Conway gains in value relative to Mont Belvieu

In general, propane prices have been on a strong upward run since the middle of September.

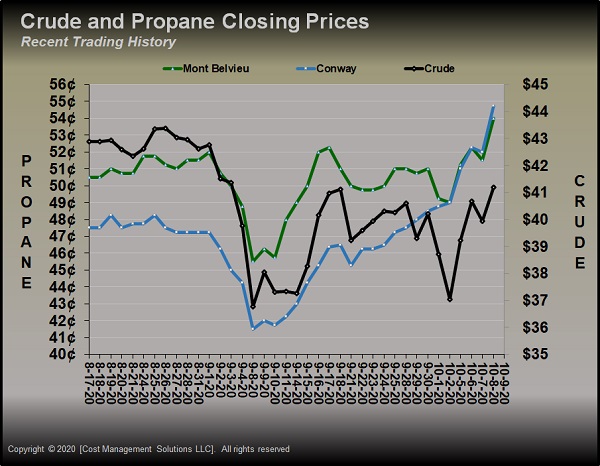

The chart shows the recent price history for Mont Belvieu LST propane, Conway propane and West Texas Intermediate (WTI) crude. All have been on a general uptrend over the last month, but Conway has been – by far – the strongest of the three. Mont Belvieu LST has been more sympathetic to crude through this movement, with Conway being far less so.

The rally in Conway has been very steady, whereas Mont Belvieu LST and crude’s move higher have been much choppier. That tells us that Conway has more fundamental support. During the rebound, crude has been up $4.43 per barrel, or 12 percent. Mont Belvieu LST has been stronger, again suggesting better fundamental support than crude is enjoying, with an 8.5-cent-per-gallon, or 18.68 percent, gain.

But it has been Conway that has really overachieved with a 13.25-cent, or 31.93 percent, increase in value.

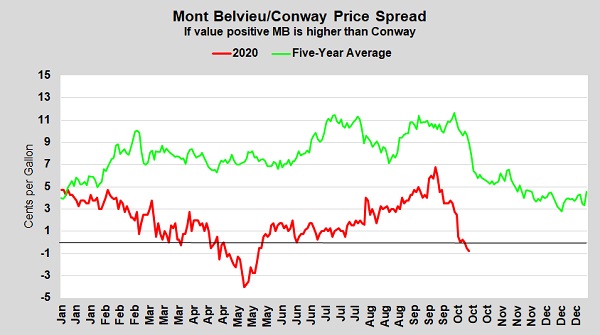

The chart plots the price difference or spread between Mont Belvieu LST propane and Conway propane. If the value is above the black line, Mont Belvieu LST is holding the premium or is higher valued than Conway. When the value is below the black line, Conway is valued higher.

The green line is the five-year average spread, and the red represents 2020. The first thing you notice is that, relative to Mont Belvieu LST, Conway has been valued higher this year than in the previous five years.

There are several key reasons for the change in relative value. First, the completion of the Mariner East pipeline system is allowing more propane to move out of the Marcellus and Utica shale plays to the east for export, or positioning it to move into the higher-valued U.S. Northeast market rather than west into the lower-valued Midwest market.

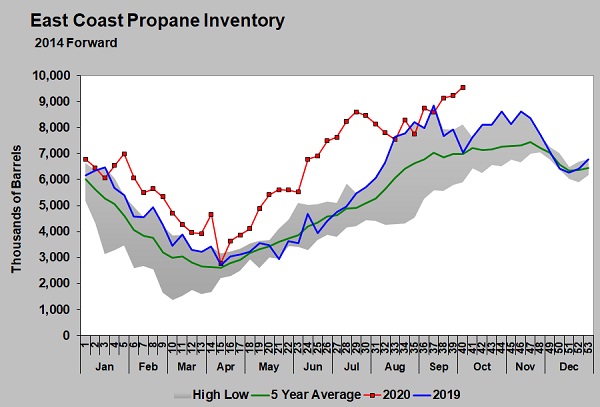

U.S. Midwest inventory is currently 469,000 barrels – or 1.7 percent – below last year. At the same time, East Coast inventory is 2.505 million barrels – or 35.6 percent – higher.

This year, East Coast inventory has set new five-year highs almost every week. The movement east is tightening supplies in the Midwest and has been an essential element in the spread between Conway and Mont Belvieu LST propane values moving closer together.

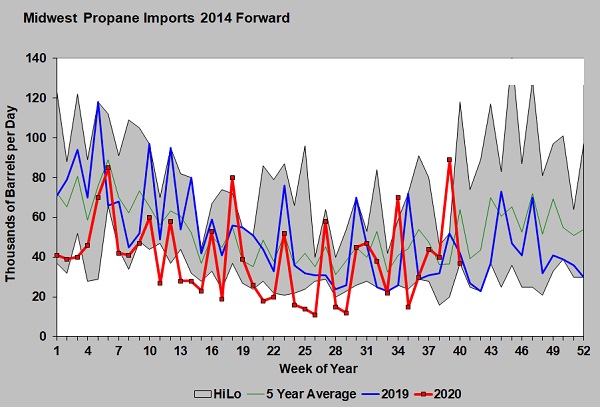

The second key factor has been more export options for Canadian producers to move their propane production. The U.S. Midwest is becoming the destination of last resort. Canadian producers began exporting propane by rail to Mexico a few years ago and, in the last two years, added the ability to ship waterborne exports to Asia.

As a result, since 2017, propane imports into the U.S. Midwest have been declining. In 2017, Midwest imports were 62,000 barrels per day (bpd); by 2019, they had dropped to 50,000 bpd, and this year, they have averaged 40,000 bpd. As the chart shows, there have been a lot of new five-year lows – actually all-time lows – set in many weeks this year.

If we compare year-to-date totals in 2017 to 2020, there is a difference of 18,000 bpd over the first 274 days of the year. That is the equivalent of 6,907 rail cars that were available in 2017 that have not been available this year. Midwest dealers that buy propane via rail out of Canada understand the significance of that reduction. Be aware that Canadian propane inventory is high. There could be product available at crunch time, but you can bet it won’t come at the fire sale prices of the past.

Finally, we also know that natural gas and crude production is lower because of lower demand due to COVID-19. Natural gas liquids, including propane, come from the production of both. Some traders think that crude production from the Bakken, which feeds the Midwest, may be one of the slowest to come back online due to higher lifting and transportation cost. That means the potential for higher crude prices, which could drive higher propane prices before that supply is available again. In addition, U.S. refinery throughput is still running 12 percent below where it was this time last year, limiting yet another propane supply source.

As we said last week, despite high inventory levels at the propane trading hubs currently, we remain concerned about the potential for local market supply shortages during high winter demand periods. The Energy Information Administration is estimating 5 percent more heating degree-days this winter. They are estimating 14 percent more propane demand due to a colder winter and the impacts of COVID-19-related quarantines. Propane price protection should be considered. Being aggressive in securing wet barrels, filling customer tanks and staying ahead of demand seems as important as ever.

Conway’s value relative to Mont Belvieu LST generally improves this time of year, but it got an early start this year, which could be simply because of early crop drying and an early bout of colder temperatures. After this seasonal demand flurry, things could level back out again. However, because of the analysis we have presented above, we fear it could be a harbinger for price pressure in the Midwest during any high-demand periods this winter.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.