Locking in for the winter heating season

Marketers preparing for the winter heating season are becoming more mindful of propane’s status as a global commodity, as overseas events are playing a larger role in domestic supply and demand scenarios than in the past.

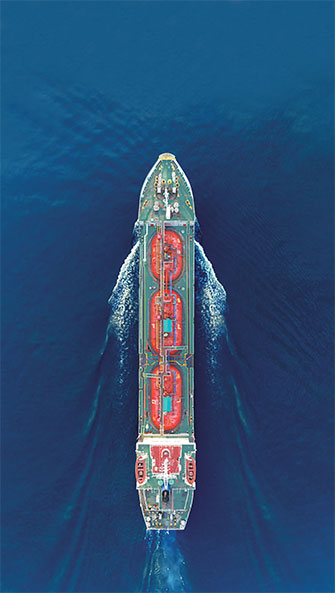

Photo: iStock.com/Suriyapong Thongsawang

However, the marketplace does seem to be proceeding under the assumption that enough propane will be available, notwithstanding the possibility of pressures from a potentially robust export market; a more-fertile-than-usual crop drying season; extra-high demand should extra-low temperatures occur; and, of course, the typical logistical challenges of ensuring that enough propane ends up in the end user’s tank in a timely manner.

Also on the radar, though its impact on propane has yet to be fully determined, is a possible disruption – or even an increase – in the levels of fuel varieties produced by worldwide refineries as they focus on fulfilling a rush toward very low sulfur fuel oil (VLSFO) for ocean-going freighters.

New “bunker fuel” standards

Beginning on New Year’s Day, per a ruling by the United Nations’ International Maritime Organization (IMO), fuel consumed by large ships must have a sulfur content of 0.5 percent or less, down from the existing 3.5 percent standard.

The term “bunker fuel,” originating from steamship days when coal was king, applies to any type of fuel grade used by a big ship. Maria Gallucci, a science and marine energy journalist, notes that cargo ship exhausts have long been significant sources of global air pollution.

“Pitch black and thick as molasses, bunker fuel is made from the dregs of the refining process,” Gallucci explains. “It’s also loaded with sulfur – the chemical that, when burned, produces noxious gases and fine particles that can harm human health and the environment, especially along highly trafficked areas.”

Marine vessels account for about 4 percent of worldwide oil demand, and shipping lines and refiners are ramping up to meet the new bunker fuel standards.

“The decisions refiners and shippers make in response to the IMO 2020 rules heavily influence one another, adding to uncertainty and complexity,” says analyst Mason Hamilton at the U.S. Energy Information Administration. The changes “have implications for vessel operators, refiners and global oil markets: Stakeholders will respond to these regulations in different ways, increasing uncertainty for crude oil and petroleum product price formation in both the short and long term.”

Global events are playing a larger role in shaping domestic supply and demand conditions. Photo by Brian Richesson

The effect of this policy on propane markets is therefore uncertain and hard to predict.

Eric Kuhle at ICF thinks impacts will be minimal. “ICF does not necessarily see an immediate large impact to LPG demand from the marine sector. There is a possibility that if there is a large impact to diesel prices that this would incent refiners to produce more diesel at the expense of gasoline, which might reduce refiner propane yield somewhat. This would be a pretty indirect impact, however, and would likely be lost in other more influential market impacts.”

Tim Danze, hedging manager at MFA Oil Co., believes increased diesel production will likely result in higher propane production.

“I think it is fair to say that if refiners are working to make more diesel in preparation for the IMO 2020 deadline, there should be some additional propane gallons produced as part of this process,” he says.

Refiners may be altering their fuel selection choices while concentrating on heightened VLSFO output, but in the view of DD Alexander – president of Global Gas Inc. and member of the National Propane Gas Association’s Propane Supply & Logistics Committee and Propane Supply Task Force – the ramifications are probably not “enough to raise the needle” regarding domestic propane availability because “the majority of propane comes from natural gas,” not oil refineries.

Locking in prices

Back on dry land, retailers should be cautious of a cold winter and how the export market could affect the Northeast differently than in the past.

Filling customers’ tanks before the cold strikes avoids potential supply and pricing issues. Photo: iStock.com/RickSause

“We believe propane inventories will be brought down due to exports – how fast will be determined by export economics, crop drying and domestic winter demand,” Alexander says.

“In today’s export world, inventory needs to be a lot higher,” she continues. “Our inventory can disappear significantly faster with the export markets. Pricing will be based on crude prices and how much of our inventory we go through and when; you will see the price of propane relative to crude go up as our inventories go down.”

Alexander reports that more marketers are buying fixed pricing to prepare for this winter compared to the past few years because they believe the potential benefits are greater than the risks.

“Our saying has always been ‘buy what you sell and sell what you buy’ when it comes to locked-in pricing,” she says. “However, at these low prices, and low relative prices to crude, it may make sense for a marketer to buy another 10 to 20 percent of their overall winter gallons at this point, depending on their market.”

Winter volume contracts in the Northeast have also increased due to uncertainty about how the Mariner East and Mariner East 2 pipelines will operate this winter. It’s the first full winter both pipelines are online, explains Alexander.

Even though additional railcars and trucks will be available to move gas now that the pipelines are running, a cold winter and strong production growth could “eat into the availability of railcars and trucks,” says Alexander.

She advises that retailers secure volume contracts going into winter and establish good relationships with their suppliers and transporters to prepare for the cold. She also suggests filling customers’ storage now to avoid the possibility of supply constraints and higher prices during the winter.

Nevertheless, propane supply is expected to remain abundant year-round.

“At this point, unless we have a very cold winter and exports are strong, our supply of propane should be in good shape,” says Danze. “I expect current inventory levels will keep prices in a reasonable range until and unless strong demand materializes.”

But like other energy sources, such as natural gas and electricity, the price of propane is market-driven and fluctuates as demand changes.

“When a cold snap hits, the potential is always there for everyone to ask for more propane at the same time, and this can create logistical problems regardless of supply levels,” explains Danze. “The pipelines and supply points are bottlenecks that can have difficulty keeping up during periods of peak demand, and that can lead to near-term price fluctuations. The best thing you can do to avoid getting caught up in something like this is to have your customers get their propane locked in and tanks filled long before winter hits.”

A nipping freeze

A late harvest and the possibility of wet weather in the fall may boost crop drying demand just as the heating season begins, placing additional pressure on propane supply. Photo: iStock.com/ghornephoto

The Propane Education & Research Council (PERC) has been encouraging everyone to fill tanks early to prepare for higher propane demand this fall from later harvests and increased grain drying needs.

Record-breaking Midwest flooding and saturated soil in many states have delayed planting season for most crops, which will delay harvests as well, according to Mike Newland, PERC’s director of agriculture business development.

“Later harvests and an increase in grain drying – the majority of which is powered by propane – will cause propane demand to be higher in late fall, when it is already higher due to increasing residential and agricultural heating needs,” he says.

A wet fall may put additional pressure on crop drying demand.

“A wet fall makes natural drying harder, but it’s too early to tell if October and November will see wetter than normal weather,” says WeatherBELL forecaster Thomas Downs V.

Locking in lower prices is also a good plan for farming customers, PERC says.

“Producers can ensure they have the propane they need to power their farms throughout fall and winter by planning ahead and taking advantage of savings by filling tanks early,” says Newland.

On the other hand, the late planting season may result in crop losses due to freezing weather, which would negatively impact crop drying demand.

“There is a risk of a freeze nipping corn before it has matured because of a combination of the late planting and cool summer weather in the western Corn Belt,” says Downs. “We believe the risk of freeze is no greater than the typical year, but again, the extra time the crops need to mature could be cutting it close.”

Views from across the country

CALIFORNIA: “I hope to be pleasantly surprised by this heating season. The current forecast for the western half of the United States is warmer than normal for this winter. I have seen a report that winter will be late (beginning in January) and linger later through spring. Precipitation is forecast to be lower than normal as well.”

William Platz, president of California-based Delta Liquid Energy

COLORADO/NEW MEXICO: “I see ample supply for this winter with the usual weather and production issues creating regional supply hiccups. The late corn crop could affect supply, but reduced acreage should mitigate a large supply issue.”

Dan Binning, executive director of the Colorado and New Mexico Propane Gas Associations

KANSAS: “Our biggest concern is, and always has been, a lack of railcars, transports and lack of storage at retail locations and customer locations. Many propane companies have increased their storage and assisted their customers by adding tanks or upsizing tanks, if possible, to increase the total number of stored gallons at end-user locations.”

Greg Noll, executive vice president of the Propane Marketers Association of Kansas

MICHIGAN: “For those of us in the Great Lakes region, I would think that the status of Line 5 in the winter is the biggest factor in supply, logistics, pricing, etc. Line 5 provides hundreds of millions of gallons of propane and natural gas liquids that are refined into propane for supply points in Wisconsin, Michigan and Ontario. Without Line 5, the ripple effects would be felt throughout the Great Lakes region and Upper Midwest, with Michigan and Canadian marketers having to go farther and farther for their supplies – making lines that much longer at supply points not fed by Line 5.”

Derek Dalling, executive director of the Michigan Propane Gas Association

MINNESOTA: “Crop drying is this year’s wild card. Crops were planted late, and we have experienced a moderate summer temperature-wise. Crop maturity will depend largely on September and early-October weather. Overall, there will be a reduced crop. How much reduced and how much of the crop that needs to be dried is yet to be seen.”

Roger Leider, executive director of the Minnesota Propane Association

NORTHEAST: A major fire in June shut down the Philadelphia Energy Solutions refinery, but a plan is in place to fill the supply gap.

“While the Northeast lost a refinery-based source of propane, the remaining refineries will run at higher utilization rates to try to make up the shortfall.”

IHS Markit analyst Debnil Chowdhury