Watch propane price curves to chart a course

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, evaluates the forward price curve for propane.

Catch up on last week’s Trader’s Corner here: Expectations versus reality: How low propane prices dropped

In this Trader’s Corner, we are going to look at the forward price curve for propane and suggest why it is shaped like it is.

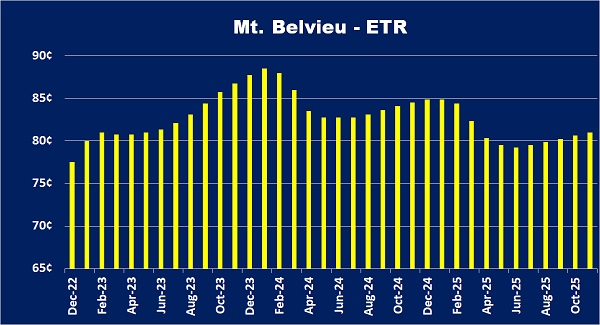

As we write this Trader’s Corner, this is what the forward price curve looks like for Mont Belvieu ETR propane. First, we need to make clear that a forward price curve reflects what value the market (buyers and sellers) has settled on for propane in the current and future months now (10:11 a.m. CST, 12/30/2022). It is common practice to be able to trade propane in a 36-month window. Chart 1 reflects that time frame. A forward curve should not be seen as a predictor of future prices. Conditions will change and the curve will change with those changes in conditions. At this point in time, considering all they know about the market currently, buyers and sellers have come together to make deals that have established the value of propane in each of the months in the chart. The left-hand side of the curve is generally referred to as the front and the right the back.

Let’s consider what this curve tells us about the market’s current thinking about propane. Note that from December 2022 to January 2024 the market is pricing propane prices progressively higher. This is called a contangoed price curve. It reflects an oversupplied market. When the market is oversupplied, the front of the price curve gets pushed down. Prices stay higher further out as the market always assumes that the conditions causing the oversupply will correct as market forces are applied. For example, lower prices may cause more demand or a drop in supply, which would bring supply and demand more into balance. The effect on the price curve would be to make it flatter. In other words, prices would be more equal across all the months.

If the conditions that are causing oversupply do not get corrected, the curve will continue looking as it does or become even more contangoed (bigger difference between the front and the back of the curve). If the oversupply continues as time passes, the prices farther down the curve will fall toward the price in the front of the curve. That possibility represents risk to the buyer. If a buyer is taking a position for next winter via pre-buys or swaps by locking down prices where the market currently values next winter (higher than today’s price), they are assuming the risk that the current oversupply conditions will not get resolved. That means they run the risk that the oversupply will still be around next winter and propane prices will be valued closer to where they are today rather than the price they are locking down for next winter.

The price curve can reflect not only propane’s supply and demand balance but also how the market perceives other market influences on propane. It is particularly true in propane’s case because no one is choosing to drill or not to drill propane wells in response to its specific value. There is no such thing as a propane-specific production well. In other words, propane can be oversupplied, and its supply will continue to grow because the market wants the other products that are produced along with propane. This fact makes predicting propane prices particularly difficult. If there were propane-specific production wells, producers would currently respond by drilling fewer of those wells, which would reduce propane oversupply over time, causing its price to rise. That would be a direct cause and effect and would be much more predictable.

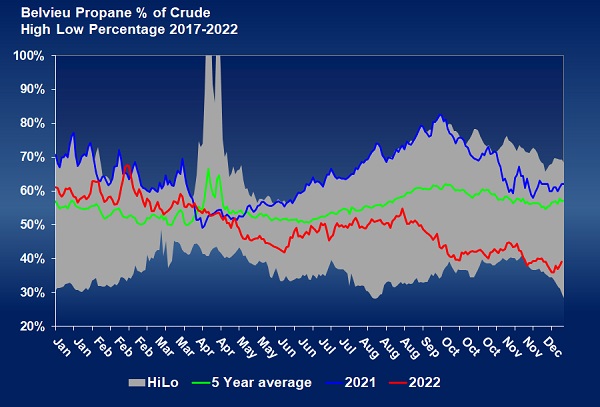

If the market needs more crude and natural gas, producers will continue to drill those wells. As a result, more propane will be produced, even though more fungible propane isn’t needed. Consequently, buyers and sellers of propane have a much more difficult time predicting supply and prices because of its “byproduct” status. And to make matters even more challenging, propane is going to get its base valuation from the value of crude. Propane’s specific valuation may go up or down relative to crude’s valuation depending on the supply and demand balance for propane, but no matter what, crude’s value is going to have some influence on propane’s value.

That brings us back to the curve in Chart 1 (above). The curve is contangoed not only because the market assumes that the propane oversupply will get corrected somehow but also because of market perceptions concerning crude.

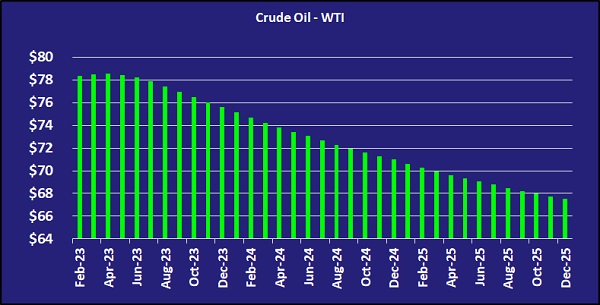

Chart 2 is WTI crude’s forward curve. It is largely backwardated. That is a term used to describe when prices are higher toward the front of the curve and lower toward the back. It reflects an undersupplied market. Again, the market assumes the undersupply will get corrected. If it doesn’t, then the price further out will move up, toward the price at the front, as time passes.

As market participants look at the current environment for crude, it’s much easier to see the threats to crude supply than how the undersupply is going to get resolved. Production of crude in the U.S. is largely flatlined at around 12 million barrels per day. The Dallas Federal Reserve just released a report expecting headwinds for increased U.S. crude production to persist. What that could mean is higher crude prices but no increase in propane supply. If crude production doesn’t increase, then the associated natural gas production from those crude wells that would provide more propane won’t increase either. We are also seeing natural gas prices dropping rapidly which could mean less drilling for natural gas, which would also mean no increase in propane supply.

Even though propane is oversupplied, buyers are still willing to pay more for it in the future. That is likely because they are concerned about the undersupply in crude and that crude prices will rise, pulling propane prices along for the ride.

Even though a recession looms that could reduce crude demand, there is a possible offset for that in the crude supply-demand balance. China, the world’s second-largest consumer of crude and its largest importer, has been enforcing a strict zero-tolerance policy to try to control the spread of COVID-19. Prompted by civil unrest, it appears to have thrown in the towel on its draconian measures. As a result, COVID-19 is spreading rapidly in China, and that is going to impact crude demand and supply chains negatively in the short term. But over the mid to longer term, this should have a positive impact on crude demand and supply chains. An improvement in supply chains could reduce inflation and the length or impact of weak economic conditions. That in turn could increase crude demand.

At the same time, the war in Ukraine rages, and Russia has said it will not supply crude to countries that impose a price cap on its crude. G-7 countries imposed a price cap on Russia’s crude of $60 per barrel, hoping to keep it flowing but reduce Russia’s revenue to fund its war effort. Russia doesn’t want to play that game and said it will reduce supply before it sells at a price that is capped below market.

Further, the U.S. and other western nations are having difficulty improving hydrocarbon production despite the potential need and desire to find alternatives to Russian supply. So threats to crude supply remain. But the change in China’s approach to COVID-19 provides the possibility that demand will not fall. OPEC has a little more spare capacity after cutting output recently; it has shown little interest in producing more when prices rise.

Chart 3 shows propane’s value to crude is already reflecting propane’s oversupply. It is valued at around 40 percent of crude. It may fall some more if the propane oversupply persists, but that may be more than offset by rising crude prices. We believe that propane’s forward curve is reflecting this possibility.

If one is managing the risk of higher prices, we need to look at propane’s value for next winter. Even though there is some risk (valued at 84 cents versus front month at 77.5 cents) given the above, it may be a risk worth assuming. Further, the out-month values for crude make it tempting as a hedge for higher propane prices. Remember, the crude forward curve is backwardated. Therefore, if you believe the risk of rising crude prices is real, then buying crude out months makes sense. The curves would suggest there is less risk to buying crude futures than propane now. Still, propane is a relatively cheap Btu, even at 84 cents for next winter, so owning it at that price has good odds of working out.

At the close of December 2022, we saw the market watching the propane curve and taking advantage of the opportunity. December 2022 propane became valued 6 cents less than January 2023 Mont Belvieu ETR propane. Buyers started playing that spread, buying based off the December price and putting it into storage. They were willing to take the risk that propane prices will not fall enough to cover that spread in January. We will see if it works out, but it nonetheless shows that traders were monitoring the curve and taking advantage where they perceive the opportunity.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.