benefit from having the Energy Price Watchdog working for you.

|

Many retailers simply don't have time to analyze the large amounts of data to make an informed purchasing decision.

We offer:

-

Detailed market recommendations on hedge and pre-buy entry points

-

Prompt market execution of hedging strategies

-

Supply cost analysis and recommendation as to effective hedging strategies

-

Large volume consideration when we place your hedges

|

|

|

GOT STORY IDEAS? Email Brian Richesson, Editor in Chief

LOOKING FOR ADVERTISING OPPORTUNITIES? Email Brian Kanaba, Publisher

|

|

|

|