US propane inventory totals could be misleading

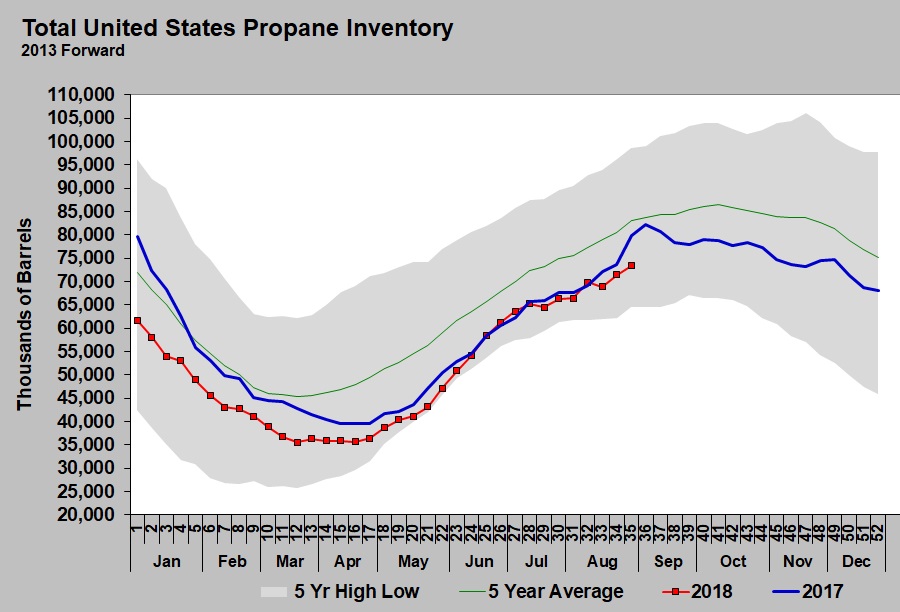

The Energy Information Administration (EIA) reported U.S. propane inventory was up 2.004 million barrels for the week ending Aug. 31.

The build left total U.S. inventory at 73.404 million barrels, which is 6.495 million barrels — or 8.1 percent — below last year. The lower level of inventory is price supportive, but the chart shows a bounce in inventory last year around this time, so there doesn’t appear to be any need to panic.

There is talk the inventory position may be even less comfortable than it seems. We are hearing there could be a lack of storage availability that is depressing propane prices in Conway and supporting prices in Mont Belvieu.

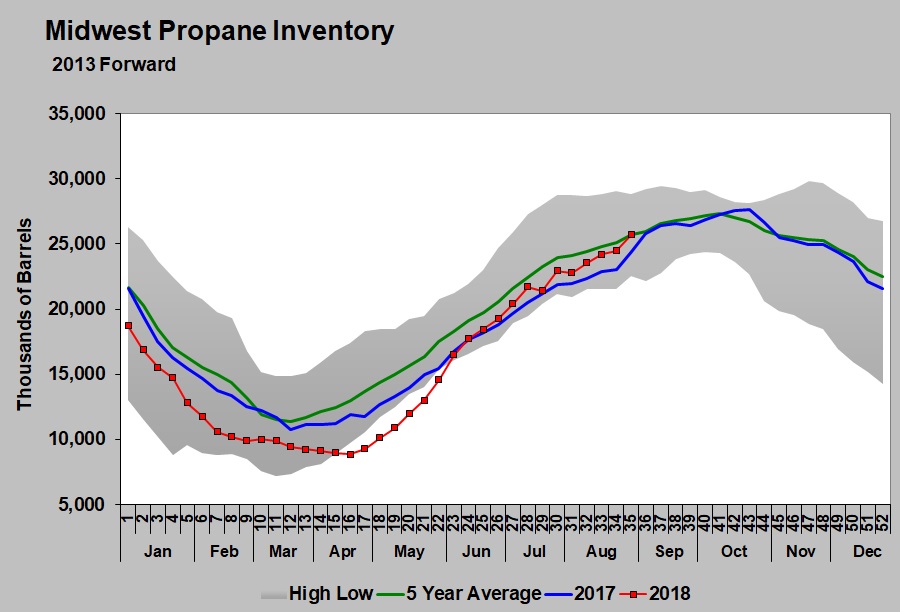

Currently, Midwest propane inventory is at 24.460 million barrels. That is a far cry from the high we have seen at 31.318 million barrels, so at first glance it may seem there could not be storage tightness.

It is not just propane that is being stored, however. In fact, we are told the core of the issue is too much Y-grade or unfractionated natural gas liquids taking up space that would normally be available for purity products, such as propane. When the EIA reports propane inventory, it does not differentiate between what is purity product and what is in Y-grade that still needs to be fractionated.

One of two things must happen for Midwest prices to recover: Either an increase in demand for Midwest natural gas liquids must occur, or market forces will work to resolve the supply/demand imbalance from the supply side. Since it is unlikely demand in the Midwest will increase significantly, other demand areas must be accessed. With Conway trading 29 cents below Mont Belvieu, it seems nearly all transportation options out of the Midwest are open — options that should send the Midwest product to export locations.

If the problem can’t be resolved on the demand side, then prices will be driven down to the point of destroying the supply side. With natural gas prices so low, the primary justification for drilling a natural gas well comes from the relatively high value of natural gas liquids. Obviously, drilling has continued in the Midwest and has once again overwhelmed the ability to do anything with the resulting supply, thus the accumulation of Y-grade despite fractionators running at max capacity. The consequence is devaluation of the supply.

If projects such as the Mariner East 2 pipeline do not solve the oversupply issue from the demand side, then the only logical outcome is a continued devaluation of natural gas liquids to a point of destroying drilling economics. In other words, market forces will work to resolve the supply/demand imbalance from the supply side.

For the week ending Aug. 31, Baker Hughes reported producers were employing 184 rigs drilling for natural gas in the U.S., which is up one from the same week last year. Specific to the Midwest, active rigs in Utica are down by 11, but Marcellus has nine more rigs operating than it did a year ago. Unless economics improve, it would seem drilling activity will decline.

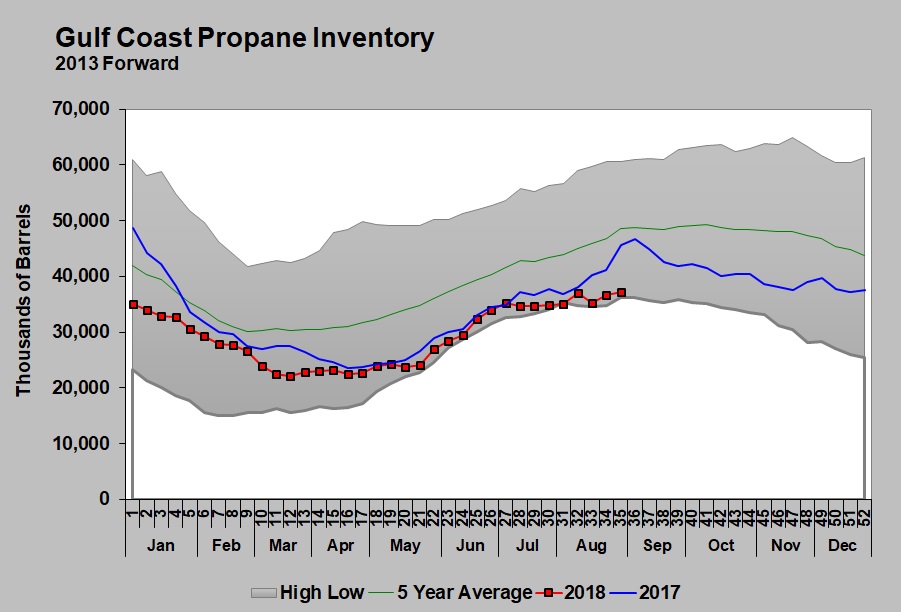

If we switch our focus to the Gulf Coast, we find propane inventory below normal.

The Gulf Coast is the opposite of the Midwest. It has plenty of demand from both petrochemicals and for exporting. Too much Y-grade and not enough fractionated or purity product is keeping a premium on what purity product is available.

In the Midwest, there is too much product and not enough outlets. Producers would rather move their product out of the region as Y-grade and have it fractionated on the Gulf Coast. Thus, there is too much product looking for transportation or storage availability that currently can’t be found, causing prices to be depressed.

There is too much demand for the available fungible or purity product on the Gulf Coast and apparently not enough capacity to get all of the Y-grade fractionated. The result is too many buyers chasing too little product, which is causing prices to rise.

Be assured market forces are trying to resolve the imbalances with the price difference of around 30 cents between Mont Belvieu and Conway. They have plenty of incentive to do so, but solving logistical infrastructure issues can take time. It is obvious there is a need for more outlets for Midwest production and more need for fractionation capacity on the Gulf Coast. Projects for both are in the works.

Until they are resolved, market forces are going to push prices toward the path of least resistance. For now, prices are lower in the Midwest and are higher in the Gulf Coast. Winter weather should soon provide the Midwest with some much-needed demand, which should close the price imbalance — but only for as long as the winter demand is present. The only thing that will keep the price spread from growing after winter demand is gone will be more infrastructure.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.