Price spread tightens between Mont Belvieu, Conway

In this week’s Trader’s Corner, we will look at the recent changes in the price difference, or price spread, between Conway propane and Mont Belvieu LST propane.

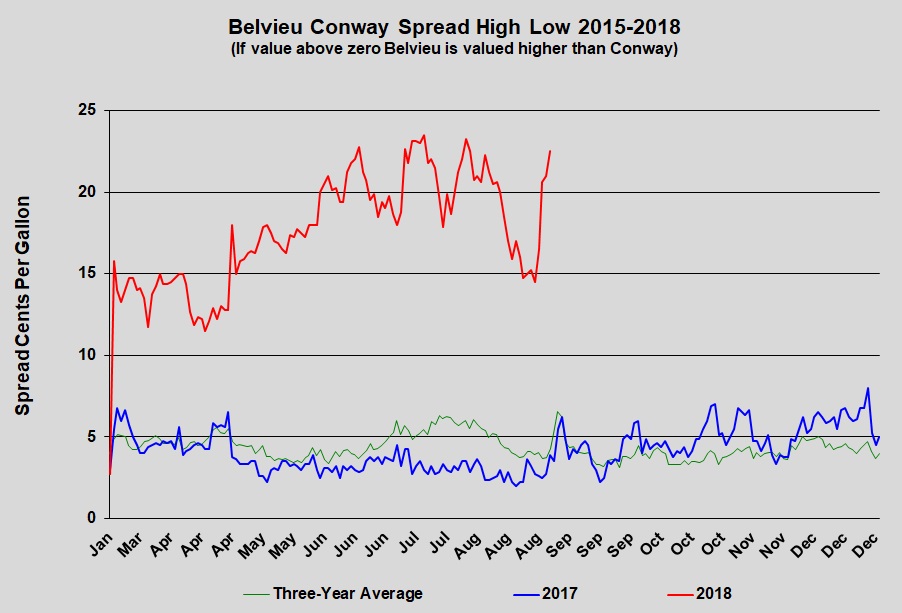

We expect Conway propane to trade at about a 4- to 5-cent discount to Mont Belvieu LST. Product needs to move from the Midwest to the Gulf Coast to reach petrochemical and export markets. The 4- to 5-cent spread covers the transportation costs of moving the product south. This summer, the spread ballooned to nearly 25 cents because of major oversupply and logistical issues in the Midwest.

As the chart above shows, the spread was coming down quite rapidly from about 20 cents above normal to about 10 cents above normal. Because of the timing of the spread collapse, we assumed it was due to the announcement that the Mariner East 2 (ME2) pipeline will open by the end of next month.

ME2 will help move propane from the Marcellus/Utica shale production areas more efficiently to Marcus Hook, Pennsylvania, where it can be exported. If those barrels are exported, it should mitigate some of the oversupply and support Conway propane prices.

When Conway weakened against Mont Belvieu LST on Aug. 22, we conjectured traders might think enough of the spread had been taken out until the actual impact of ME2 is better known, – or traders believed the opening of ME2 would only solve part of the oversupply problem in the Midwest.

Then, on Aug. 23, the prices diverged again. In a matter of a couple of days, 5 cents were added back to the spread that had been dropping for about two weeks. Most of the reversal came after the U.S. Energy Information Administration reported a 1.742-million-barrel draw in Gulf Coast inventory against a 678,000-barrel build in Midwest propane inventory. But, the inventory numbers only supported what was already happening: Traders suddenly were seeing Conway propane overpriced.

So, it became questionable whether the announcement of the ME2 pipeline opening by the end of September was ever a factor in closing the price gap between Conway and Mont Belvieu, since as far as we know, the opening of the line is still on track.

After a few conversations, we have concluded that the announcement regarding ME2 was the catalyst for unleashing the pent-up buying interests. Potential buyers recognized the excellent opportunity that Conway’s discount to Mont Belvieu represented and were looking for a reason to step into the market.

Once the buying started, more buyers stepped in, fearing the opportunity was getting away from them as Conway propane’s price increased. But, the buying suddenly stopped as quickly as it started. Apparently, enough of the immediate demand was satisfied to push buyers back to the sideline. It would appear to us that the market has likely overcorrected in both directions, as it often does.

We now expect the spread to settle in somewhere between its recent highs and low, or around 20 cents. We think the spread will hold there until the impacts of ME2 or fall demand – or both – are known. If ME2 is not that effective in removing oversupply or fall demand is weak, we could see the spread widening again. But, if supplies tighten because of ME2 or increased demand, we would expect Conway’s price discount to Mont Belvieu to narrow again.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.