Propane marketers assess operations, winter readiness

Whether the weather brings a brisk big-load winter heating season remains up in the air, of course, but government scientists are predicting nasty storms that could create infrastructural challenges for propane marketers while causing disruptions among the customer base.

Amid August’s massive flooding, road washouts and evacuations in Louisiana, forecasters at the National Oceanic and Atmospheric Administration (NOAA) were expecting this winter’s climatic havoc to top 2012’s, citing a 70 percent chance that 12 to 17 named storms will sweep ashore at various locations.

These anticipated calamities come in the wake of record-setting heat, as 2016 is set to become the hottest year ever. Surpassing 2015’s hottest-ever ranking, March and July produced the highest respective monthly mercury readings since temperature records were first recorded in 1881.

“I doubt if the hot summer will impact the heating season. If anything, the rule of thumb is that extreme heat brings a colder-than-normal winter,” says supplier George Jaques of Plains Marketing in Mount Pleasant, Iowa.

Joe Rose, president of the Propane Gas Association of New England (PGANE), points out that even if the desired cold is indeed delayed, a “late arrival means we can keep setting tanks” to better serve the customers and improve operational efficiencies.

Additional retailer storage and new rail terminals have helped replace the void left by propane pipeline reversals in recent years. Photo by Brian Richesson

Although it’s “too early to tell” what will happen with winter’s temperatures, the region’s marketers are on track with their preparations, including “lots of new storage in New England, and there is plenty of propane,” Rose says.

“Transportation may be an issue if we get a prolonged cold spell. Regional rail will always be a concern; otherwise all is well,” he adds. “With the reduction of fracking due to low prices, many railcars and transports will shift back to propane. Several haulers have added capacity,” Rose reports, and “everyone is looking for drivers.”

Recruiting enough drivers “is a continuing challenge for the propane industry,” says Tod Griffin, executive director of the Kentucky Propane Gas Association (KPGA). “We hear about it all the time from our members.”

“While there is always a need for more drivers, particularly during busy delivery months, our marketers have enough vehicles and drivers to serve customers for this winter,” says Tom Osina, executive director of the West Virginia Propane Gas Association. “It appears that we are in a very unsettled weather pattern right now. Just as there have been record-setting high temperatures, I would not be surprised if we have seriously cold temperatures this winter, as well.”

Addressing such a frigid scenario, supplier D.D. Alexander at Global Gas cautions that a paucity of propane could envelop New England because fewer gallons are being purchased in advance.

“The Northeast is running a lot tighter this year compared to last year,” she says. “I believe the retailers’ contracting less will cause us to have supply issues in the Northeast if we have a cold or even normal winter.

“A lot of them got stuck with gallons their suppliers made them pull from last winter. Some are still pulling winter gallons,” Alexander adds. “They didn’t want to contract as much this year because they didn’t want to be stuck with extra gallons again if we don’t have a [cold enough] winter.”

Alexander says the Northeast has much less spot gas on the market, which she attributes to exports ramping up out of the Philadelphia area. This also could contribute to shortages in the region if a cold winter develops, she adds.

With the lack of price volatility in the market this year, retailers have been buying time waiting to position propane, says supply consultant Jeff Thompson at Propane Resources.

“Since winter, the market has moved up 20 cents and then back down 10 cents from the May high. Retailers see this and do not see an urgency to come into the market and position,” he says. “The downside to this strategy is that everyone is doing it. When the market changes, retailers will be coming into the market hard to cover deals.”

Adjusting to reality

Several questions are under consideration in Minnesota, reports Roger Leider, executive director of the Minnesota Propane Association: “How cold will it be during winter? How wet will the fall weather be? When will we have the first freeze of fall? Those are the variables we always live with. I believe most marketers plan for the average winter and adjust to reality. I expect that will be the same this year.”

“Supply looks great,” says Deb Grooms, executive director of the Iowa Propane Gas Association. “I am hearing that corn will start coming out right after Labor Day, with some drying due to wet stocks that are rotting.”

Jaques at Plains Marketing says, “The best money is on a little early drying in September, then less than normal.”

Seeds were planted sooner in the season than usual; good growing conditions are driving good yields, yet with diminished overall values due to the increased volume; and “farmers are letting it dry in the field,” Jaques says.

Corn growers are likely to up their production by 11 percent over the 2015 harvest, according to the U.S. Department of Agriculture’s National Agricultural Statistics Service. The agency forecasts record-high yields in 10 of the largest corn-producing states, including Iowa, Illinois and Nebraska. A summer progress report shows that 76 percent of this year’s 15.2-billion-bushel crop is in good to excellent condition.

Jaques expects adequate propane supplies throughout the fall and winter.

“Enterprise MAPCO, Oneok, and NuStar terminals appear ready for the season,” he says. “Rail terminals continue to spring up in Iowa, Illinois and Minnesota, and production and rail from Canada helps supply the upper Midwest. Secondary storage continues to grow, as does tertiary storage.”

Securing contracts

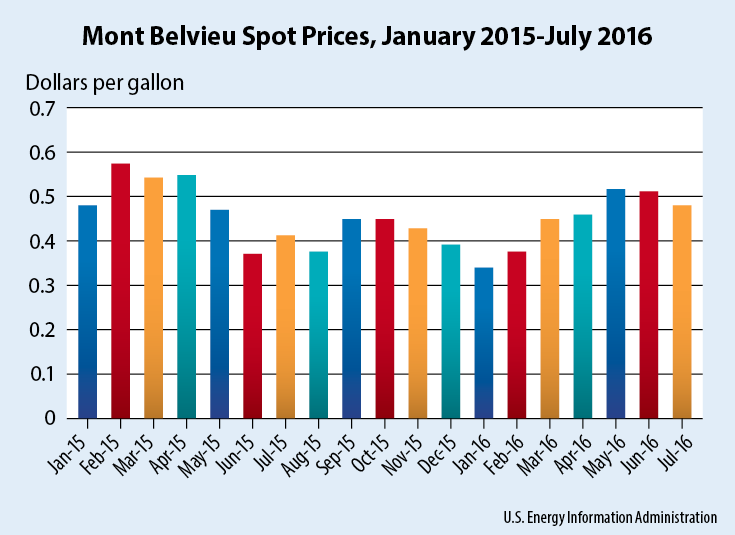

In early August, the Mont Belvieu spot price for propane was 44 cents per gallon, down from 48 cents in July when heating oil was selling at $1.29 per gallon, according to the U.S. Energy Information Administration.

Mont Belvieu spot prices dropped from May 2016 to July 2016, and they fell another 4 cents in August to 44 cents per gallon based on the latest data from the U.S. Energy Information Administration. Last year, spot prices at Mont Belvieu moved upward from August to September, and they held steady into October before dipping from November 2015 to January 2016.

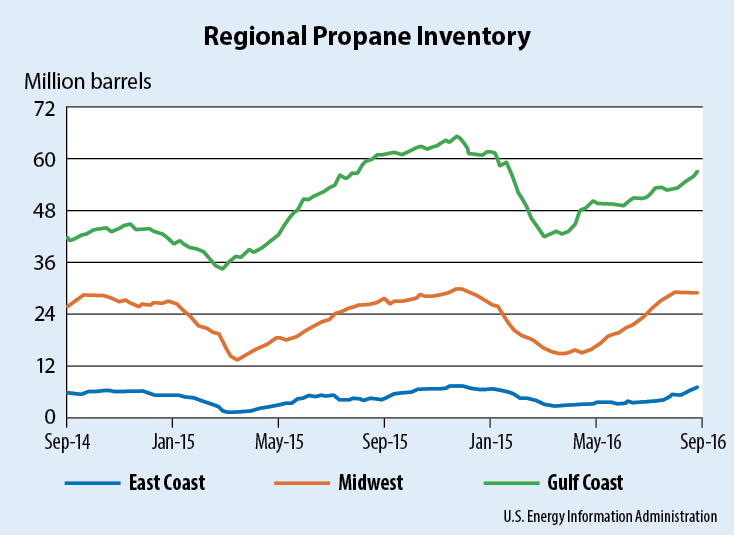

Overall domestic propane inventory increased to 91.9 million barrels, which was 1 percent lower than the same period in 2015. Propane inventory in 2015 soared to a record 106 million barrels in November. Even with such large inventory numbers, the industry is starting to realize that it’s operating in a new energy environment, with increased export capacity and petrochemical demand impacting the domestic market.

“We had a session on this topic [propylene and exports] during the KPGA convention this summer, and the jury is still out on this,” Griffin says. “I think it’s safe to say that the industry is changing and both these demands are having an impact on supply for the heating season. Propane marketers can’t just expect to have propane delivered when and where they need it at the drop of a hat like they used to. They must make sure to plan ahead and communicate with their supply chain reps.”

Griffin says the closing of the Todhunter, Ohio, terminal and storage facility hurt his dealers.

“But we’re excited about a new propane terminal getting ready to open in western Kentucky that will offer new supply options for Kentucky dealers and others in surrounding states,” Griffin adds.

At press time, propane inventory was tracking at a pace near last year’s record-setting inventory level. The nation’s inventory reached 106 million barrels in 2015.

A family business owned in part by KPGA President Shane Fortner, the Bluegrass West Terminal is scheduled to come online in September. Serving marketers throughout Kentucky, Tennessee, Illinois, Indiana and Missouri, “it will help alleviate some of the supply concerns,” Griffin says. “It’s an exciting development for us here in Kentucky and the region.”

The facility’s upcoming unveiling made front-page news in The Madisonville (Kentucky) Messenger. Capable of storing 360,000 gallons, five railcars can unload at a time, simultaneously filling two transports.

“Propane has always been distributed to retailers through a pipeline transport system that traveled from south to north, but those pipelines are changing,” Fortner explains to The Messenger’s Heather Scott. “The propane industry is turning toward railroads to fill the void of the pipeline, and we saw the need in the area for a rail-fed propane terminal for other marketers and retailers to use.”

Gulf Coast propane stocks are trending below last September’s level yet significantly above the level achieved in September 2014.

Rail terminals and additional retailer storage have helped replace the void left by propane pipeline reversals, and the Cochin Pipeline is no longer shipping propane, says Reid Simonett, a supply consultant at Propane Resources.

“The rail terminal situation has changed the propane distribution system drastically over the years,” he adds. “They have complemented the pipeline terminals, and in the case of the Cochin Pipeline replaced its propane volume in the Midwest. We have yet to have a harsh winter to see how they will stand up in the face of true winter demand, but we are encouraged.”

Rooftop competition

Bobtails, transports and drivers are ready to roll in with frost protection services if too much cold threatens California’s crops, according to Robert Jacobs, vice president of retail operations at Paso Robles-based Delta Liquid Energy.

“It was not a big event last year,” Jacobs says. “It’s weather driven, and you just can’t predict that.”

Residential accounts are remaining steady, but Jacobs expresses longer-term trepidation over a proliferation of solar panels.

“You see a lot of them on rooftops – there’s something to realize there,” he says.

“People are still maintaining propane appliances, too,” adds Jacobs, yet “maybe when they get their hot water heater replaced they’ll go with electric rather than propane because they’ve already made that investment.”

An up-top system to harness the sun can cost $15,000 to $25,000, and thus Jacobs says the potential does exist for people to eschew propane in favor of beamed-in electrical wattage.

“I’m concerned,” he says.

Another issue, emanating from Sacramento, California, is the state government’s policy of promoting grants and initiatives favoring widespread electrical conversions, including with vehicles. Delta has an accelerated autogas program and other applications traditionally within the nearly exclusive domain of petroleum products.

“The discretionary funds from government agencies are thinking more about electrifying things. That’s the way things have been moving,” says Jacobs, recalling previous industry-fought efforts to encourage electric forklifts at the expense of propane-powered units.

“They’ve gotten off that,” he adds, “but they’re driving more and more into electricity – a push away from carbon fuels. It appears that California wants to take away our carbon fuels. That’s a concern of ours for the future.”