Big draw on propane inventory keeps market bullish

Propane prices chart courtesy of Cost Management Solutions

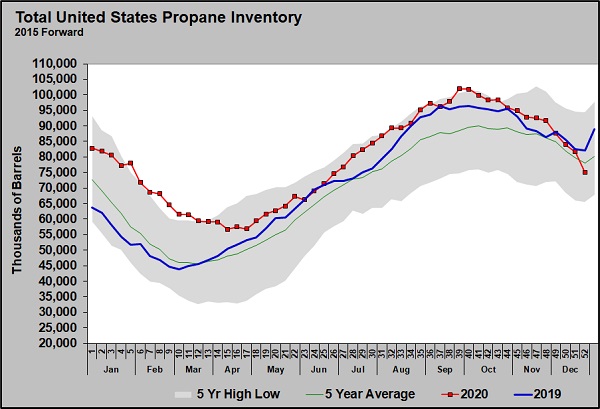

We build off last week’s Trader’s Corner with: “Despite ample inventories, U.S. propane prices have appreciated markedly this winter with most of the gain coming in the last few weeks.” Those inventories are less ample after the Energy Information Administration (EIA) reported a 6.450-million-barrel draw in U.S. propane inventory that left it at 75.146 million barrels.

Expectations were for a draw of 2.2 million barrels. The larger-than-expected decline suddenly left inventory that had generally run above last year and the five-year average well below those marks.

U.S. inventory is now 7.042 million barrels, or 8.6 percent, below last year. Keep in mind that inventory began the year more than 19 million barrels above where it had begun 2019. It is now 2.7 percent below the five-year average.

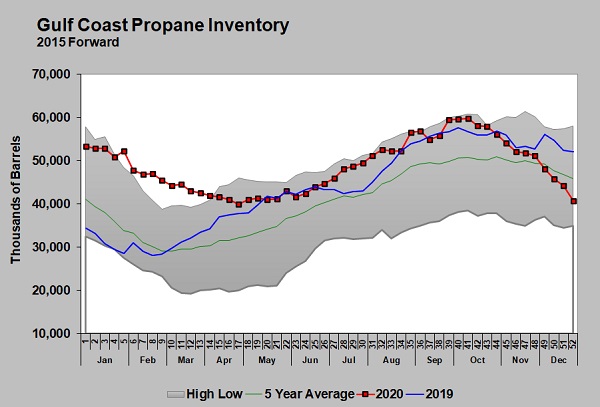

Gulf Coast inventory has been taking the bulk of the beating, with export demand extremely high.

Propane prices chart courtesy of Cost Management Solutions

Gulf Coast inventory now stands at 40.778 million barrels, down 11.399 million barrels, or 21.8 percent, from the same week last year. The latest EIA data was for the week ending Dec. 25, so there is almost another full week for inventory to potentially decline more.

During 2020, there were a lot of trend changes. The extremely rapid growth in propane supply slowed due to less natural gas production and less refinery throughput. Imports also dipped due to Canadian producers focusing their attention on supplying more lucrative Asian markets. U.S. propane consumption appears to have benefited significantly from pandemic-related shutdowns. Propane export volumes increased, especially during the winter months.

Propane inventories are still more than adequate, but the focus is on the trends. How will these trends change in 2021? The U.S. energy sector is in disarray due to the low price, low volume environment. To assume rapid increases in propane production in 2021 might be overly optimistic. There is plenty of fractionation capacity and we think plenty of y-grade (mixture of NGLs). Going into this slowdown in production, there was plenty of y-grade. In fact, a lot of storage caverns that used to hold specification finished products were being used to store the excess of y-grade. However, if natural gas production does not increase, then the y-grade surplus is likely to continue down.

Keep in mind a lot of the new natural gas production was coming as associated gas from predominantly crude-producing wells. U.S. crude production is 2.1 million bpd below its peak, and most are predicting a very slow recovery. U.S. liquefied petroleum gas exports are increasing rapidly, which will help make room for more natural gas production. We should look for more drilling for purely natural gas/natural gas liquids wells in 2021 as a result. That will help propane supply, but will it offset the lost propane production resulting from lower crude production?

We wouldn’t expect propane imports from Canada to improve in 2021. Instead, we would expect even less. Asian buyers backed off on commitments to Canadian producers in 2020, causing their inventories to build. But note that the excess was not forced into the lower-valued U.S. market. Canadian producers are counting on exports to Asia to dramatically improve in 2021, and there is no reason to doubt that expectation since the export market to Asia has been robust to close out 2020. We expect Canadian propane inventory to start declining again and not build as much next year.

U.S. exports are likely to remain strong for the same reason as Canada: strong Asian demand. There is a lot of new demand in Asia from propane dehydrogenation units. High prices could slow the export volumes, but the demand appears to be there.

We would expect the benefits of pandemic-related lockdowns on U.S. domestic propane demand will diminish in 2021. However, many are predicting that where we work may not go back to the way it was before the pandemic when the pandemic is under control. This last year has proven to a lot of companies that requiring workers to commute into a central business district every day is not necessary. As the move to go green continues to pick up steam, we would expect telecommuting to a higher degree is here to stay. Propane could continue to benefit from the trend well beyond the pandemic.

We will simply have to continue to closely monitor the trends in 2021 to anticipate how it will all play out. However, with crude prices expected to rise and the current trends in propane fundamentals, it is not hard to imagine a higher pricing environment that has developed in late 2020 maintaining itself in 2021.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.