Trajectory of refinery throughput to impact propane production

As we write this Trader’s Corner, producers around the world are having a teleconference to discuss the possibility of cutting global crude supply by as much as 15 million barrels per day (bpd). Even if they do, that will not offset the crude demand destruction that has taken place due to COVID-19. There are estimates that demand is down at least 20 million bpd, and we have seen estimates of more than 30 million bpd.

Under the current situation where crude is oversupplied on a global basis, U.S. propane supply fundamentals are becoming more price-supportive. While Saudi Arabia and other producers have been ramping up crude supply, U.S. producers have been cutting back on production. The U.S. Energy Information Administration (EIA) reported last week that U.S. crude production dropped 600,000 bpd. Since some of our natural gas supply is associated with crude production, natural gas production declines as well. Of course, that means less propane supply from natural gas processing.

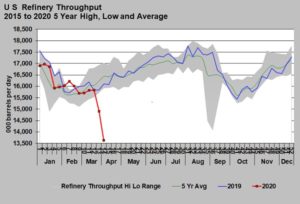

Fifteen percent of propane supply comes from the refining of crude. Due to low demand related to the impacts of trying to contain COVID-19, less crude is being refined. The EIA reported U.S. refinery throughput was down 1.264 million bpd for the week ending April 3.

Refinery throughput at 13.634 million bpd was 22.466 million bpd lower than throughput during the same week last year. Given that gasoline demand is running 4.741 million bpd below last year and its inventory climbed a staggering 10.497 million barrels last week, it is hard to see much of a change in the trajectory of refinery throughput anytime soon.

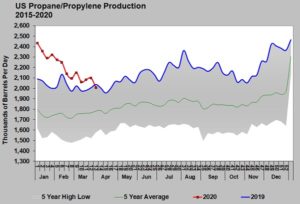

The impacts of lower crude refining rates and lower natural gas processing rates are starting to show up in propane production.

For the week ending April 3, U.S. propane production fell 93,000 bpd to 2.007 million bpd, putting it essentially where it was at this time last year. That is in stark contrast to the rapid growth that had been taking place over the last couple of years.

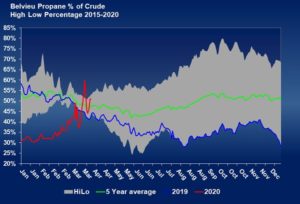

Crude’s low value is reflective of the major oversupply globally, while propane’s value reflects what is happening specifically inside the U.S. market. The result is that the relative value of U.S. propane is rising rapidly against crude.

The chart to the right shows the value of Mont Belvieu LST propane as a simple percentage of the value of West Texas Intermediate (WTI) crude. Propane, which was extremely low-valued against WTI at the beginning of the year, is now above both last year and the five-year average.

We would certainly expect the relative value of propane to come back down if crude producers are able to come to an agreement to lower production. Such an agreement would improve crude’s fundamentals. But we still think current market dynamics may be more impactful on propane fundamentals. If correct, this could prevent propane’s relative value from falling to the lows seen at the beginning of the year.

Following the outcome of the producers meeting, assuming they are able to come together on production cuts, we will be watching to see how propane’s relative value settles out. Watching this relative value is a really good way to see how market players are perceiving the fundamental picture for propane. When the relative value is declining, market participants are seeing fundamentals that are bearish for prices. When the relative value is improving, market participants are generally seeing fundamental changes that are more supportive of higher prices.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.