Heating season delivers steady US propane market, global uncertainty

As the winter heating season shifted into the warmth of spring, a chilling sense of international uncertainty and foreboding was taking hold over the propane market.

With the Russian invasion setting off war in Ukraine, it remained unclear if the conflict would spread beyond the country’s borders and into other European nations.

Russia’s invasion of Ukraine occurred near the end of the winter heating season, adding to market volatility. (Photo: sandsun/iStock / Getty Images Plus/Getty Images)

Along with the loss of life reported daily, fears were arising over the widespread infrastructural devastation inflicted by Russian bombs and artillery, bringing the possibility of long-lasting disruptions in worldwide fuel supplies, including propane.

“It has generated a great deal of volatility on the market,” says JD Buss, president of Twin Feathers Consulting, based in Overland Park, Kansas, “and the volatility is having a greater impact on people preparing for the next heating season.”

Stephen Kossuth, chairman of the National Propane Gas Association’s (NPGA) Propane Supply and Logistics Committee, observes that volatility in the propane market has been on the rise in response to the events roiling in Ukraine.

“The unprovoked Russian invasion initially sent energy prices soaring while stock prices softened,” Kossuth says. In the first week of March, he reports, Europe’s natural gas spot pricing hit levels more than 2,000 percent higher than its trading levels in all of 2021.

As the markets grappled with uncertainty, and “clarity and reflection” were starting to take hold, one fact has come into focus, according to Kossuth: “Despite prevailing desires to cease trade and place sanctions on Russia’s energy exports, Europe needs Russia’s energy production and Russia needs Europe’s energy demand.”

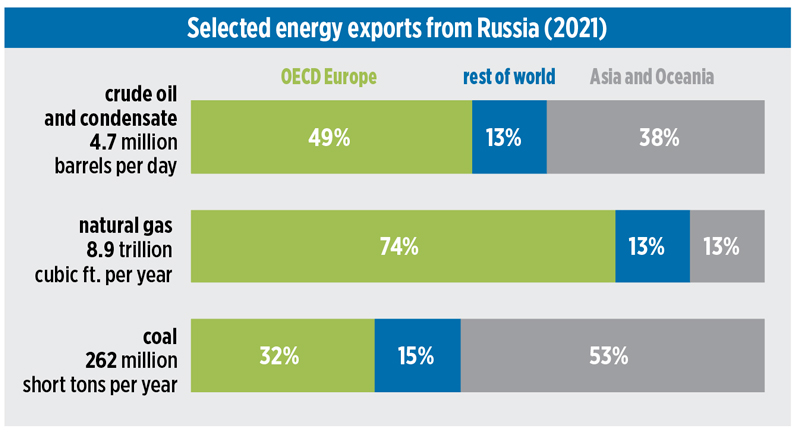

Russia supplies 40 percent of Europe’s natural gas load for heating and power generation; thus, a divorce from each other would have disastrous economic consequences for both, says Kossuth, who additionally serves as vice president of global LPG supply at UGI Corp., AmeriGas’ parent company.

“The spikes for LPG pricing were likely muted due to Europe’s ability to import western waterborne product,” Kossuth explains. “As the market relaxes, we are not out of the woods yet, and we will have to watch the conflict” as it unfolds.

Attention is being paid to the NATO territories, “as any Russian aggression here would escalate the conflict considerably. However, all of this pales in comparison to the real human tragedy; our thoughts, support and hope for peace are with the Ukrainian people as they face their aggressor,” Kossuth says. “Their courage and example to the rest of the world is nothing short of inspiring.”

The ultimate impact in the U.S. pertaining to the Russian invasion of Ukraine is yet to be seen, says Greg Noll, executive vice president at the Propane Marketers Association of Kansas, but the short-term result has been “skyrocketing prices of fuel because of the uncertainty. It’s not good for our industry and it’s certainly not good for our country.”

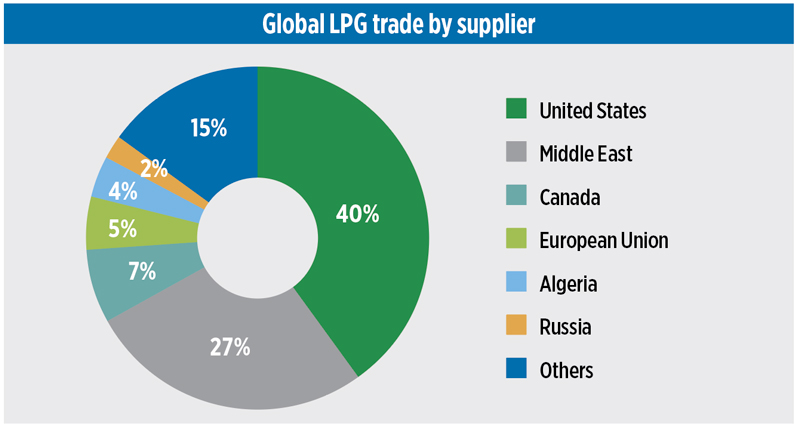

The United States, which exports about twice as much propane as it consumes, controls global LPG trade. Most of Russia’s supply is consumed domestically, S&P Global reports. (Source: S&P Global)

Supply chain expert Thomas O’Brien, executive director of the Center for International Trade and Transportation at California State University in Long Beach, explains that in relation to the war in Ukraine “we are not going to be as affected dramatically in the short term as our European partners because of changes to the oil and gas supply chain, but we’ll be affected [in some fashion] because when you remove product from the market it is going to impact pricing – and that impacts the cost of fuel for the people who move it as well.”

When he looks ahead, O’Brien says: “I’m starting to hear more people talk about a return to normalcy in terms of traditional cargo volumes. People who hadn’t been putting a date on it are starting to talk about coming out of the dark tunnel. [But] the war puts more uncertainty into the supply chain just when it was needed least.”

Successful seasonal outcome

As an industry, the U.S. propane sector weathered this past winter’s challenges well, Kossuth says.

The NPGA was able to work effectively with regulators at the Federal Motor Carrier Safety Administration (FMCSA) when acute driver shortages associated with surging post-Christmas cases of COVID-19 plagued the industry, says Kossuth.

A most-welcome granting of hours of service (HOS) waivers at the federal level “allowed the extremely dedicated drivers of our industry the ability to work more hours per week to appropriately compensate for the increased driver vacancies. Gratitude belongs to these men and women for placing our customers’ needs first and keeping the gas moving,” Kossuth says.

“Gratitude also belongs to the NPGA and the FMCSA as their proactive efforts enabled the industry to avoid significant out-of-gas events. Advocacy, education and partnership with regulators are at the center of this successful outcome,” he says.

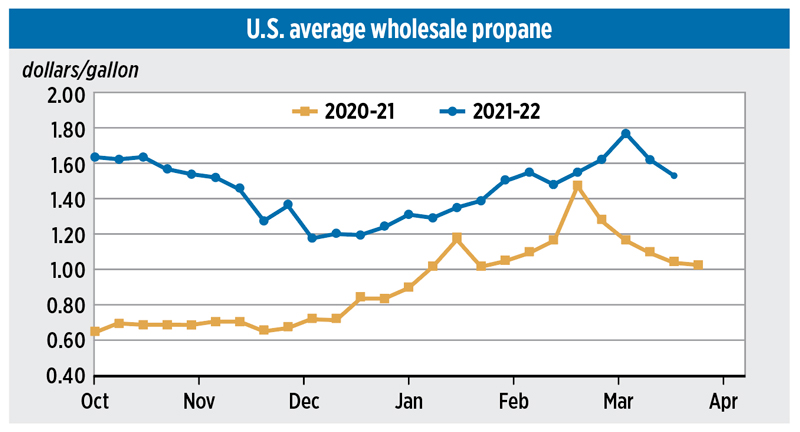

The market has had a relatively wide range of index pricing this past year, according to Kossuth. Since July 23, 2021, Mont Belvieu consistently closed higher than $1 per gallon for all but six days (as of March 16 of this year).

Prior to that date, you would have to reach back to October 2018 to see prices above $1 per gallon. As North America increased its production of propane, says Kossuth, waterborne exports became the balancing mechanism for an oversupplied market.

In 2021, Russia was the largest natural gas exporting country in the world, the second-largest crude oil and condensate exporter and the third-largest coal exporter. (Source: Graph by the U.S. Energy Information Administration, based on Russia’s export statistics and partner country import statistics published by Global Trade Tracker)

Currently the U.S. exports about twice as much propane as it consumes throughout the domestic residential and commercial propane industry.

“We truly have become a global market,” he says.

“Global market demands of the pandemic, the world’s recovery, the petrochemical business in Asia and recent geopolitical events in Ukraine are all considerations that now influence prices here at home. That said, exports are not all bad,” according to Kossuth.

The exports are necessary “to clear the market” and ensure that the U.S. has the most secure production of propane at a value that is generally less than pricing around the globe.

“Despite being at relatively low inventory levels, the U.S. is still exporting at positive arbitrage values to Europe and Asia,” Kossuth says. “Given the increases in daily production in the United States and relatively flat domestic demand over the same time period, perhaps inventory levels are less relevant than they were a mere five to 10 years ago.”

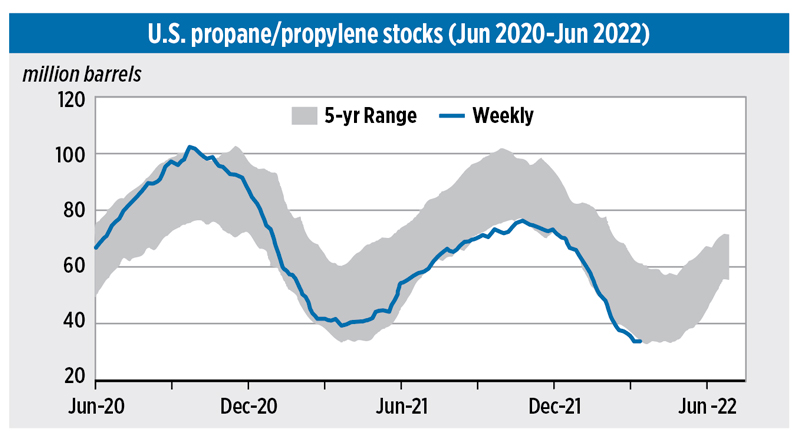

With inventory still an important indicator for consideration, he adds, the industry performed well this winter despite the inventory peak not reaching the historically focused watermark of 80 million barrels; 2021’s inventory build was the lowest level since 2013, which amounted to about 68 million barrels, he notes.

When bottlenecks did break out, attributed mostly to driver vacancies associated with the pandemic, “the industry worked through the NPGA to address this challenge head-on,” Kossuth reports.

The NPGA’s Propane Supply and Logistics Committee met monthly from September onward to keep an open line of communication and information-sharing among the membership, and when concerns arose “the NPGA had a bias for advocacy and action,” Kossuth says.

Prepared and determined

Dennis Halverson, propane product manager for Washington-based Christensen Inc., says the Pacific Northwest winter was mild overall, though supply issues persisted.

“Supply was tough this year,” he says. “With COVID, the railroads weren’t working, so we had times that it was a real bear to get rail cars into our sites.”

With railroad lines lacking adequate manpower, Halverson says, other suppliers faced similar challenges.

“Not only did it affect us – it affected them too because they weren’t getting their rail cars either,” he adds. “It wasn’t like we could run to a loading rack and get a load of propane.”

Scott Levene, office operations manager at Levco Oil & Propane in Trumbull, Connecticut, notes the price of oil almost doubled in a week and the cost of propane rose 40 percent per month over a two-month period.

“We had the tough conversations with the customers,” he recounts, pointing out to unhappy and skeptical patrons that “we’re not making any more money because our prices are going up, too.”

Fortunately, Levene says, most customers “were able to leave the conversations satisfied” with the explanations.

As a third-generation family business that had specialized in fuel oil before adding propane to the product mix a year ago, “we did a very good job of planning in advance” to better handle the reactions to propane’s rising price.

Sources say the industry performed well this winter despite the 2021 propane inventory build measuring the lowest since 2013, which amounted to about 68 million barrels. (Source: U.S. Energy Information Administration)

Identifying opportunities

Temperatures were mainly above average in central Virginia, but in January the mercury plummeted from 64 degrees on one day to 24 degrees the next – accompanied by 11 in. of snow.

“This storm also hit following two back-to-back holiday weekends,” recalls Nicole Sullivan, senior vice president at Anderson Propane Service and past president of the Virginia Propane Gas Association. “All of these factors coalesced into an extremely challenging time, but also an incredible opportunity for the prepared and determined.”

It did not work out well for travelers on Interstate 95 who were stuck for 24-plus hours.

“What made this storm particularly problematic was the weight of the snow, which caused significant power line and tree damage resulting in massive, sustained power outages,” Sullivan says.

Some residents were without electricity for a week as temperatures continued to drop. Customers with propane-powered generators brought an unexpected increase in LPG demand during January – the area’s peak winter month of load under normal circumstances.

The Anderson office was without internet service and electrical power for almost a week, and only three employees had electricity and internet at their homes. In addition, many cell towers were down, so communicating with essential staff presented extra challenges.

“Our staff in all sorts of roles – including management – answered the phones, took care of the mail, pulled the hoses for injured drivers and installed tank monitors along with other hands-on tasks,” says Sullivan.

Sullivan observes that “it is also hugely important to debrief [the entire staff] after these kinds of events to assess what you could do differently, more of, less of. This storm allowed us to identify opportunities that arise in challenges so that we can leverage them to be better tomorrow. The best thing the industry and Anderson can do is to communicate very openly and often with all of your suppliers. Poor communication can harm your business, and effective communication gives you a huge advantage.”

Challenging market structure

Jeff Pinter, executive vice president of NGL liquids at NGL Energy Partners, is succinct when applying a supplier’s perspective to the winter of 2021-22: “To sum it up in one word: volatility.”

The main pricing hubs climbed rapidly in the late summer and fall, he reports, then dropped at an even faster rate upon a warmer start to the winter. Pricing climbed back up in late winter as the Russian invasion impacted Europe and elsewhere.

“Volatility can make it very challenging for retailers, customers and suppliers to manage their business effectively,” Pinter notes.

The upcoming year is set to present another challenging market structure, “so it is important for customers to ensure that they contract with reliable propane suppliers focused on the physical barrels to protect them from any logistical or transport issues,” Pinter points out. “Price is important, but reliability and dependability are far more crucial in these volatile times.”

The trucking business

Transportation firms help to ensure the reliable distribution of products, but they are having to overcome the shock of rising fuel prices.

“We’ve never had the fuel price this high,” says Henry S. Papiano, president of C Three Logistics, headquartered in Newfield, New Jersey.

He expresses confidence while assuring his concerned diesel-using transport industry colleagues that diesel’s costs will eventually come down to a more manageable level.

“I’m not one to panic,” he adds. “Every season presents its own challenges.”

High international demand and low global supply have contributed to higher propane prices in 2021 and 2022, the U.S. Energy Information Administration says. (Source: U.S. Energy Information Administration)

Among the troubles faced by truckers is a pattern of increased breakdowns and a higher number of out-of-service rigs.

“People are holding onto their vehicles longer than they want to,” Papiano says about a situation made more problematic by supply chain issues culminating in fewer replacement components available across industries. Procuring computer chips for vehicle functionality has been particularly difficult.

Delivery delays caused by a lack of replacement parts and drivers out sick because of COVID were disadvantageous for trucking firms during the winter months, according to Papiano, who additionally serves as president of the New Jersey Propane Gas Association.

“I strongly suggest that everyone be tied in with your local association,” he says, citing the many benefits that can be gained by such affiliations.

Different aspects of the propane and trucking businesses are constantly changing, Papiano says, emphasizing the benefits of communicating often and forthrightly with customers.

Being upfront and on top of situations was key for maneuvering through the delays and other issues.

“I spent a lot of energy and money on building communication,” he notes. “We had to know our customers’ businesses as well as they did. We did a lot of planning and forecasting with our customers this year.”