New report examines consolidation patterns, future implications

Consolidation patterns affect not only individual propane marketers gauging whether to buy or sell a business but also the structure of the industry at large and its competitiveness in a changing energy landscape.

The report “Consolidation Carousel in the U.S. Propane Industry: A Historical Perspective & Outlook,” published by independent investment bank Matrix Capital Markets Group and contributing industry expert Randy Doyle, explores these questions:

- Has the propane industry consolidated over the 2000-20 period?

- Have select consolidators gained and retained market share based on gallon figures?

It also shares insights from past and present industry leaders on consolidation and provides an outlook on future consolidation.

Measuring consolidation

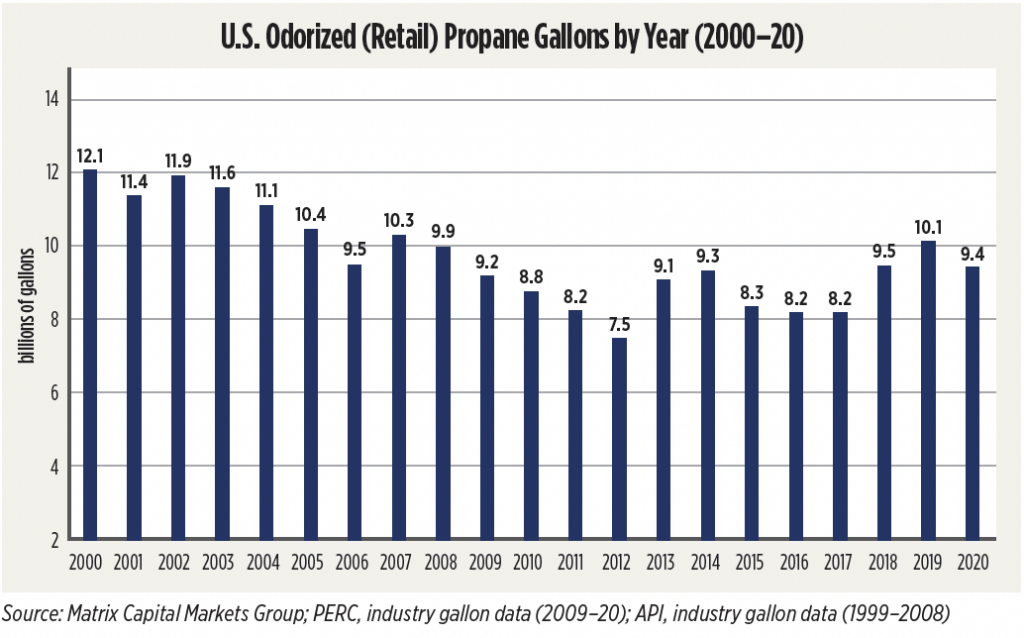

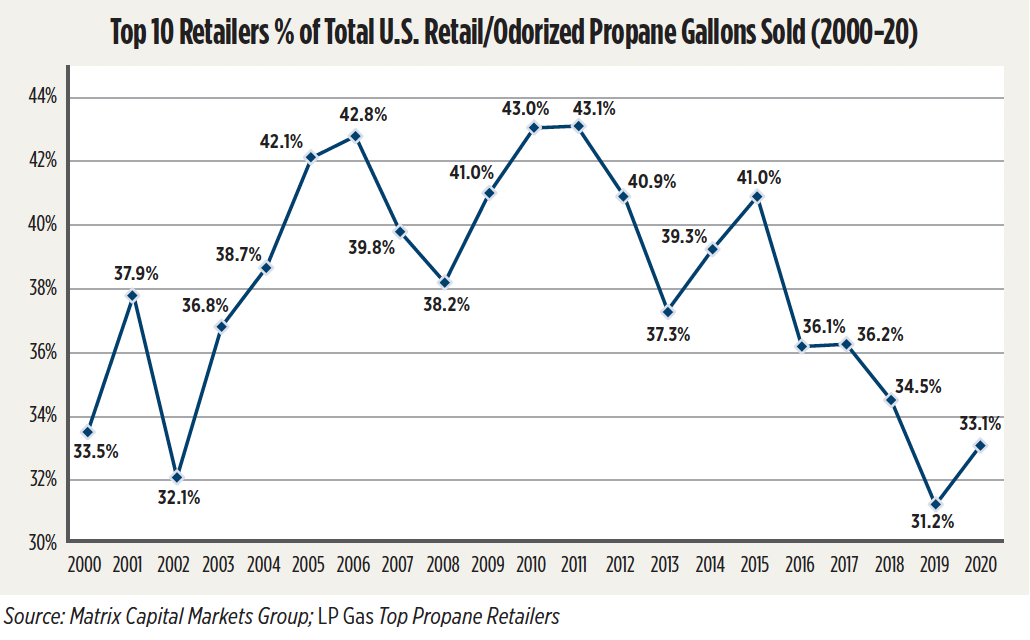

The report measures industry consolidation as the annual percentage of total retail propane gallons sold by the top 10 companies, as self-reported in LP Gas’ Top Propane Retailers ranking. It defines retail/odorized propane on the same basis as the Propane Education & Research Council: propane sold to the residential, commercial, industrial, agricultural, cylinder, forklift, autogas and off/non-road markets.

The report measures consolidation as the annual percentage of total retail propane gallons, as defined by the Propane Education & Research Council, sold by the top 10 companies.

The report shows that the top 10’s share of the propane industry’s topline gallon sales in 2020 – 33.1 percent – remains relatively unchanged from the share in 2000 – 33.5 percent. The top 10’s share peaked in 2011 at 43.1 percent but has since declined. Most notably, the share during each year of the 2016-20 period ranks below the 20-year average of 38 percent, according to the report.

The report shows that the top 10’s share of the propane industry’s topline gallon sales in 2020 remains relatively unchanged from the share in 2000.

These results suggest the propane industry is not consolidating in the way a mature industry is expected to consolidate – with the largest companies gaining share over time.

Consolidation and industry health

According to the report, consolidation tends to increase for industries during the mature life cycle phase because it enhances economies of scale that should, in theory, lower operating cost structure, make operations more efficient, enhance returns for companies remaining in the industry and improve the customer experience.

According to the report, consolidation tends to increase for industries during the mature life cycle phase because it enhances economies of scale that should, in theory, lower operating cost structure, make operations more efficient, enhance returns for companies remaining in the industry and improve the customer experience.

In the propane industry, many business functions have grown more complex in just the past 10 years, and that complexity motivates consolidation, explains propane industry veteran Randy Doyle in an interview with LP Gas about the report’s findings. Larger companies have more resources to hire specialists in information technology, human resources, finance, marketing, legal, logistics, safety, propane supply and fleet management.

Healthy consolidation should also help the industry grow as large companies can invest in new markets: “With autogas, for example, smaller companies have a hard time having the resources necessary to have somebody out there to sell it or with the technical expertise to support it,” explains Doyle.

So if the largest retail propane companies generally have not gained market share in volume terms over the past 20 years – as the report illustrates – the industry should consider whether consolidators have reaped the purported benefits of consolidation, says Doyle.

A personalized utility

Historically, consolidation and industry maturity have helped improve technology, safety and marketing, but consolidators, in general, must do more to enhance public perception and the overall customer experience, according to longtime industry leaders cited in the report.

The propane industry’s local, personal relationships with customers set it apart from other utilities like water, electricity and internet service. As such, customer service proves paramount post-acquisition, especially since propane plays an essential role.

The propane business involves more frequent engagement of a highly emotional product, explains Spencer Cavalier, co-head of Downstream Energy & Convenience Retail Investment Banking at Matrix Capital Markets Group, in an interview with LP Gas: “If you run out of gas to cook with or heat your house, people are more apt to change providers than with another product, good or service that you don’t need as much.”

The report references several causes of customer attrition post-acquisition – such as raising prices to achieve higher margins, and centralizing pricing and customer service centers – as well as capital structures that could hamper a customer-centric approach.

Cavalier expects these findings to heighten sensitivity among propane marketers about how they operate and structure their companies, as those choices can affect how well the marketer retains customers after an acquisition.

Outlook

Report authors agree consolidation and mergers and acquisitions will remain active forces in the propane market going forward. The industry is fragmented, with a large pool of potential sellers, and offers stable and recurring cash flow.

Consolidators that are structured properly to manage a personalized utility can access an “incredible opportunity” and lead the industry in its effort to promote propane’s clean attributes and remain an integral part of national energy policy, according to the report. If consolidators focus on retaining customers and growing volumes, the industry should attract investment during this pivotal moment in the energy sector.

“There’s going to be consolidation because it’s a great industry,” says Cavalier. “But it’s part of the national discussion of energy policy. We have to be good. We have to give good customer service.”

Learn more

Read the full report here: “Consolidation Carousel in the U.S. Propane Industry: A Historical Perspective & Outlook.”

Featured homepage image: metamorworks/iStock / Getty Images Plus/Getty Images