Potential impacts of Biden presidency on propane

We considered several topics for this week’s Trader’s Corner: rising propane exports, a big draw in propane inventory or perhaps the softening of propane prices in Conway. But everything seems to pale in comparison to the change in leadership in Washington. President-elect Joe Biden’s outlook on energy is considerably different than outgoing President Donald Trump’s. Much of what we will consider in this Trader’s Corner, specifically what the change could mean for the propane industry, could only be classified as conjecture at this point.

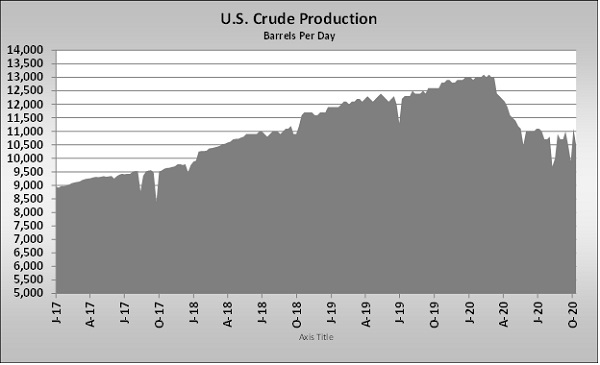

Something we do know is that the Trump administration was very pro U.S. energy growth. Indeed, the growth in U.S. energy production was well underway before Trump took office, but I argue that he did all in his power to continue, and even accelerate, that growth. Trump took office on Jan. 20, 2017. On that day, the EIA reported U.S. crude production at 8.961 million barrels per day (bpd).

By Feb. 28, 2020, U.S. crude production hit a peak of 13.1 million bpd. The 4.139-million-bpd, 46 percent increase pushed the U.S. to the world’s top crude producer. It could be argued that this increase in crude production improved the national security position of the U.S. Production declined this year as a result of the impacts of COVID-19.

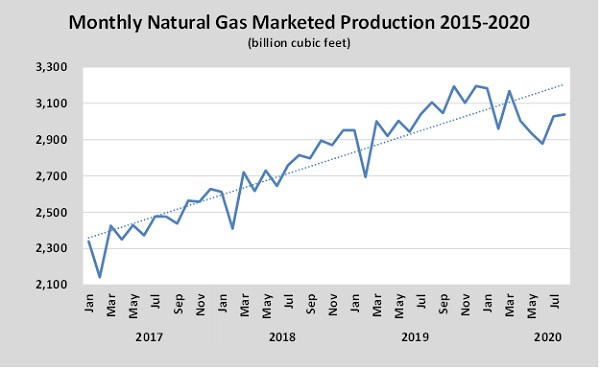

During the same period, marketed natural gas production increased.

When Trump took office, natural gas production was 2,339 billion cu. ft. per month. Production increased to 3,195 billion cu. ft. per month by December 2019. That was an increase of 856 billion cu. ft. per month, or 37 percent.

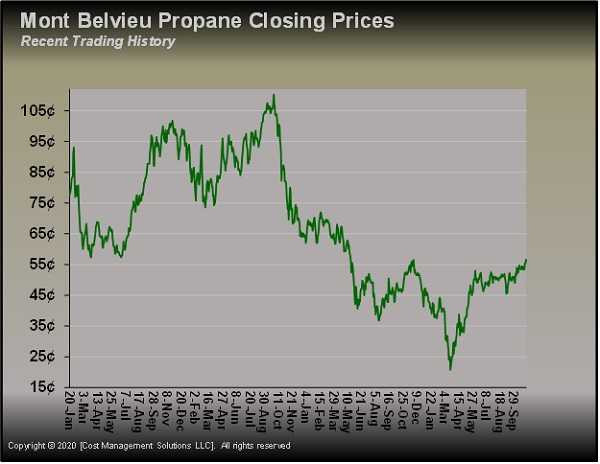

All the new oil and gas production increased propane supplies, resulting in a drop in propane prices.

On the day that Trump took office, Mont Belvieu propane traded at 77.5 cents. Today, it trades at 56.5 cents, a 21-cent, or 27 percent, decrease. During the Trump administration, propane became oversupplied, driving its value lower. During the Trump years, Mont Belvieu LST propane averaged 66.569 cents per gallon compared to 74.567 cents in the previous four years.

Chart: Cost Management Solutions. Click to expand.

As we move to contemplating what could happen under a Biden administration, he has stated he wants to phase out hydrocarbon production in favor of renewable energy. The concern is climate change. Overall, policy is very likely to increase the cost of energy in the long run. However, there are some things the administration may do that could keep crude prices in check during the short term. Under the Obama/Biden administration, a nuclear agreement was made with Iran. The Trump administration exited that agreement, taking strong measures to limit Iran’s crude exports in an effort to limit its revenue. The justification was to hurt its ability to cause unrest in the Middle East and potential terrorist-related activity. At times, Iran’s exports dropped from 1.5 million bpd to nearly zero.

A Biden administration will likely revive the Iran nuclear deal and remove the sanctions that limit Iran’s crude exports. That could put somewhere between 1 million and 1.5 million bpd of crude supply into the global market. That move is not likely to come until late next year, according to some analysts. It would be bearish for crude prices when it occurs.

Biden is also expected to move to more normalized trading with China. Much of the tension between the U.S. and China that was present in the Trump administration could go away. There is tremendous growth in propane consumption in China, and one can speculate that more propane will flow from the U.S. directly to China under Biden. That could tighten up U.S. propane inventory and what is available to the domestic market.

In the long term, however, one has to expect any type of hydrocarbon energy to become more expensive. Many are already predicting that U.S. crude production will never hit 13.1 million bpd again. Any tax incentives and other accommodations for the U.S. oil and gas industry will likely be removed. Drilling on federal lands will likely be phased out. Much more stringent regulations will be imposed that will drive up drilling and production costs. Approval of new pipelines will become much more difficult. Many major oil and gas production companies have already announced major changes to start transitioning out of the hydrocarbon industry.

In general, one can assume there will be an effort to drive up hydrocarbon costs while discouraging its consumption. The plan will be to make renewable fuel alternatives more financially viable to encourage investment in that sector. Cheap hydrocarbon prices would be a detriment to a transition to renewable fuels. One could also predict more taxes on hydrocarbons, from production to emissions. Hydrocarbons are likely to be taxed to support the transition to renewable energy, and lower energy consumption will make the hydrocarbon-related businesses more irrelevant. Indeed, hydrocarbon business will likely be taxed to fund its own elimination.

The challenge for the Biden administration will be to navigate the transition to renewable energy without driving up energy costs to the point of causing a recession. There will also be the challenge of seamlessly moving the jobs from hydrocarbons to renewable energy. That transition would be made easier if the “green” jobs were created in the current hydrocarbon-producing regions. However, since most of the money for renewable energy is likely to come from elsewhere, it would be very tough politically, in our view, to create green jobs in places like Louisiana, Ohio, Oklahoma, Pennsylvania, Texas and West Virginia.

There will be more challenges through this transition. Texas has long benefited from oil and gas production revenues. As hydrocarbon production declines, Texas officials will become hard-pressed to keep their current low tax structure. Very long term, one could see a reversal of population movement, currently toward Texas, to other areas where green technology is being developed.

All that is stated above is conjecture, but it is certainly plausible based on what has already been stated publicly and what is already occurring. Interestingly, the transition from hydrocarbon fuels was already occurring naturally, with many predicting that peak hydrocarbon demand will be reached in the next decade. Some have predicted that the social changes brought on by COVID-19 will accelerate the day to peak hydrocarbon demand.

A slower transition would likely lower the risk of economic turmoil. However, many believe there isn’t time to allow hydrocarbon consumption to peak and then begin its slow decline. Many view the reduction of hydrocarbon consumption must be accelerated. That means it will be necessarily done by government intervention and policy changes.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.