Dissecting EIA’s latest report

This past Wednesday, the Energy Information Administration (EIA) released its Weekly Petroleum Status Report, showing data collected for the week ending Dec. 6. Propane prices were moving up just ahead of that report, but quickly reversed course once the data was released.

The EIA reported U.S. propane inventory increased 1.718 million barrels. It is very rare for inventory to increase in December. That magnitude of the build was truly an anomaly. The data also showed U.S. domestic demand tumbled 1.017 million barrels per day (bpd) to just 756,000 bpd. That was 1.241 million bpd less than the same week last year. It also didn’t seem to line up with the recent cold weather and heavy crop drying demand.

There were other data points that raise some curiosity, if not as shocking, as the demand collapse. U.S. propane exports jumped 699,000 bpd to an all-time high of 1.38 million bpd. Propane production surged 165,000 bpd to an all-time high of 2.423 million bpd. That put production 472,000 bpd higher than the same week last year. Propane supplies have certainly been rising rapidly, causing downward pressure on prices, but there hadn’t been anywhere near that kind of year-over-year increases to date.

to the latest move up in U.S. propane inventory.

Image: Cost Management Solutions

Propane demand is calculated by the EIA. They do not send out surveys or collect specific data on domestic propane demand. They collect data on inventories, production, imports and exports. With that data in hand, they calculate or imply domestic demand.

Concerning exports, the EIA told the industry customs data determines their export figure and not ship departures from loading facilities. It has been our assessment that if there are big swings higher in exports there are often big swings lower in domestic propane demand.

Due to the massive amount of data points across crude, distillates, gasoline and NGLs, the EIA encourages market participants to put more weight on the four-week rolling average reports. As good of sense as that makes, the market will remain fixated on the weekly data.

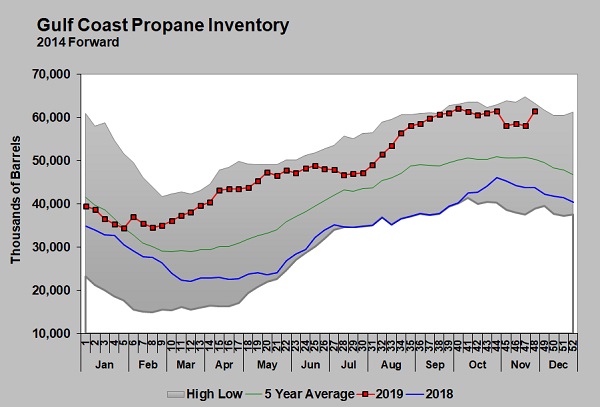

Looking at the chart above, three weeks ago there was an abnormal draw in propane inventories. By that afternoon, the market was up 5.7 percent in Belvieu and 4.5 percent in Conway as that set a bullish tone to the market.

An unusually large inventory build during the heart of winter usually creates a bearish bias in the marketplace. Last week was different in that prices stalled on Wednesday but were higher on Thursday. The market shaking off a bearish inventory report was noteworthy. Maybe the market took a hint from the EIA and looked at the last four weeks of activity.

IN CASE YOU MISSED IT

FERC OKs pipeline tariff changes to aid Midwest

propane needs

The Federal Energy Regulatory Commission (FERC) accepted two oil pipeline tariff amendments aimed at helping to move propane to the Midwest. Read more.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.