Propane industry experts look ahead to winter

Stocks should maintain an adequate number of days of supply coming out of winter. Photo: iStock.com/BrendanHunter

Although the spot market could get iffy due to high levels of propane exports if sustained cold hits, industry experts are cautiously optimistic that propane providers will have enough winter gallons available despite a record-setting deluge of rainfall, destruction and infrastructural disruptions wrought by Hurricane Florence and its lingering remnants.

“Overall, we expect stocks to behave similarly to last year, maintaining an adequate number of days of supply coming out of winter – at or around 20 days, based on previous years’ trends,” says Austin Rial, senior NGL analyst at S&P Global Platts.

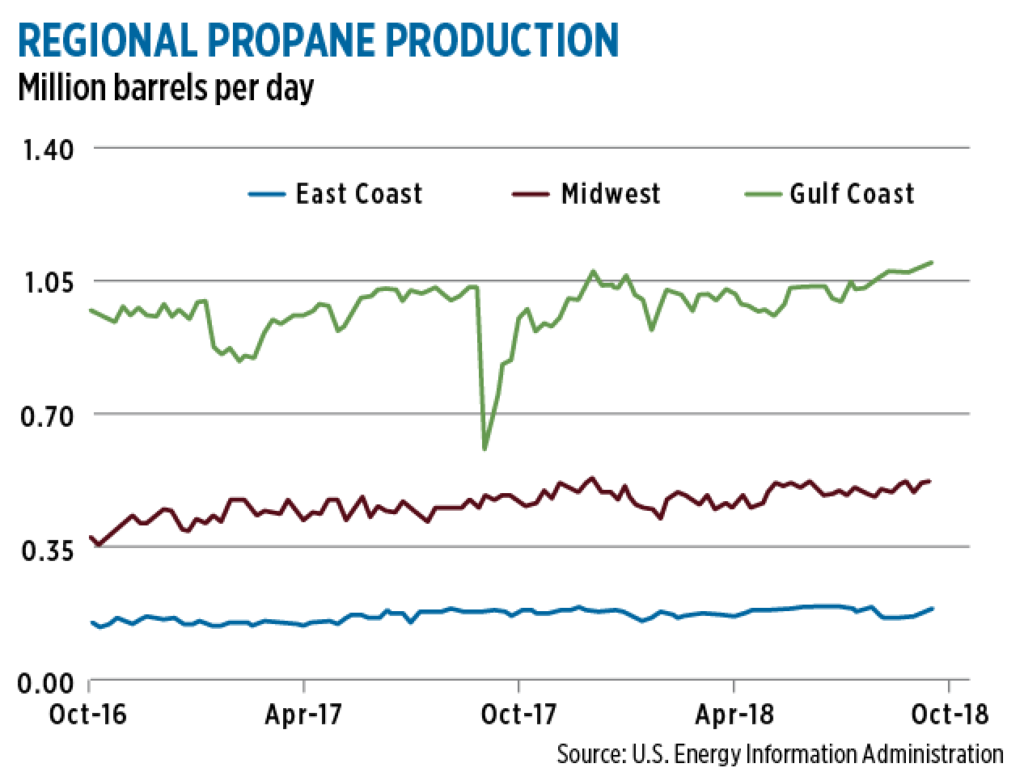

“Propane production has increased by over 25 percent since this time last year, meaning that stocks – while very important during acute winter demand periods – will play a diminished role in supplying domestic demand,” he adds. “Said another way, an increasing percentage of U.S. demand will likely be met by the growing monthly supply.”

Hurricane Florence should not impact propane supply this winter. Photo courtesy of NASA

Regarding the prospects of spot purchases off the high seas, “You’ll have to pay up if it’s a cold winter,” says Mark Meacham, principal analyst at IHS Markit. “It’s going to get tighter; exports are going to expand this year.”

Should heavy loads arise, however, spot buys will remain an option.

“If there’s a bid for propane in New England, there will be cargoes directed there,” Meacham says. “If New England runs out of propane, that’s when you’ll see the price blow out.”

“That is absolutely a concern of ours,” says Kirk Saunders, vice president of White Mountain Oil & Propane in North Conway, New Hampshire.

“The spot market is something we sometimes turn to. We try to do most of our contracts to cover our fuel so we’re not hanging out on a limb. Even though we had contracts [last winter], our normal supply couldn’t get in, so we had to turn to the spot market. We started pulling from different supply points all over New England and Canada.”

This year’s spot market will depend on weather in other parts of the world. Supply could get tight if Europe has a cold winter, says consultant Michael Sloan, managing director of ICF’s Natural Gas & Liquids Advisory Services.

The premium associated with propane is going to get bigger depending on what happens with the weather, both at home and abroad, he says.

“If we have several hurricanes, the impact will be felt mostly in price,” says D.D. Alexander, president of Global Gas and member of the National Propane Gas Association’s Propane Supply and Logistics Committee. “Make sure all your customer tanks are full and that your tanks are full. You should contract now for winter-only gas if you’ve determined that you don’t have enough allocated gas for your winter volume. Winter-only gas is more expensive, and if it’s warm you still have to take it, but it will be good if it gets cold.”

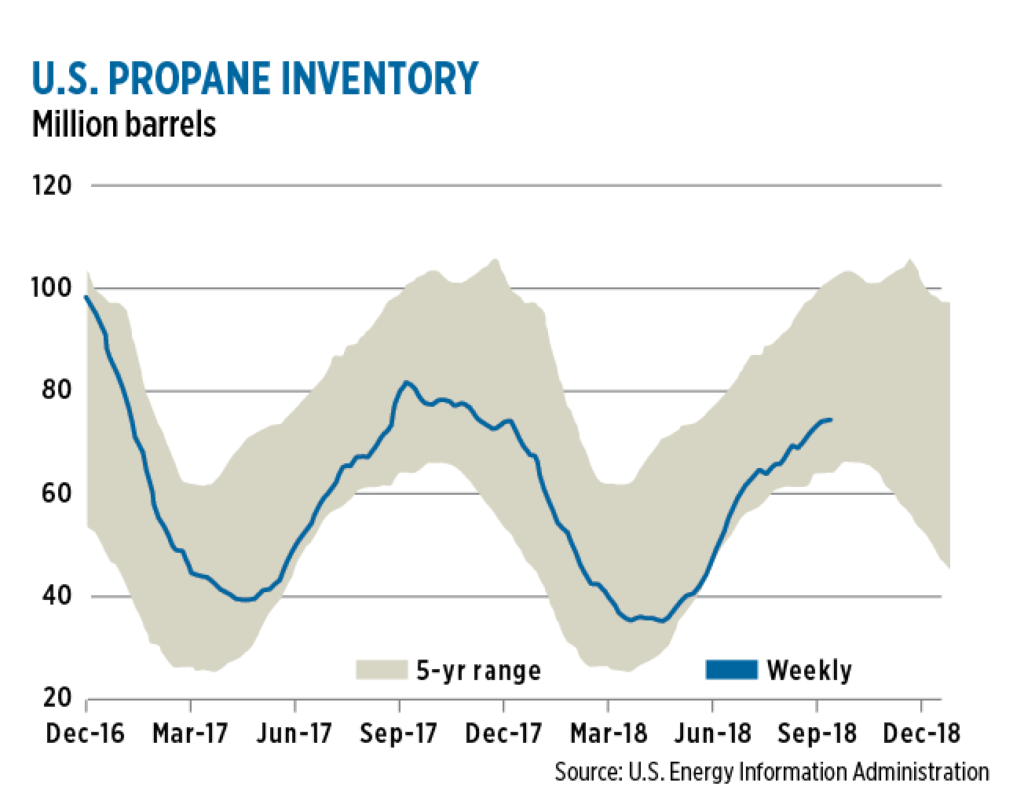

U.S. inventory stood at 74.8 million barrels in mid-September, 11.3 percent lower than the five-year average for the same time of year.

According to Alexander, if you plan to rely on spot purchases, you must prepare in advance. A ship can’t deliver gas the week it is purchased, she says.

A shortage of transports, or more specifically recruiting enough qualified drivers to operate them, could create situational bottlenecks, Alexander adds.

“People are buying new transports, but they’re selling their old ones and not building up their fleets because they can’t get enough drivers for the trucks that they have,” Alexander says. “Why should you add more trucks if you can’t find drivers?”

Saunders has experienced the same issues at his operations. In order to avoid getting caught short-handed, White Mountain strives to maintain year-round staffing opportunities. According to Saunders, keeping drivers employed has been one of the strategies for making sure it has year-round drivers.

An increasing percentage of U.S. propane demand will be met by a growing monthly supply, according to S&P Global Platts.

Diminished domestic railcar availability and loading spots may also be issues, says JD Buss, trading manager at Twin Feathers Consulting. Buss cites robust tanker traffic between Canada and Mexico along with higher overall railcar demand as the primary reasons for this. He also suggests buying a weather protection insurance policy.

“It’s become a little more mainstream, and still growing in usage. Each region can be different. It’s worth evaluating,” he says.

Twin Feathers is not predicting a scramble for product like in 2013-14.

“It looks like the product will be there, but we’d encourage clients not to depend on hours-of-service waivers,” says Buss.

The firm is also advising its clients to make next-winter purchases due to advantageous pricing conditions.

An overabundance of supply can be harmful to the bottom line, yet “if we get an early cold snap we can be in a bit of a pickle,” says Jack Belcher, executive vice president at HBW Resources. “Everybody’s been trying to get just-in-time inventory, but you don’t want to get caught with undersupply.”

Serving crucial facilities

Any trepidation caused by Hurricane Florence about providing enough propane for wintertime heating loads is likely to be remedied in advance of precipitously falling temperatures.

The biggest impact is that marketers were not able to get in the field to fill customers’ tanks, notes Tom Osina, executive director of the West Virginia Propane Gas Association.

Enough time still remained prior to the core heating season to rectify any Florence-related bottlenecks, says Stephen Kossuth, vice president of supply and logistics for AmeriGas.

“There’s enough diversity in the supply system that we’re able to absorb events like Florence,” he adds, referring to the propane industry as a whole.

Hours-of-service exemptions were declared for Delaware, the District of Columbia, Florida, Georgia, Maryland, New Jersey, New York, North Carolina, Pennsylvania, South Carolina, Virginia and West Virginia as Florence’s slow-moving downpours raged amid fatal family tragedies, destroyed homes and businesses, massive evacuations, widespread power outages and severely compromised infrastructure.

“There are parts in [West Virginia] where the railroad is built right next to a river,” notes Osina. “We’re expecting a lot of flooding. It’s been a very wet summer and the soil is saturated. If it washes out roads, it’s a problem, and it makes transportation impossible in some areas.”

According to Osina, many West Virginia marketers are familiar with these types of natural disasters. They make sure customers understand what to do in case of flooding and they train their employees to deal with such situations.

As the storm loomed off the coast of the Carolinas, AmeriGas prepositioned transportation assets and topped off tanks before the storm hit, Kossuth says. Cylinder exchanges were also pre-supplied with additional stocks.

“Propane marketers provide services that can literally save lives or make the pain a bit less severe,” says Stuart Flatow, vice president of safety and training at the Propane Education & Research Council. “It is the nature of their culture to help those in need and to supply fuel to those who cannot get it.”

According to Flatow, marketers have been serving crucial facilities such as hospitals and nursing homes along with delivering propane for cooking thousands of hot meals for emergency response personnel, local volunteers and displaced residents.

Foster Fuels, a propane retailer based in Virginia, put out a call for additional drivers while activating its Mission Critical program to move more than 100 trucks into impacted areas.

“Fuel is a crucial commodity during these times of need,” says Foster Fuels Vice President Stephen Tibbs. “When the power goes out and local vendors are affected and not able to meet that need, our team has the experience and the capability to fill those orders and keep the operation running.”

Generac mobilized five company units consisting of 10 technicians each and a trailer stocked with portable electrical generating equipment.

“We pride ourselves on deploying storm response teams,” says President and CEO Aaron Jagdfeld. “We help to provide emergency service for generators at homes, in retailers’ parking lots and our dealers’ shops.”

John Jessup, executive director of the North Carolina Propane Gas Association, took to the airwaves to advise the public about what to do to prepare as the storm approached, and what to expect regarding available supply.

“Some people are getting extra cylinders and things like that, and that’s put a lot of strain on the supply that’s out there,” says Jessup. “If your tank is for heating or cooking, you’re really not going to use a lot of propane, even if you’re cooking with it for the next five days. You might burn through a couple of gallons of gas, so there’s no reason to have your propane company come and top you off for cooking or something like that,” he notes.