Propane exports slow; inventories soar

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines the connection between the slowdown in U.S. propane exports and high propane inventories.

Catch up on last week’s Trader’s Corner here: How events in Venezuela affect US crude supply

In this Trader’s Corner, we are going to look at U.S. propane exports. It will be the first of a two-part series. We will look at annual exports in this report and show how a slowdown in exports has contributed to record-high propane inventories. Next week, we are going to explore the destinations of propane exports and see if they tell us anything about why export growth has slowed down and if there is a path to a rapid increase in export rates. If specific buyers are not decreasing volumes, then export facilities may be struggling to keep up.

U.S. propane inventories reached a record high before this winter began at 106.094 million barrels. Propane inventories have been drawing this winter, but not as much as normal. As a result, inventories are at a record high of 95.714 million barrels with more than half of the winter gone. The closest inventories have been to this level this late in the winter was in 2020, when they were at 80.581 million barrels. Of course, that was the year COVID-19 was having its biggest impact on demand.

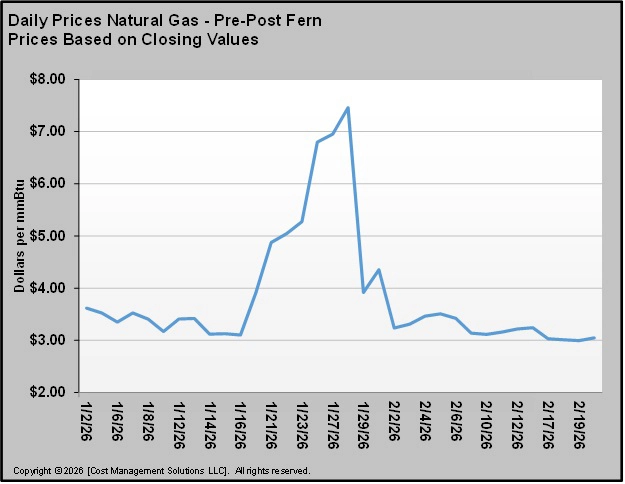

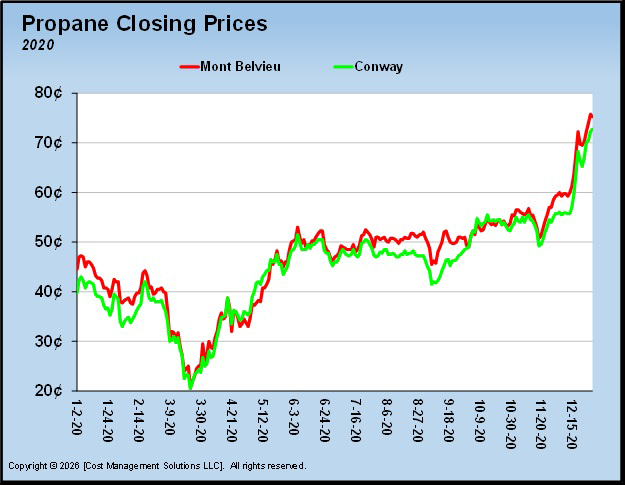

Chart 1 shows what propane prices did that year.

Of course, the situation surrounding COVID-19 was so unique that it is probably unfair to make the comparison. Crude prices essentially went negative that year. Still, the comparison of inventories is hard to ignore. Inventories are currently 15 million barrels higher than they were at this point in 2020.

This winter, domestic demand has been sporadic. Compared to last year, heating degree-days are up 2 percent, but that still leaves them 12 percent below normal. With domestic demand growth limited at best, it is up to exports to keep pace with the growth in U.S. propane production.

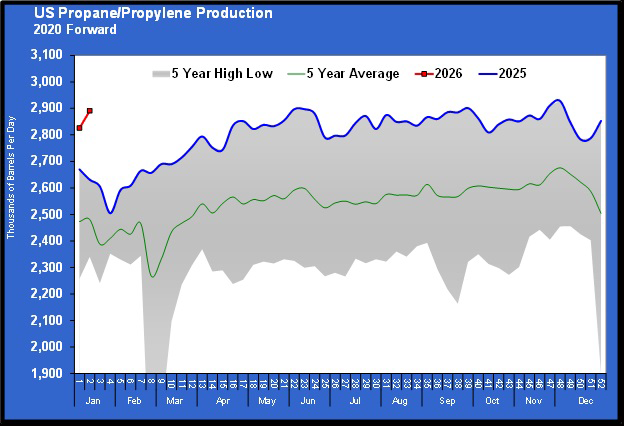

Production was at 2.891 million barrels per day (bpd) last week, not far off the 2.928-million-barrel record set in late November 2025.

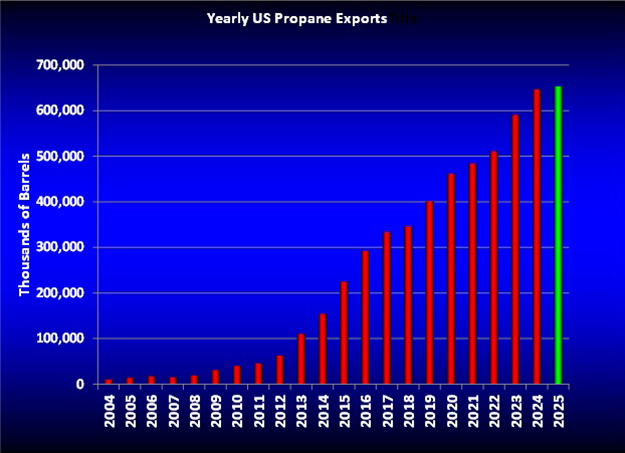

Chart 3 shows annual U.S. propane exports.

The growth over the last 20 years has been phenomenal. However, the growth this year has apparently fallen off the pace.

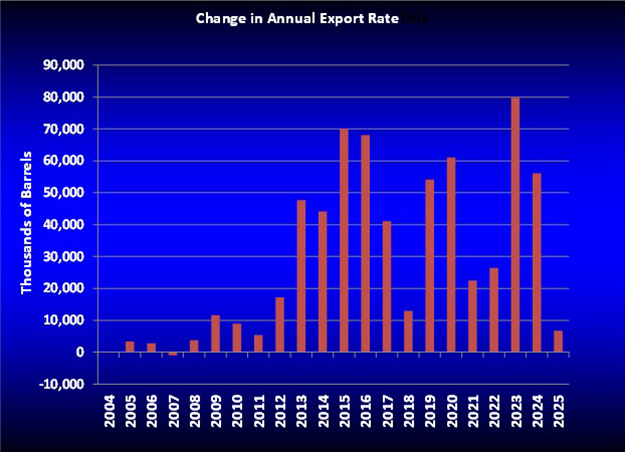

The chart above shows the annual change in exports. The limited growth in exports does not keep up with the growth in production, resulting in a very oversupplied U.S. market.

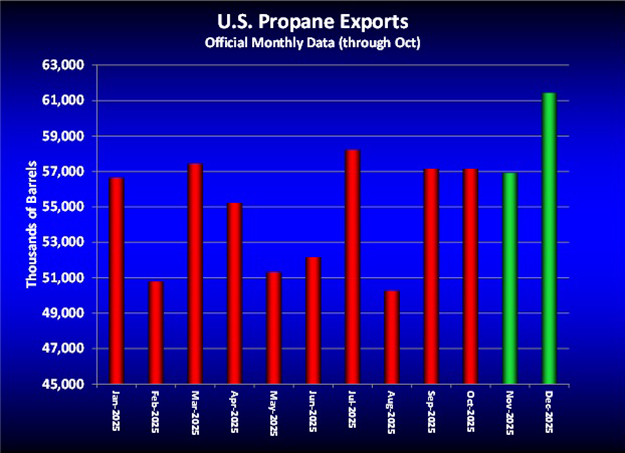

Having said that, we need to qualify the statement. Official propane export data only goes through October 2025. Therefore, we had to use unofficial weekly data to provide the 2025 number.

Chart 5 shows the official export data through October. We have highlighted the November and December data to denote that we calculated those volumes based on the weekly data.

Even though those months are calculated and the official data for those two months will certainly be different, we don’t think it will alter the annual data enough to change the probability that export growth is going to be well off this year compared to the last two years, and frankly, most of the last decade.

We ran an estimate of the annual export rate using the whole year’s weekly data, and the growth rate came in double the official growth rate through October 2025. That means the odds favor that the official data will likely be lower than our estimates above. But even if it’s not, the official export rate for November and December 2025 would have to be massively higher than the weekly estimates to move the needle much.

The likely conclusion then is that 2025 exports did not keep up with the massive growth in 2025 propane production.

If we go back to 2020, the reason for the high inventory position was a near full stop on demand due to COVID-19. Demand was able to come back quickly, and we can see in the 2020 price chart that propane prices made a strong recovery from March through the end of the year. Note in the annual export chart that propane exports in 2020 had significant growth, increasing by 61 million barrels. Inventories still started the next winter at a record 101.842 million barrels.

It looks like export demand growth in 2025 will be below 7 million barrels. The current inventory conditions almost certainly mean that propane prices will be low at the start of summer. But it remains to be seen whether that will be enough to drive rapid growth in export demand like what occurred in 2020.

By our calculations, the average daily export rate was 1.790 million bpd in 2025. That is below the capacity of what we believe is around 2.2 million bpd. There have been weekly reports of exports of more than 2.1 million bpd in some weeks of 2025. The actual export rate is almost never going to reach capacity, so the capacity estimate of around 2.2 million bpd probably isn’t too far off.

If the average export rate this year could increase to 2 million bpd, that would be a 76 million annual increase in demand. If, at the same time, the growth in production slows, that could bring inventories more into line. But note there are plenty of “ifs” above.

We look forward to reviewing individual countries’ import rates of U.S. propane in next week’s Trader’s Corner to see if they reveal anything that helps us better determine if an increase to 2 million bpd in exports is probable.

Charts courtesy of Cost Management Solutions.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.