5 yardsticks propane marketers use to scale profits

It has been over two years since the price of propane peaked around $1 a gallon. After a precipitous fall to under 30 cents a gallon as COVID-19 hit the U.S. a year ago, prices were back up to 88 cents a gallon early in 2021.

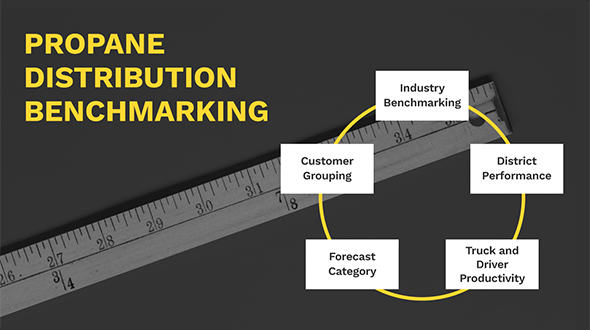

Technology enables the ability to benchmark performance and practice, both from within the company and across the entire propane industry. (Yardstick image: Ivelin/stock.adobe.com)

Yet, many propane marketers struggle to drive new profits – too often failing to capitalize on improved pricing, mainly due to their stalwart reliance on old methods. Handcuffing efforts to reduce costs and gain new efficiencies, they squander opportunities to perform better. Meanwhile, tech-savvy competitors widen the gap – and their client bases – with technology and insight that make outperforming traditional business models seem easy.

Industrial IoT (IIoT), specifically remote tank monitoring, has been providing propane marketers with information for years, such as how much fuel is left in a client’s tank.

Extrapolate that data across an entire client base of tanks, districts and regions, trucks and drivers – then start to ask the “what ifs” – and we enter the purview of advanced business intelligence, built specifically for fuel distribution profitability.

Would tank monitors drive a better fill rate? Where should they be placed? What impact would they have on out of gases, excess fills, costs or even my drivers’ sanity?

To help propane companies and LPG marketers assess their historical delivery costs, efficiency and quality of service – represented by out-of-gases frequency at a customer level – new capabilities are required of our industry’s tools.

By enabling in-depth “what if” analyses, marketers have been able to review any number of scenarios: improved fill rates across a geography or market by using tank monitors, for example. Or, analyzing how many drops, out of gases and associated costs would be saved and the impact on the number of trucks needed to deliver the same quantity of product using IIoT monitoring.

What has evolved is a unique platform for business transformation. It has become evident over time that a fundamental benefit of the right technology – available today – is that it enables the ability to benchmark performance and practice, both from within the company and across the entire industry.

Let us examine the five core benchmarking opportunities that this affords.

Industry benchmarking: In the competitive propane distribution business, technology that allows marketers to compare their performance against the industry and helps achieve best-in-class fill rates will become critical to building and maintaining a competitive advantage. Understanding how you compare to the industry is a key first step.

District (depot) benchmarking encourages improvement: Typically in propane distribution, each district is responsible for a fleet of trucks, drivers and storage to supply a discrete set of customers. The forecasting, ticketing and scheduling systems they use ultimately determine delivery timeliness and efficiency. Ranking districts by key performance indicators and assessing excess delivery cost by week, month, quarter and year is critical in identifying the most effective districts. When technology reveals significant differences, unexplained by customer density (miles/stop), it triggers dialogue; best practices sharing; informs technology and assets upgrade investment decisions; and encourages districts to improve.

Truck and driver benchmarking drives significant profitability impact: Truck productivity is one of the most significant factors in cost per drop – trucks representing a fixed and high replacement cost to the business. Understanding and narrowing the disparity between most- and least-used trucks must become an operational priority. Analyzing the utilization of trucks, by month, is a starting point for rethinking how these precious resources can be used most effectively.

Forecast category benchmarking, beyond K-factors: Comparing forecasting method effectiveness helps identify improvement opportunities in forecasting systems and in customer management. For example, the challenges of will-call customers often result in expensive deliveries. Having the ability to identify and then successfully move specific clients to automatic refills by using a tank monitor reduces a company’s delivery cost.

The effectiveness of K-factor analysis has shifted. Reviewing customer efficiency by K-factor setting, combined with degree-day data, has become less accurate. While reassessment of the K-factor settings is relatively simple, issues arise when usage changes. The account is rendered unforecastable. Tank monitoring becomes the obvious answer in these cases.

Customer benchmarking pinpoints profitability opportunities: In propane distribution, the data identifies groups of customers where the cost of delivery exceeds the contribution margin from gallons. Understanding profitability by customer group is key. Identifying groups that underperform offers the opportunity to address change, whether simply improving fill efficiency or changing the capacity at sites. Conversely, looking at profit and loss as an aggregate of all customers provides little to no opportunity for change.

Emerging stronger

By the time we emerge from this pandemic, those that have turned to advanced technology to gain deeper insight into their business and understand how they compare to the industry will have a leg up. They are also the most likely firms not just to emerge, but to emerge stronger than ever.

It is not too late to explore how advanced IIoT could help scale profits for your business.

Robert Battye is the senior vice president of customer and product strategy at Anova, the remote tank monitoring solution provider. He has more than 30 years’ consulting, project and executive management experience with global IT and service companies in Europe, the U.S. and Australia, working exclusively in propane.