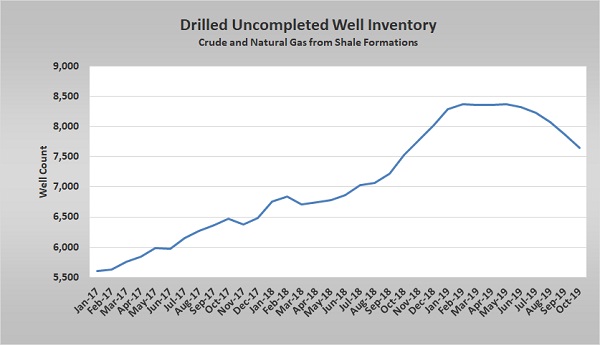

Drilled/uncompleted well inventory drops as drilling activity slows

After the British routed Rommel’s forces at Alamein, driving German troops out of Egypt and providing Britain with its first victory of World War II, Winston Churchill gave speeches concerning the event in late 1941 and early 1942. In those speeches, Churchill famously said, “Now is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”

Churchill’s words may be applicable to what is happening with drilled/uncompleted oil and natural gas wells in the United States. These wells are commonly known as DUC wells.

For years, producers in the United States have been drilling oil and gas wells faster than they could complete them. A drilled but uncompleted well, just as its name implies, has been bored but requires additional preparation to produce oil or gas. This can include running casing, cementing, perforating, gravel packing, stimulating and installing surface control systems.

With the aggressive drilling programs and the slower rates of completions, the number of DUCs increased to a high of 8,374 in May. Drilling activity for both oil and gas slowed dramatically in recent months. However, the production of both oil and gas continued to rise because of two reasons. New wells are initially producing more than older wells, meaning fewer are necessary to replace lost production. These improvements have come with increased experience in drilling and producing wells in shale formations that have resulted in better processes and improved technology. The production life of wells in shale formations is relatively short, requiring a high rate of replacement.

Production is also being maintained by completing DUCs and bringing them into production.

Since May, the inventory of DUCs has dropped by 732. Certainly, Churchill’s words would be appropriate here, as there is a long way to go before all of the inventory of DUCs is depleted, and there is no guarantee the decline will continue. Monitoring this trend is very important in perhaps getting ahead of a change in propane’s price trend.

Since more than 80 percent of propane supply comes from natural gas processing, increased natural gas supplies increase propane’s supply. Domestic propane demand isn’t growing significantly, so increased propane supply increases the pressure to export more propane to balance supply and demand. Without strong export volumes, propane inventory will grow and drive propane values lower, something the market experienced over the past year.

Crude drilling, and consequentially increased crude production, does very little to increase propane supply except for the associated natural gas that comes with producing a crude well. More crude production would increase propane supply if it were being refined in the United States. About 20 percent of propane supply comes from crude refining, with propane a byproduct of that process.

Instead, the excess crude production is being exported from, not refined in, the United States. For example, refinery throughput was 16.435 million barrels last week, which was 420,000 barrels per day less than the same week last year. Plus, refineries are trying to tweak their systems to make more propylene, which is higher value than propane. What makes crude production important to propane’s value is that propane gets its base value from crude, not natural gas. If crude is overproduced, then its value goes lower, and propane’s value generally follows.

Increased natural gas production drives down propane’s value. Overproduction of crude has driven down crude’s value, which also lowers the base value for propane. We can look at it as a two-part process. When crude’s price falls, it brings down propane values. When propane production is excessive due to too much natural gas production, it drives down propane’s value relative to crude.

Inversely, if natural gas production falls, propane’s value to crude will increase. If crude production decreases, its value will improve and pull propane values higher with it. That is why monitoring DUCs is so important. If the trend above continues, we will eventually see a reduction in growth of both natural gas and crude production and likely a corresponding increase in propane’s value. And once the inventory of DUCs is exhausted, if drilling does not start to rise again, natural gas and crude supplies could actually start to decline.

Again, it is just the beginning of the possible longer-term decline of DUCs and U.S. energy production. There is still a long way to go and a lot of uncertainty. Churchill was trying to give hope to those with whom he was speaking that the fortunes of the war might be changing. His listeners experienced nothing but defeat and disappointment, but the turn in the war in Africa with the victory at Alamein gave hope that the future might be different on other fronts as well.

This analysis is not so noble as trying to give hope to a downtrodden people, unless perhaps you are a producer. It is more of a heads-up for the buyers of propane that the future might be different from the recent past concerning energy values if the reduction in DUC wells continues.

With that, we tip our top hat to you, draw a satisfying puff of our cigar and bid you a good day with a twinkle in our eye.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.