Crude production and drilling impact propane supply

Last week in Trader’s Corner, we took a close look at natural gas production and drilling. Since more than 80 percent of propane supply comes from natural gas processing, it is important to look at how natural gas production and drilling activity are trending to get an idea of how propane supply may trend.

This week, we are going to look at crude. Crude is less important as a source of propane supply than natural gas. However, natural gas liquids (NGL) values get their base value from crude’s value. In other words, crude’s value sets the baseline for NGL values, such as propane, and then NGLs’ own fundamentals, such as supply and demand, take it from there.

U.S. crude production recently hit a record high of 12.5 million barrels per day (bpd). The expectation is that production will continue to grow in the short term, but there are signs that it could start slowing soon. Most of the growth in production is coming from shale formations.

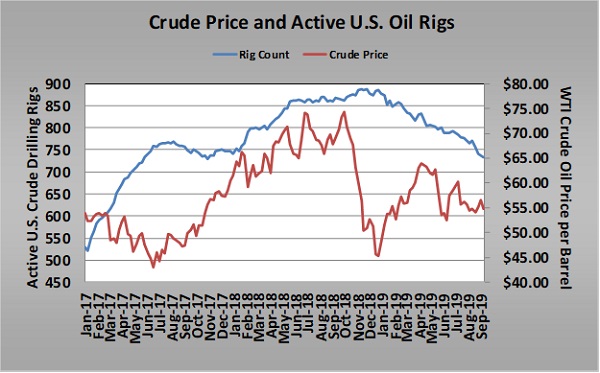

Oil output from the seven major shale formations in the United States is expected to rise by 74,000 bpd in October to a record high of 8.8 million bpd. The number of rigs drilling for crude has been declining this year. Producers are cutting back on drilling programs as they try to reduce expenses and keep investors happy.

But, improvements in technology have helped reduce the need for as many rigs. For example, there has been a significant increase in new well efficiency in the Permian Basin, the largest U.S. shale play. In 2010, a new well produced just over 100 bpd. A new well today produces just under 600 bpd.

Still, it takes a lot of new production to offset the rapid decline in legacy or older wells. For October 2019, production from new wells in the Permian will be up 338,000 bpd, but production declines from older wells will total 267,000 bpd, resulting in a net increase of 71,000 bpd. There are 419 rigs active in the Permian, as producers try to stay ahead of the production decline.

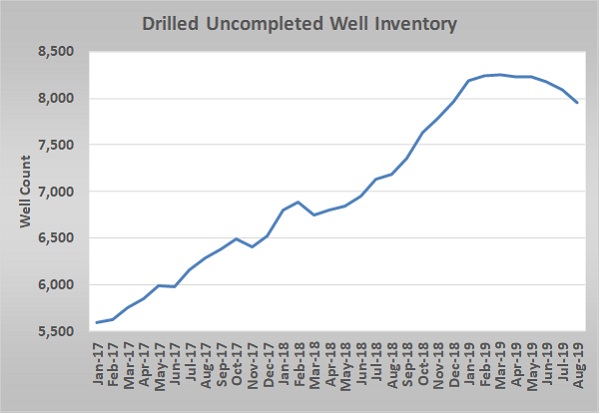

As the chart above shows, active rig count has declined with crude price. The slower drilling rate means that the inventory of drilled, but uncompleted wells, known as DUC, is finally starting to come down.

In addition to increased new well efficiency, a key reason that slower drilling has not yet resulted in decreased production has been the number of DUCs available. Since March, the number of DUCs has declined 296 wells, from 8,246 to 7,950. That is an annual rate of about 720 wells. A recovery in prices would likely increase drilling activity and replenish the number of DUCs.

Still, monitoring DUC count is a good way to anticipate when U.S. production might peak. As DUC inventory declines, replacing rapidly depleting older wells will require more drilling. Drilling activity will depend on the price of crude, which will require a lot of capital. Investors have poured money into shale production firms, and those firms are struggling to provide those investors with an appealing return on investment.

Production companies focused on shale have already acknowledged they are going to struggle to attract investors in the future. We can’t necessarily assume investment capital will come into these companies at the rate they need to offset well depletion. Crude prices will almost certainly have to be higher than they are today to attract investment. Prices are unlikely to improve much until the rate of growth in U.S. production is slowed significantly or even halted. OPEC, Russia and other major producers have been limiting their production to make room for U.S. production so as not to collapse the price of crude. If U.S. production slows, they will add production, limiting the upside in crude’s price.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.