US propylene inventory sets 5-year high

The propane inventory number reported each week by the Energy Information Administration also includes propylene. Propylene is a non-fuel used in the petrochemical industry primarily to make polypropylene, which is used to make a myriad of consumer and industrial products. Propylene does not contribute to the fuel-use propane supplies needed by U.S. propane retailers and their consumers.

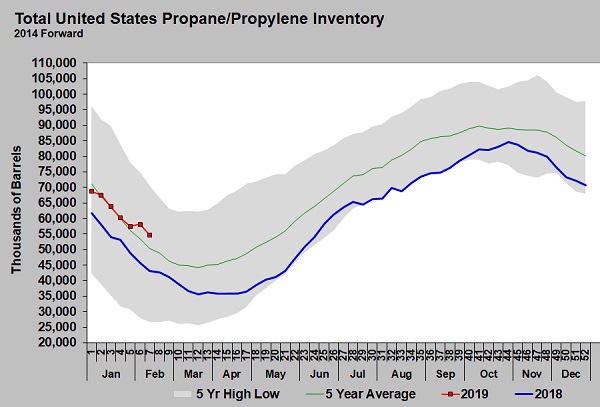

As of March 1, the inventory level of propane/propylene was at 51.371 million barrels.

That means propane/propylene inventory is 10.283 million barrels higher than at the same time last year.

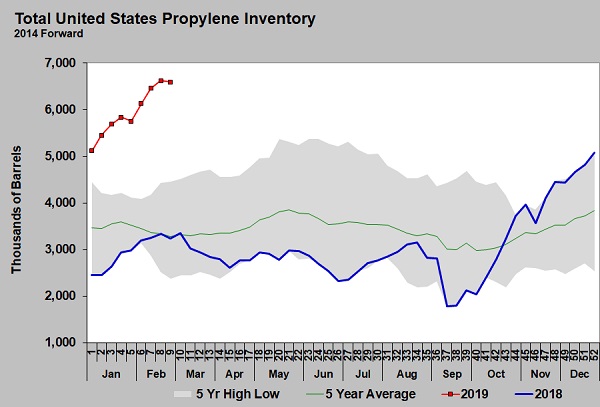

As the chart above shows, the amount of propylene-only inventory has been growing rapidly since September 2018. Propylene inventory is easily setting new five-year highs. It is 3.354 million barrels higher than where it was last year.

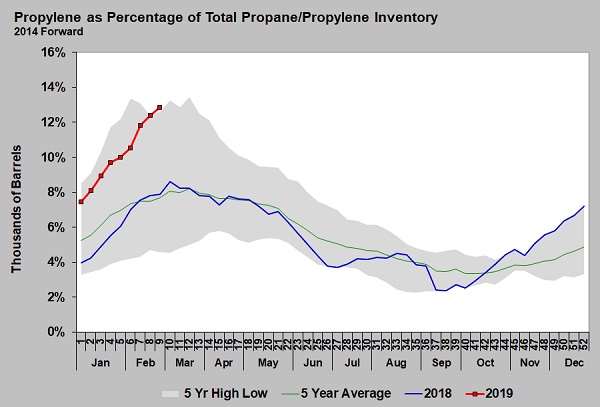

Propylene is 12.84 percent of the total inventory, which sets a new five-year high mark for the ninth week of the year.

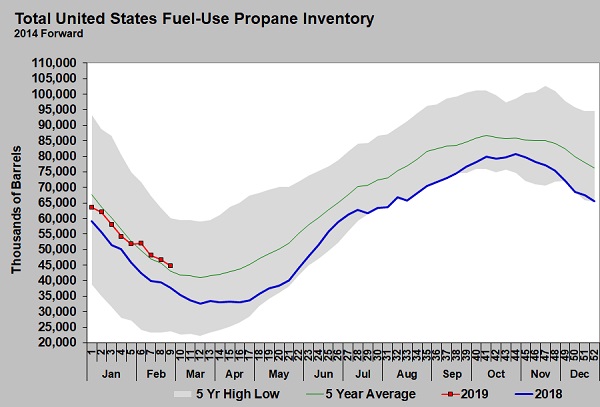

As the final chart above shows, U.S. fuel-use propane inventory is still in good shape despite relatively higher levels of propylene. Fuel-use propane inventory is above last year and its five-year high. However, at 6.929 million barrels higher than week nine of last year, it isn’t nearly as oversupplied as the total inventory number suggests.

Due to propylene’s higher relative value to propane, the United States is building propane dehydrogenation (PDH) plants to turn propane into propylene. That could potentially increase U.S. domestic demand for propane, which has been mostly stagnant for years.

Much of the U.S. supply of propylene still comes as a byproduct of the crude refining process. Refinery propane/propylene yield is split about evenly between the two products. Since a disproportionate amount of propylene still comes from refineries compared to PDH plants, propylene inventory should start declining this spring when refinery maintenance season is in full swing.

With the effort to build more PDH plants, some of the seasonal impact shouldn’t be as much of a factor, which would give propylene a good chance to increase as a percentage of the overall propane/propylene inventories. That would make it increasingly important to monitor fuel-use only propane supplies rather than combined propane/propylene supplies when evaluating the health of propane stocks.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.