Growth in US propane supply exceeding demand

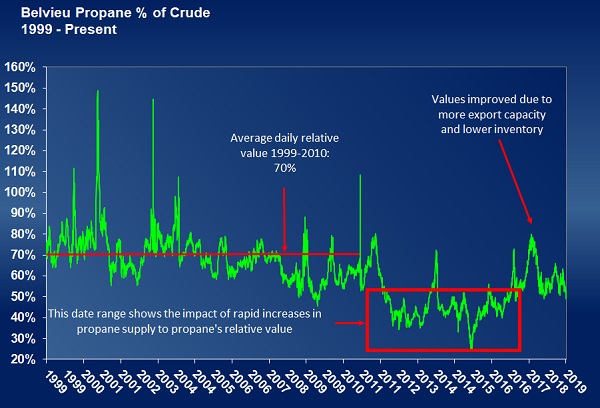

Propane’s relative value to WTI crude has been falling this year. Comparing propane’s value to crude’s value is an excellent way to determine the strength or weakness of propane fundamentals.

There were ultra-low propane values in 2015. That year, propane production greatly outpaced propane export expansions. Propane inventory reached a staggering 106.2 million barrels. Mont Belvieu propane’s relative value to crude averaged 40 percent, and recorded a low of 24 percent. The culmination of declining propane values began in 2011.

In 2016, the inventory build and corresponding declines in relative value ended. Still, inventory reached a high of 104 million barrels. The low relative value was 40 percent, and the year average was 47 percent. Even though inventory didn’t decline much, export capacity kept up with production, which placed upward pressure on prices.

In 2017, export expansion impacted propane inventories and price. Propane inventories reached 82.183 million barrels. Propane’s relative value to crude increased to an average of 63 percent, and the low was 48 percent.

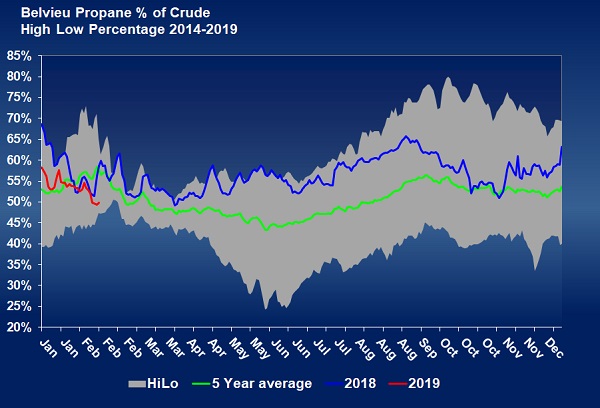

In 2018, the pendulum began to swing back in the other direction. U.S. growth in propane supply was once again overwhelming demand. Inventory reached a high of 84.528 million barrels. The result was an erosion in propane’s relative value.

The average relative value for 2018 declined to 57 percent. The low, 49 percent, was 1 percent higher than in 2017. The high relative value reflected the changing tide between propane supply and demand. The high relative value in 2017 was 80 percent, but only reached 69 percent in 2018.

At this point in 2019, propane inventory is about 12.5 million barrels more than it was at the same point last year. Propane’s relative value is averaging 54 percent. The low was 49 percent, and the high is 58 percent. Those values show growth in supply is exceeding growth in demand.

From what we can see now, the pendulum is likely to continue to swing in this direction for the foreseeable future. Drilling for natural gas remains equal to last year, so we would expect propane supply to remain robust. New export capacity is not slated to be online until the last quarter of the year, as far as we know. Even then, is it possible the world may not take all that we are capable of exporting? Is it possible U.S. exports are hitting a saturation point? Could there be logistical limitation, such as not enough available shipping assets – even if export capacity increases?

What is not in question is the need to monitor growth in propane supply versus growth in propane exports this summer. That will guide decisions on positioning for next winter’s price protection.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.