Breaking down US propane exports by destination

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines key export destinations of U.S. propane to see if any of those destinations had a significant decrease in volume in 2025.

Catch up on last week’s Trader’s Corner here: How events in Venezuela affect US crude supply

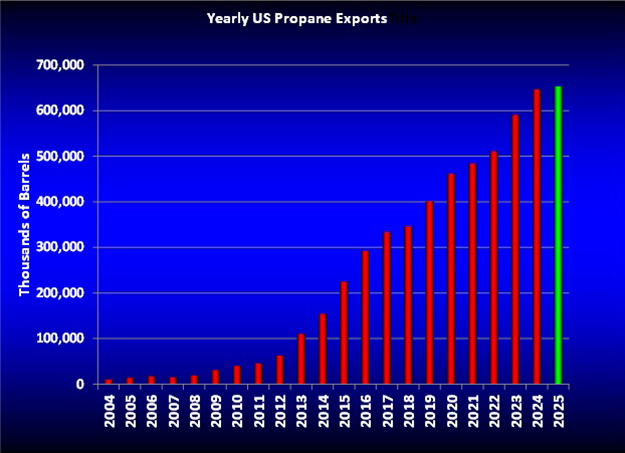

This Trader’s Corner is the second in a two-part series on U.S. propane exports. Last week, we focused on the overall picture. What stood out was that U.S. propane export growth was much lower in 2025 than it has been in recent years. The growth did not keep up with the rising U.S. propane production, which resulted in the record-high inventory levels entering this winter.

Couple the slower growth in exports with a rather mild winter, and inventories remain at record highs for this time of year. The result has been a bearish pricing environment for propane. That environment is likely to continue through 2026 unless propane export growth increases.

In this Trader’s Corner, we wanted to identify the key export destinations to see if any of those destinations had a significant decrease in volume in 2025. If a key export destination, or destinations, saw a drop in volume, they could recover in 2026 and get export growth back on track.

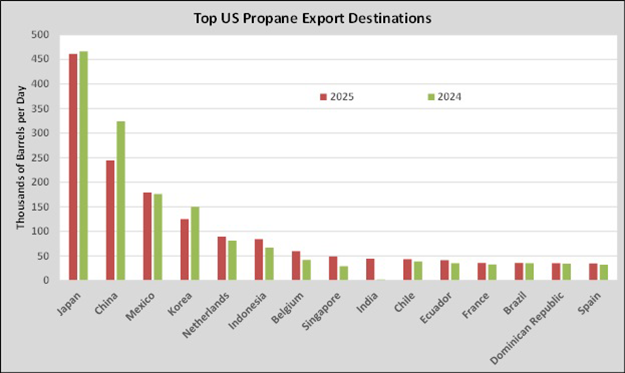

We began our research by identifying the top export destinations from 2020 to 2024. We then looked at exports specifically in 2024 and 2025 to see if any significant changes were taking place. Ultimately, we decided to use the top 15 export destinations for 2025 as the basis for charting. However, 40 countries received propane exports in 2025.

Again, there are numerous countries that received propane exports from the United States that were similar to the levels Spain received, but we had to limit the number on the chart.

Japan has been, and remains, the largest importer of U.S. propane. It and most other countries continued to import U.S. propane in 2025 at about the same rate as in 2024. The notable exceptions were China and Korea. An increase by India helped to offset those lost export volumes to a degree.

The drop in China is about 80,000 barrels per day, which is nearly 30 million barrels for the year. That drop alone is enough to result in the high inventory position in the United States. But more so, it was growth in demand from China each year that had been keeping up with new U.S. propane production, keeping supply and demand in balance.

So, the growth was lost. Other locations, like India, have stepped up to offset the decline from China, keeping exports in 2025 slightly above 2024 levels. But it was the lack of overall export growth that was the key to the inventory build, and the other countries just couldn’t take on enough additional volumes to offset China and Korea’s declines and keep up with production growth.

There is no doubt that the tariff wars and deteriorating relationship between the United States and China have contributed to this situation. China needs U.S. propane; there simply isn’t another source that can keep up with its demand. It would no doubt like to normalize trade relationships. If that were to happen, it is possible that U.S. propane export growth could rebound in 2026.

However, at this point, it’s hard to see anything normal happening between the United States and China in 2026, so it will be up to other countries to continue taking up the fall-off in imports from China and Korea. The question remains whether they can increase their volumes enough to keep up with the growth in U.S. production.

Low prices will certainly help yield that result. Also, the low price of crude will likely start catching up to U.S. propane supply growth in 2026. That could start whittling away at the surplus inventories from the supply side. Commodities, including propane, have periods where supply and demand get out of balance. Market forces will always push toward a balance. Geopolitical events that can take place quickly can make it much harder for the market to do its job.

The United States did not use all its sustainable export capacity in 2025. If exports do not increase enough to start maxing out export capacity, the inventory overhang that developed in 2025 is likely to continue throughout 2026 as well.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.