How to manage propane price uncertainty

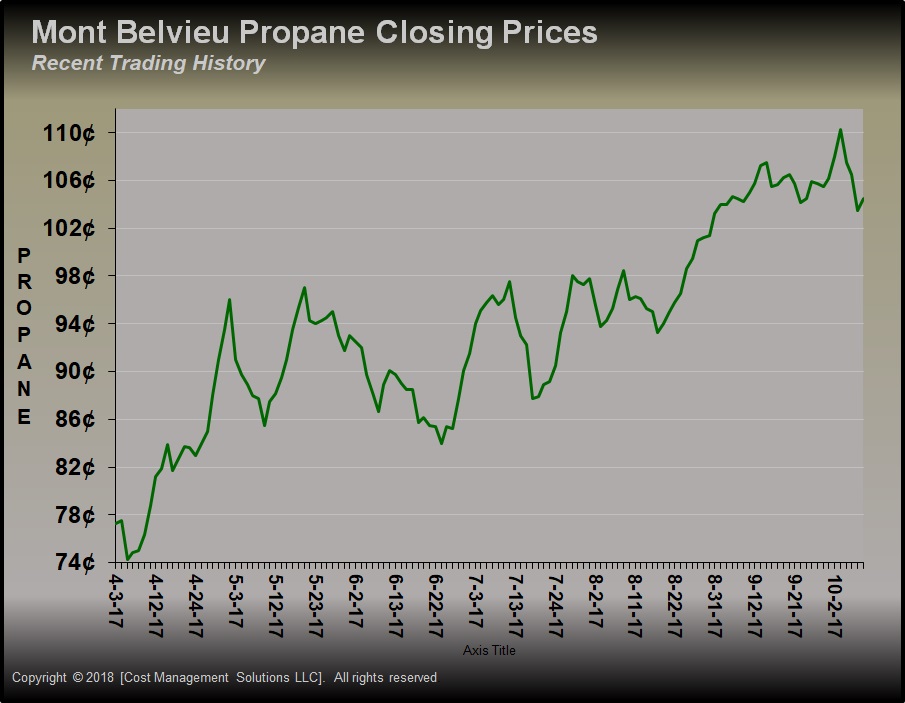

Last week, Mont Belvieu LST (MB) propane prices experienced the first significant downward move since mid-August, dropping 6.75 cents Oct. 2-4. The pullback came after MB set a new high for the year at 110.25 cents on Oct. 1. Prices recovered somewhat on Friday.

MB propane was on a general uptrend all summer with periods of downward movement. For the most part, the downward moves were associated with falls in crude prices. As we have pointed out several times, all of the upward movement in propane prices this summer can be directly related to the rising crude prices.

The downward move this week could be based on inventory data from the Energy Information Administration (EIA).

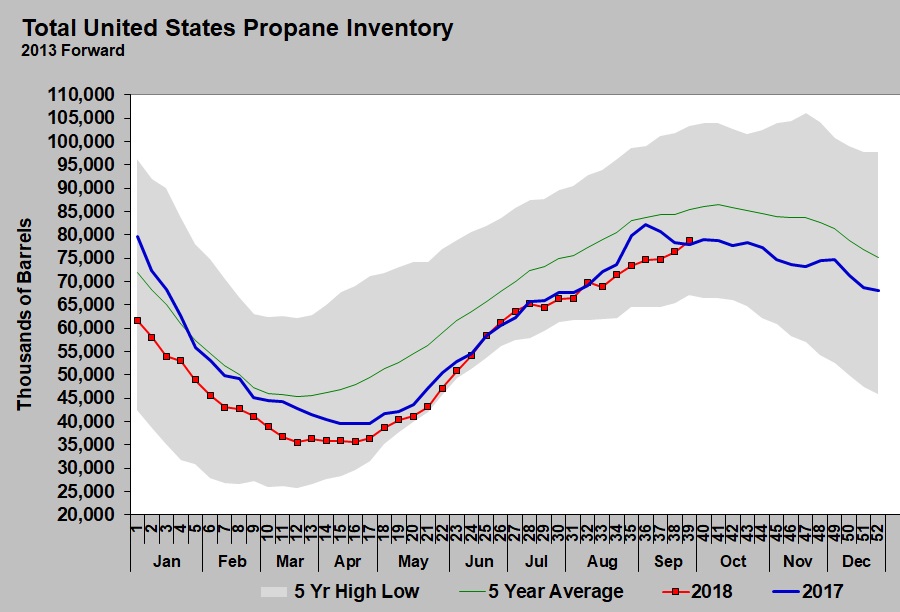

Industry analysts were expecting a 1.3-million-barrel build in U.S. propane inventory for the week ending Sept. 28. The EIA reported a 2.364-million-barrel build – more than a million barrels higher than that estimate. Over the last five years, inventory only averaged a 959,000-barrel increase during the week reported. The build pushed U.S. inventory to a slightly higher number than where it was during the same week last year. Traders know that same level of inventory was enough to get through last year.

Traders are wondering how much of that inventory is consumer-grade propane. Over the last couple months, too much of the propane was still in a natural gas liquids (NGL) mix, called Y-grade, and needed to be fractionated. Traders wonder if reported inventory levels really matter if the propane isn’t in a form that can meet demand.

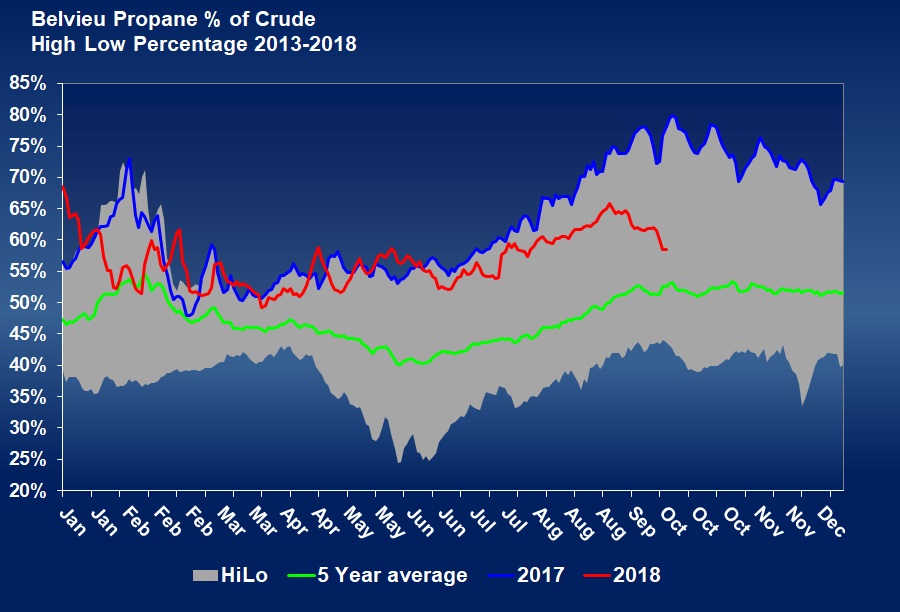

The issue creating the lack of purity, or consumer-grade propane, is said to be a lack of fractionation capacity. An analysis on fractionation capacity indicates there isn’t enough to handle rising NGL production. What we have not been able to come terms with, however, is why this tightness is not being reflected in propane’s price.

If there is a problem getting enough propane, it is expected its value relative to crude would raise higher, but as the chart above shows, it actually is falling. If the market were truly worried about supply, we do not think crude prices would be falling.

Propane prices beyond December are in backwardation, which means the price for propane in January is cheaper than December, February is cheaper than January, and so on. When a commodity’s price structure is in backwardation, it generally is indicative of a well-supplied market. The price structure does not reveal concern about getting supply in the heart of winter, or later in the winter when inventory would be at the lowest.

We conclude traders are confident propane exports will drop again this winter, as they did last winter. A significant drop in export demand would resolve the lack of fractionation capacity since there is plenty of capacity to meet domestic demand and less robust export demand. This week, one trader told us he was already seeing some softening in Asian demand for U.S. propane. Industry data also showed final September exports were lower than early September estimates. October estimates are starting lower than September’s. There is not enough evidence to conclude high export demand will not be a problem later this winter, but it is at least providing some explanation of why propane’s relative value to WTI crude is not increasing, and why its futures prices are in backwardation.

It still appears higher crude prices, not propane fundamentals, present the highest upside risk for propane prices. Crude is well supported by worries U.S. sanctions against Iran will take more crude off the global markets than other producers can replace. Crude reached a new high for the year on Oct. 3 at $76.41, due to the fears surrounding supply. But in a report to clients Friday, commodities broker Goldman Sachs said it believes crude supply will be slightly more than demand in early 2019. Crude traders have been betting heavily the opposite will be the case. In fact, a report showed a sharp increase this past week in the demand for $100 December call options for WTI crude. Those are essentially a bet that WTI crude will reach $100 per barrel by December.

Opinions like that of Goldman Sachs could cause short term profit taking, but it is hard to imagine crude taking a major dive anytime soon. To us, this all means that the pullback in propane could be a buying opportunity to those finding themselves in really short price protection at this point. Those that feel adequately covered should probably not add to their positions, nor should they sell/close positions due to upside risk.

We like taking shorter-term positions of one to two months protection. We also like call options with so much uncertainty. They give us upside price protection, but allow us to move our market price lower if the bottom falls out. Options can be pricy, but if we limit them to cover the next month or two the premium can be manageable.

If a retailer takes longer-term positions in the midst of this uncertainty, they should be vigilant in watching two things. The first is the news concerning crude. Look for signs that traders are becoming less worried about the impacts of U.S. sanctions on Iran. If that develops, consider exiting longer-term positions taken at this price point. Also, monitor U.S. propane export volumes. If those start falling off as they did at the end of November last year, guard against a similar fall in propane prices in the second half of winter. Should these conditions not develop, we would expect positions already owned – and even those bought on this pullback – to be relatively safe.

The new paradigm is exports are the key fundamental factor in determining propane valuations. With so much production, if exports aren’t there, prices will move lower – and possibly sharply lower. If exports remain robust, retailers could find themselves competing in a high price environment for supply. Export demand can switch on and off fairly quickly, which makes propane price risk management all the more challenging. Adding in all the economic and geopolitical uncertainty surrounding crude multiplies those challenges.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.