|

|

|

|

|

|

THIS WEEK'S TOPIC:

PROPANE INVENTORY

|

|

Propane’s relative value to crude continues to set five-year highs

|

Last week, the Energy Information Administration reported U.S. propane inventory increased 3.446 million barrels. It was a build that was more than double the five-year average for the week that was reported.

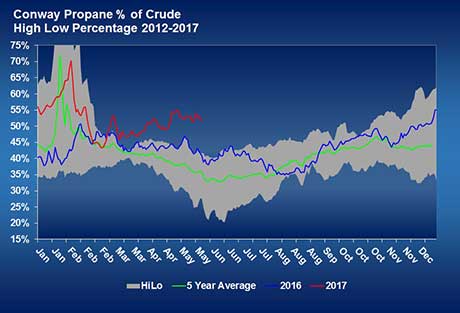

The big inventory build, along with a sharp pullback in crude’s price, certainly put downward pressure on U.S. propane prices. However, overall fundamental support for propane remains very strong, which is reflected in propane’s relative value to West Texas Intermediate (WTI) crude. The charts below show Mont Belvieu's and Conway's relative value to WTI crude on a simple percentage basis.

The red line in the charts shows at what percentage a barrel of propane is trading relative to a barrel of crude. With the big build in inventory, Mont Belvieu propane’s relative value dropped to 54 percent of WTI, while Conway propane’s relative value dropped to 52 percent of WTI.

However, propane’s relative value is still easily setting new five-year highs. Although it's choppy, the overall trend line is upward at a point in the year when propane’s relative value is generally falling. At this time of year, we expect rising crude prices with crude inventories to decline as refiners consume peak amounts of crude to keep up with gasoline demand. At the same time, propane inventory is generally building, taking price pressure off propane. The result is a general drift lower in relative value as seen by the five-year average line (green) and 2016 line (blue) in the charts above.

Propane consumers are very fortunate that crude prices have been weak to this point in the year. It has caused bullish propane fundamentals in the form of below-average inventory builds (prior to last week), which haven’t mattered that much concerning price.

(continued below)

The relative value charts tell a totally different story. Indeed, propane markets are paying attention to the more supportive fundamentals for propane, causing propane values to increase relative to the general energy market. Though the market price for propane doesn’t feel like it is rising that much, it is becoming a more expensive Btu for its consumers relative to other energy sources. That is clear indication that traders are taking note of tighter supply and demand conditions for propane.

Nominal market prices don’t always tell the whole story for propane because its value is so heavily influenced by crude. Though crude prices rallied through much of May, WTI crude is now lower than it was in early April. That is not typical for crude prices. Meanwhile, Mont Belvieu's propane prices are a half-cent higher than they were at the start of April, and Conway’s are about two and a half cents higher.

We advise propane retailers to not let the flat market prices this summer lull them into thinking that upside price risk has not increased over this past year. A few more 3.4-million-barrel inventory builds would go a long way toward assuaging that risk. Despite last week’s big inventory build, it is worth noting that U.S. propane inventory is at 47.132 million barrels compared with 75.381 million barrels at this point last year.

|

|

|

|

|

|

|

|

|

WHAT IS COST MANAGEMENT SOLUTIONS?

|

|

|

|

|

The Propane Price Insider is an email service that provides:

- Three daily price Flash Wires

- Periodic option quotes

- Wednesday inventory data updates around 11 a.m. ET

-

Evening report with executive summary, weather maps and complete review of energy prices that are based on propane's Btu equivalent

For a free 10-day trial subscription by email, sign up online here or call 888-441-3338.

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the analysis of the energy markets for the propane marketplace. Since we are not a supplier of propane, you can be assured our focus is to provide an unbiased analysis.

Contact us today to see if you can benefit from having the Energy Price Watchdog working for you.

|

Many retailers simply don't have time to analyze the large amounts of data to make an informed purchasing decision.

We offer:

-

Detailed market recommendations on hedge and pre-buy entry points

-

Prompt market execution of hedging strategies

-

Supply cost analysis and recommendation as to effective hedging strategies

-

Large volume consideration when we place your hedges

|

|

|

GOT STORY IDEAS? Email Brian Richesson, Editor in Chief

LOOKING FOR ADVERTISING OPPORTUNITIES? Email Brian Kanaba, Publisher

|

|

|

|