What to expect from changes in the crude price curve

Last week, the Organization of the Petroleum Exporting Countries (OPEC) announced that it expects the world to need 410,000 barrels per day (bpd) more of its crude in 2018 than it anticipated in its last forecast. OPEC now projects demand for its crude will average 32.83 million bpd in 2018.

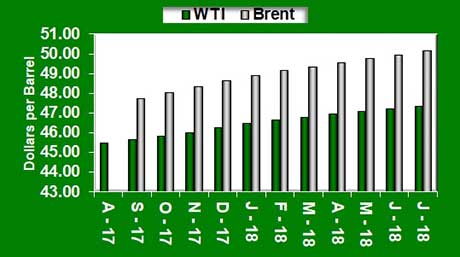

OPEC believes that crude supply and demand is balancing. It argues this case by pointing to the future price curve of global benchmark Brent. The charts below show the future price curves for West Texas Intermediate (WTI) and Brent crudes (Brent is represented in the gray bars).

In the chart above, which was posted about two months ago, Brent crude is in what is called a contangoed price curve, where the front, or nearest, month is priced less than the further-out months. Contango price curves occur in an oversupplied market. The immediate oversupply drives down the value of crude in the front of the curve relative to the price further out.

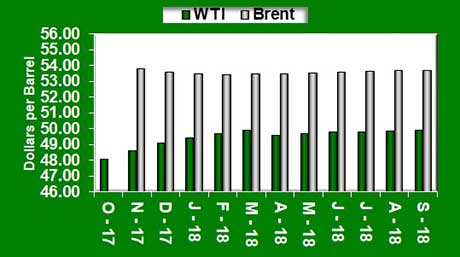

Now, compare Brent prices in that curve to the more current price curve in the chart below.

Note how the price in the front month (November) is higher than the next three months. When the nearest-month prices are higher than the next month out, it is called backwardation. The full curve is not yet backwardated, but it is moving in that direction. Backwardated futures curves are common with balanced or undersupplied crude markets. Under those conditions, the immediate, or nearest, crude is more valuable than the crude further out.

Note also that even WTI crude has become less contangoed than it was two months ago. Crude markets are beginning to reflect what traders expect to be a tighter supply and demand situation in the future. That decreases downside risk to crude prices.

Since crude prices impact the value of propane prices, the change is important to propane buyers and sellers. A contangoed price structure reduces downside risk to a near-term supply position. A backwardated price structure increases downside risk to that same position. Opposite statements would be made for further-out supply positions.

However, the crude price structure is only one influence on propane prices. The trends and conditions in propane’s own fundamentals have to also be accounted for in supply decisions.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.