Propane fundamental support may raise prices

Propane prices have been extremely weak during early spring. Much of it was due to a weak fundamental picture for propane. Basically, propane supply was outpacing propane export and domestic demand. That has caused inventory to rise, putting downward pressure on prices.

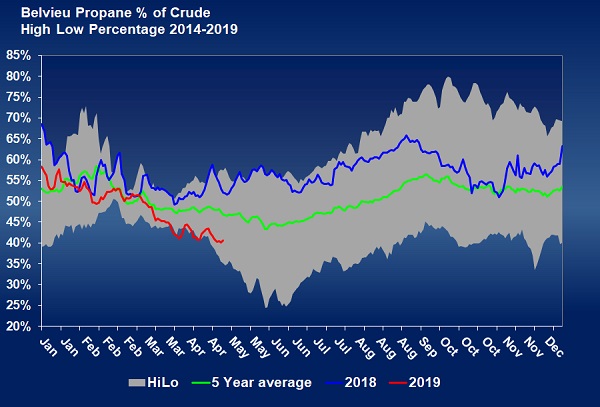

The fundamental weakness is reflected in propane’s relative value to West Texas Intermediate (WTI) crude. Currently, Mont Belvieu LST is trading at 42 percent and Conway at 36 percent of WTI crude. The chart below shows Mont Belvieu LST’s relative value to WTI crude.

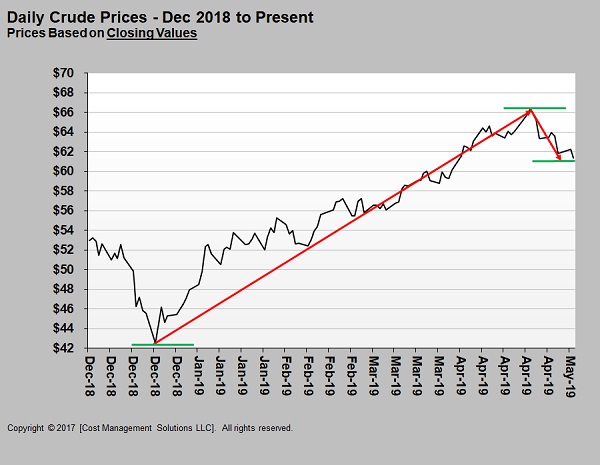

When the crude rally depicted in the chart below began, Mont Belvieu LST was 58 percent and Conway was 53 percent of WTI’s value.

Mont Belvieu LST eventually reached 63 percent and Conway 58 percent in late December 2018.

Propane’s nominal value was 69.875 cents Mont Belvieu LST and 62.75 cents Conway when the crude rally began. Propane prices are down only about 10 cents, with the fundamental weakness in propane partially offset by the strength in crude.

Since mid-December, crude has seen very few corrections and really no sharp or steep corrections until the current one that began in late April. Now, for the first time in three and a half months, propane is losing support from rising crude prices.

However, at the same time crude has become less of a support, propane fundamental support has improved. Propane exports have now been over a million barrels per day (bpd) for seven weeks in a row. That is the longest such streak on record.

Two weeks ago, propane exports hit a record high of 1.341 million bpd. For the most recent week data is available, ending May 3, exports only dropped 37,000 bpd from a high of 1.304 million bpd.

Suddenly, propane inventories built at below-average rates over the last couple of weeks. In the past seven weeks, propane exports averaged 1.197 million bpd. That accounts for all but 790,000 bpd of the average 2.018 million bpd of U.S. propane production during that time span.

It is hard to predict if exports will continue at the same rate for the remainder of this summer as they have over the past seven weeks. If they do, the fundamental picture for propane may not turn out to be as bearish as it was a month ago.

Crude and equities are down, with the potential of the U.S.-China trade deal falling apart, but crude is well supported fundamentally. Should this downward correction in crude end with the better fundamental support for propane, there is an increasing possibility that propane could see upward price movement.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.