US natural gas prices at 3-year high

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explores the relationship between the current high natural gas prices and propane prices.

Catch up on last week’s Trader’s Corner here: Calling on propane inventories

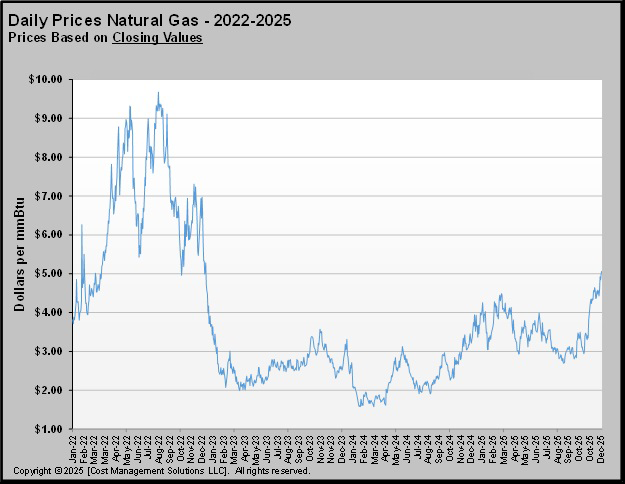

This past week, U.S. natural gas prices exceeded $5 per MMBtu for the first time since December 2022. In February 2022, Russia invaded Ukraine, disrupting natural gas supplies to Europe. That disruption increased demand for U.S. natural gas in Europe, which came with a major surge in prices.

But as recently as mid-October, natural gas was under $3 per MMBtu.

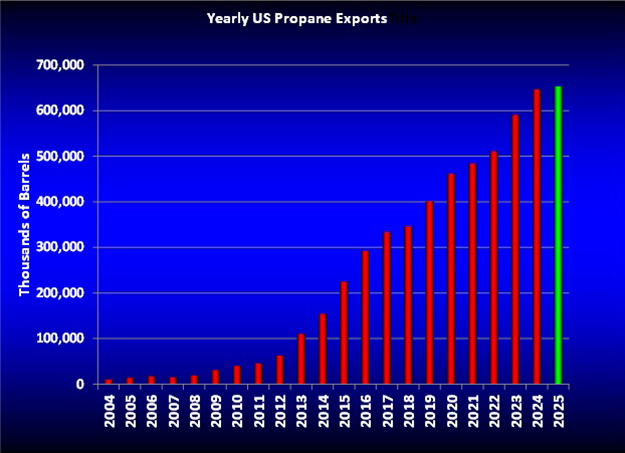

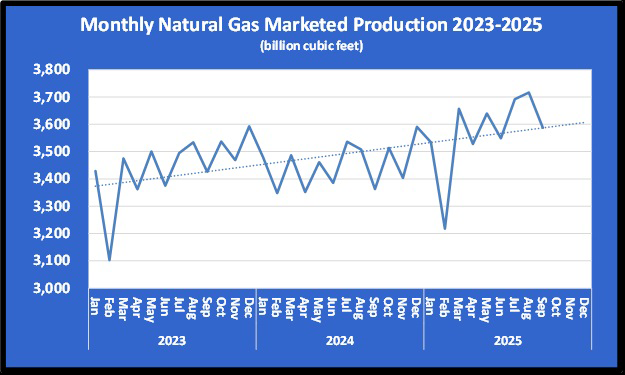

Natural gas exports have been trending higher as new export facilities are completed.

The increase in natural gas pricing has little impact on propane’s price since propane’s price is based on crude’s price. However, factors like weather that cause an increase in natural gas prices also put upward pressure on propane’s price.

More importantly, the production of natural gas has a significant influence on propane’s supply and therefore its price. When natural gas prices are good, it justifies more drilling for natural gas, which increases propane supply as well.

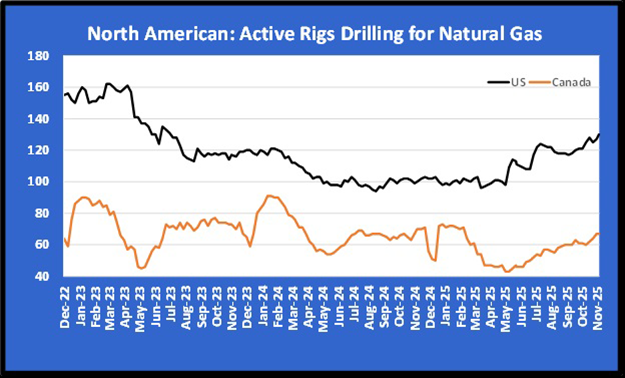

The number of rigs drilling for natural gas has been on the rise since the middle of this year. Rigs actively drilling for natural gas have increased from below 100 at the start of summer to 130 for the week ending Nov. 26.

Remember that natural gas comes from both light hydrocarbons (natural gas wells) and heavy hydrocarbons (crude wells). The natural gas produced from crude wells is called associated natural gas production. The United States is producing a record-high amount of crude oil. Official production in September was 13.84 million barrels per day. The increase in crude production has been the key factor in driving up natural gas production.

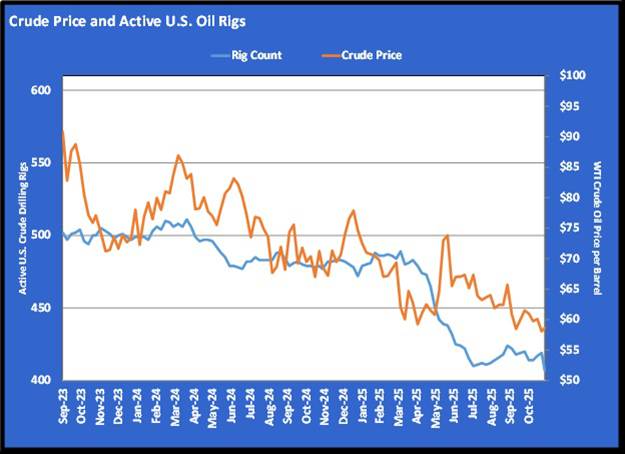

However, with crude’s price falling, the number of rigs drilling crude wells has been falling, making the increase in natural gas well drilling important for maintaining natural gas and propane supplies.

Rigs drilling for crude surged to over 500 at the start of the year and are now down to 407.

The increased drilling for natural gas wells has helped keep natural gas production on its upward trajectory.

That helped put U.S. propane inventories at a record 106.094 million barrels to start this winter. Propane production is also at a record high, helping to keep calls on propane inventory limited. Propane inventory stood at 103.546 million barrels for the week ending Nov. 28.

The United States has supplied Europe with 56 percent of its LNG imports this year. The European price for natural gas has been dropping due to mild winter conditions. The European price was down to $7.64 per MMBtu, the lowest since February 2024, this week. The squeezing of the price spread between the U.S. and European markets could hurt exports. However, the United States is also providing Asia with LNG, and the Asian market was nearly $11 per MMBtu this week. Any short-term drop in European demand due to mild weather could be taken up by Asian buyers.

Retail natural gas is the natural enemy of retail propane marketers. When the natural gas mains are extended into an area, propane retailers must adjust their market area. Wholesale natural gas is trading at the equivalent of 47 cents per gallon of propane, and that is high compared to where it has been. In October, before this rise in natural gas prices, it was trading at the equivalent of 32 cents per gallon of propane.

But it is the rising demand for natural gas that has helped keep propane well-supplied and propane prices favorable for propane consumers. Propane retailers will hope that most of the growth in natural gas demand will come from overseas, which provides the best of both worlds: increased propane supply with perhaps relatively moderate growth in domestic natural gas demand.

U.S. LNG exports are up nearly 10 percent this year, while marketed natural gas production is essentially flat overall. Since inventories of natural gas are roughly the same, it would suggest that domestic demand for natural gas is flat. Also, there has generally been a trend to use more natural gas for power generation, so that may account for any domestic growth in natural gas demand.

There is always give and take between propane and natural gas, but at least right now, the abundant natural gas supply from both natural gas and crude wells is providing an ample supply of propane at a low price.

Charts courtesy of Cost Management Solutions.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.