Prices and inventory inversely correlated – with exceptions

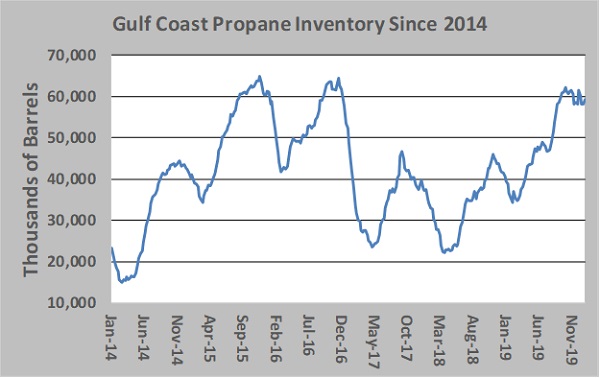

Propane inventory positions are a reflection of all underlying fundamental conditions, such as production, imports, exports and domestic demand. When supply exceeds demand, inventories grow. In general, when inventory grows, prices decline, and when inventory falls, prices rise.

We qualified the above statement a bit because there isn’t always a direct correlation between inventory positions and price. A good example can be seen with Conway pricing and Midwest propane inventory this year. Currently, Midwest inventory is 917,000 barrels lower than it was at this time last year, but Conway propane is currently 41.75 cents compared to 54 cents a year ago. In the case of the Midwest, there is so much more production than there is demand, so there isn’t the need to hold as much inventory.

There are conditions in which rising inventory wouldn’t necessarily result in a decline in prices. This could happen because demand is growing much faster than supply, so the market is wanting more and more in reserve. There was a time not long ago when this was the case with crude. The market could be well supplied, but if crude production capacity declined, prices would rise simply because of the threat there might not be enough if current production was disrupted.

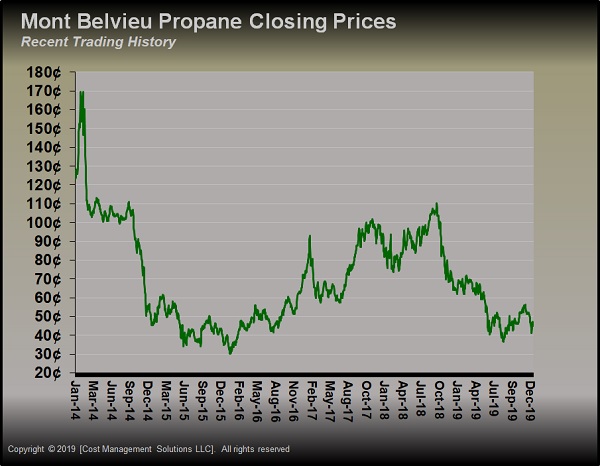

That is not the case with propane these days. There is so much more supply than demand that prices are inversely related to inventory levels. The first chart above shows Mont Belvieu LST propane’s closing price since 2014.

The second chart is Gulf Coast propane inventory over the same five-year time frame. It is easy to see a fairly consistent inverse relationship between price and inventory position by comparing the charts.

For example, when Gulf Coast inventories rose in 2014 and 2015, Mont Belvieu prices collapsed from 170 cents per gallon to 30 cents per gallon. There was an exception in 2016 when inventories increased, but prices didn’t decline. The market knew that new export capacity was just added, and it was only a matter of time until the high inventory positions would come down. Essentially, the market ignored the high inventory position based on what it knew, or at least assumed, about the future.

From January 2016 through October 2018, there was a general uptrend in Mont Belvieu’s price as inventories declined. During that time, propane retailers who speculated on propane by locking down future prices by buying prebuys, swaps or call options, but not committing to a sales price to customers, came out ahead.

But, since late 2018, anyone trying to speculate on propane has more often than not been burned. Propane production started exceeding export capacity again, resulting in rising inventory and declining prices.

Notice in the first chart how propane prices were rising in the second half of 2019, even as inventories were rising. The reason is the same as 2016 when the same thing happened. There was new export capacity coming online toward the end of 2019. Traders were ignoring the inventory build and pushing prices higher because of what they anticipated would happen after the new export capacity was available. They anticipated that the new capacity would cause a repeat of 2016 when inventories started declining again.

But, this time around, they got fooled … at least so far. When the new export capacity was completed, exports did not begin to rise. In fact, export demand has been below the old export capacity for much of this winter. When traders began to realize they had assumed wrong, the punishment to the price of propane was swift and significant. Mont Belvieu propane dropped 13.875 cents, or 25.4 percent, in December.

Gulf Coast inventory has been about as likely to build as decline each week this winter. For the week ending Jan. 3, Gulf Coast propane inventory increased 1.222 million barrels. Ironically, that is a week that had averaged the exact opposite 1.222-million-barrel draw over the past five years.

Propane retailers continued to be rewarded for maintaining a short position on their propane supply. In other words, it is best not to speculate on the future value of propane and instead buy it at market prices as close as possible to when it will be sold.

At the same time, a retailer can’t forget about that 2016-18 stretch when prices rose. Remember, that stretch began when there were still extremely high inventories. At this point, we still can’t assume prices are going to be higher in the future despite being extremely low now.

However, as they say, the best cure for low prices is low prices. It is highly probable things will change to swing the pricing pendulum in the other direction. Retailers should be vigilant in watching for signals that the supply/demand balance is shifting. This analysis today says that when it does, prices could start rising well before the fundamental shift shows up in inventory.

Back in 2016, we had a number of clients who locked down the price on varying portions of their supply for three years, based on the exceptional low-priced environment at the time. Needless to say, that decision paid off handsomely. Since there isn’t a lot of threat of sharply rising prices anytime soon, it is very easy to let an opportunity, like the one that presented itself in 2016, slip by.