Crude outlook more bearish, latest analysis shows

Crude analysts are surveyed each month concerning their outlook on crude prices. Those analysts work for huge investment houses and brokers that have large budgets for research and formulating price outlooks.

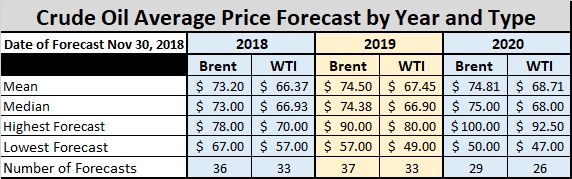

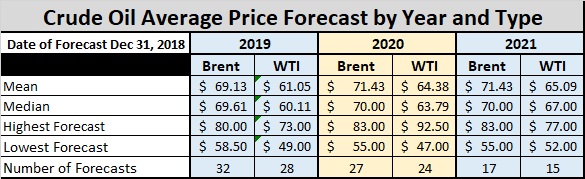

The table below shows the analysts’ combined outlooks for the end of November, followed by results from the last survey taken at the end of December.

The second table that includes the survey results from the end of December shows a significantly more bearish bias for crude for 2019. Analysts forecast Brent crude next year will average $69.13 per barrel, and WTI will average $61.05 per barrel. Analysts trimmed $4.07 per barrel from their Brent outlook and $5.32 per barrel from the WTI forecast between the November and December surveys.

That is the most dramatic one-month change we can recall since we began monitoring these surveys. Still, crude would have to move considerably higher than where it is now for traders to hit the revised average outlook.

The highest forecast for Brent in 2019 is $80 per barrel, which is up $2 from the last report. The high forecast for WTI is up $3 per barrel to $73. It was on the low forecasts where the big change occurred. The analysts’ lowest prediction is $58.50 for Brent and $49 for WTI in December, which are down $8.50 and $8, respectively, from the November estimates.

That survey of analysts was followed by a survey of U.S. energy industry executives. They predicted WTI crude to be at $60 per barrel by the end of the year.

As the month-to-month changes show, forecasts can change dramatically as new information becomes available to the market. The predictions for a higher crude price are backed up by the production cuts of 1.2 million barrels per day by major producers. Those cuts were implemented at the beginning of this month. The U.S. also provided 180-day exemptions to allow most of Iran’s crude customers to continue buying at least some crude from the Middle East country. Those exemptions will expire in May 2019.

The crude price forecasts could be too high if the global economy continues to tank, the U.S. again provides waivers to buy Iranian crude, and/or the crude output outside of Organization of the Petroleum Exporting Countries (OPEC) and its allies grows more than expected.

For now, propane price planning models probably should be based on $60 WTI crude by year’s end. Since the end of last winter, Mont Belvieu propane posted an average value at 57 percent of crude. If we assume the same relative valuation, Mont Belvieu propane would be trading around 81 cents next December.

Conway is much harder to predict. Right now, we might expect Conway prices to be beaten up again this summer, but recover as they did last year in the fall and early winter. Conway averaged 54 percent of crude in December 2018. If we assume the same for December 2019, Conway propane would be valued at 77 cents.

Those early estimates can guide short-term buying decisions for next winter. At the end of January, new crude price estimates will be released, which will require an adjustment on propane’s price forecast. We also will have to monitor propane fundamentals to see if relative valuation estimates used above remain appropriate.

If growth in propane supply looks as if it is outpacing growth in demand, we would lower the relative valuation for propane, and thus lower the price forecast for propane. On the other hand, if fundamentals for propane tighten, the opposite would take place. We would raise our relative valuation projections, thus raising the price forecast for propane.

Given the forecast for higher crude prices, taking some positions for next winter’s supply appear warranted. We also have some reservation about propane fundamentals being very supportive this coming year, so, regarding price protection, we initially would lean to the cautious side. We are more confident crude prices will recover than we are that propane’s relative valuation will hold.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.