Favorable relative value for Mont Belvieu, Conway propane

In last week’s Trader’s Corner, we looked at propane’s price history throughout the past year. The trend showed the best opportunity to buy price protection for this winter came right at the end of the 2016-17 winter.

This week, we are going to look at propane’s relative value to crude and how it is trending compared with last year.

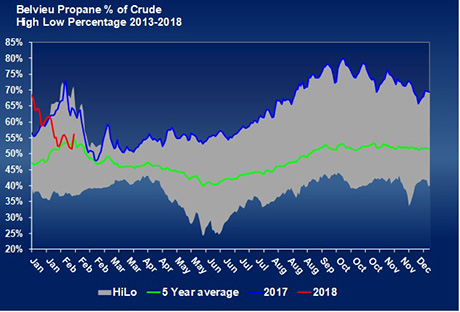

The chart above plots Mont Belvieu propane’s value as a percentage of West Texas Intermediate (WTI) crude’s value.

On Feb. 6, Mont Belvieu propane’s value fell to just 52 percent of WTI crude’s value. To put that relative value into context, when propane supply had overwhelmed domestic demand and there was not nearly enough export capacity to handle the excess, Mont Belvieu dropped to a relative value of 24 percent of WTI crude. With export capacity capable of handling all of the excess supply over domestic demand, it is difficult to believe U.S. propane would ever trade to that low of relative valuation again.

With export capacity in place and U.S. inventory coming down from historically high levels as a result, Mont Belvieu traded to a high relative value of 73 percent last winter. Inventory continued on its downward slope this winter and Mont Belvieu reached 80 percent of WTI crude.

In 2017, the lowest relative value Mont Belvieu reached was 48 percent at the end of February. During the summer months, the lowest relative value for Mont Belvieu was 51 percent, which is essentially where it reached this week.

It is possible that propane is destined to go back to relative values in the twenties as it did in the depths of oversupply two years ago. However, we truly believe conditions have changed, making that scenario highly unlikely.

What is much more likely is a similar pattern to last year. If that turns out to be the case, the best values for next winter may not be far away. Propane exports have slipped this winter compared to last winter, which caused the recent price slide. We are watching for an uptick in propane exports at these low valuations, which could signal the end of the downturn and perhaps the beginning of the slow upward trend that began developing at the end February 2017.

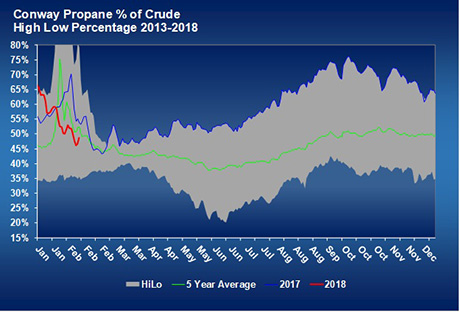

The chart below shows the same relationship to WTI crude for Conway.

The overall pattern for Conway is the same as Mont Belvieu, however, Conway’s percentages are slightly lower.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.